- Private Equity firms have bought stakes in 5 of the top 26 US accounting firms in less than three years.

- Why? They see huge untapped potential in these traditionally staid accounting firms.

- Here’s a glimpse into the exciting trend shaking up the industry… and why India should be excited about this!

Background

Private Equity firms, known for chasing high-growth sectors like technology, healthcare, and consumer goods, are now …Setting their sights on an unexpected target: CPA firms!

On February 5, 2024, Baker Tilly shook the accounting world by announcing a $1 billion deal with private equity giants Hellman & Friedman and Valeas Capital Partners.

This blockbuster investment, set to close in June 2024, is the biggest PE deal the accounting sector has ever seen.

Shortly after Baker Tilly announced its billion-dollar deal, Grant Thornton (GT) received its investment infusion from the PE firm New Mountain Capital.

But Baker Tilly and GT aren’t the first to receive this kind of funding.

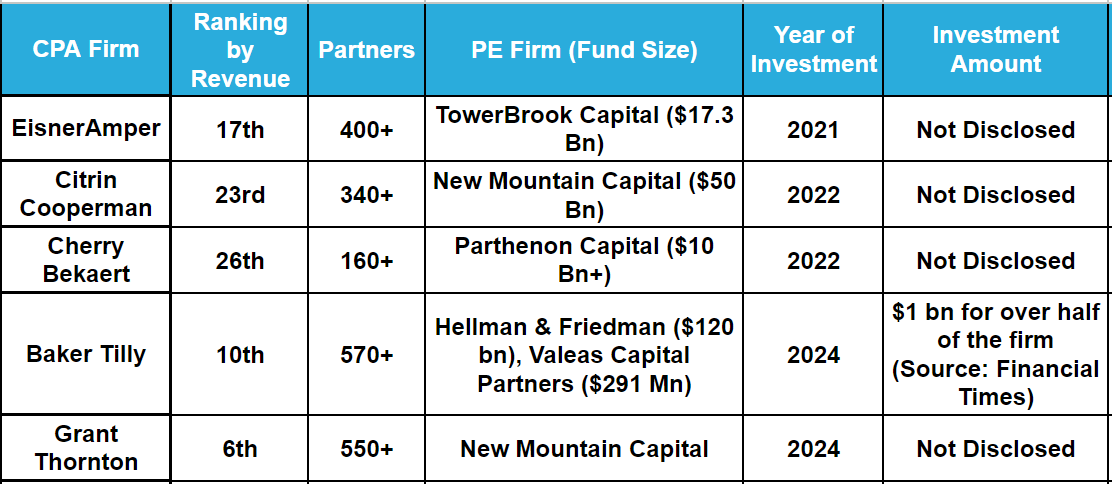

Since 2021, PE firms have been on a shopping spree, snapping up stakes in top accounting, planning, and advisory services.

Here’s the list of PE investments:

TPG had proposed a stake in EY

EY informed TPG Capital that it had no intention of selling a portion of its consulting business.

Because, in addition to giving up some control to TPG, EY would have been required to separate its auditing business to meet SEC regulations.

But why are PE Firms investing in boring CPA Firms?

Value Creation

The accounting industry is highly fragmented, presenting opportunities for consolidation.

PE firms aim to generate significant investment returns by partnering with CPA firms with strong growth potential.

Through strategic guidance and operational improvements, PE firms help CPA firms enhance their value proposition, increasing profitability and shareholder value.

Market Influence

PE firms invest in CPA firms to facilitate consolidation efforts, creating larger entities with economies of scale and increased market influence.

Innovation

Shrenik Shah, Managing Director of Armanino India (US CPA Firm with over USD 750 Mn in revenue) says,

“PE firms are drawn to CPA firms for their stable revenue streams, growth potential through consolidation, and opportunities for technological and service innovation.

These investments often lead to structural changes, separating attest services from advisory and non-attest services to comply with regulatory requirements.”

What’s in it for CPA firms and what will the firms do with PE Money?

Strategic M&A

PE firms provide capital to support CPA firms in acquiring other firms. This helps expand their market reach, client base, and service offerings.

Additionally, M&A activities can lead to synergies and operational efficiencies, enhancing overall profitability.

Joel Cooperman, “To aggressively seek out and acquire technology and advisory companies as it continues to build a fully developed financial services company that will help drive organic growth.”

Here is the list of acquisitions by Citrin Cooperman:

- MIBAR, is a tech-enabled consulting firm specializing in ERP, BI, and CRM software solutions.

- Appelrouth, Farah & Co., P.A., in Coral Gables

- Bloom, Gettis & Habib, P.A., in Miami, Florida

- Massarsky Consulting in New York, a music economics and valuations business

- Kingston Smith Barlevi in Los Angeles, business management firms focused on the entertainment industry

- Kaufman Bernstein Lee & Robert (KBLR), business management firms focused on the entertainment industry

- OLC Management Inc. is a California-based business management firm in the entertainment industry

- Murray Devine Valuation Advisors, an independent advisory firm headquartered in Philadelphia

- Untracht Early is an accounting firm in Florham Park, New Jersey

- Shepard Schwartz & Harris, it expanded into Chicago

- McNulty & Associates, a consulting firm in Westford, Massachusetts

- Keefe McCullough & Co. (KMC), is a full-service tax, attest, and business advisory firm based in Fort Lauderdale, Florida. They had 11 partners, more than 75 employees, and over $15 million in revenue.

- Coleman Huntoon & Brown

- Gettry Marcus, a Top 200 CPA Firm

- Chapman Bird & Tessler specialises in entertainment industry clients

- Maier Markey & Justic LLP (MMJ), a White Plains, NY-based CPA firm.

- Berdon LLP and Citrin Cooperman joined together, becoming a $600 Million Powerhouse Firm

Technology Investments

PE money can be allocated towards upgrading technological infrastructure and implementing innovative solutions. This enhances the efficiency of operations, improves client service delivery, and keeps the firm competitive in a rapidly evolving digital landscape.

Jeff Ferro, CEO of Baker Tilly US told Accounting Today, that they plan to use the extra funding to:

- Expand the Chicago-based firm’s presence in New York, Boston, Chicago, the Bay Area, Los Angeles, and Houston, and potentially expand in the Southeast, especially in Atlanta and Florida.

- He also wants to invest more in technology initiatives, recruiting, development, learning, and training,

- As well as offering additional advisory services

Accelerating Organic Growth

PE investment enables CPA firms to invest in marketing, branding, and talent acquisition to drive organic growth. This includes hiring top-tier professionals, expanding service lines, and penetrating new markets.

Innovative Solutions for clients

Charly Weinstein, CEO of EisnerAmper said in an official statement,

“Rather than conforming to traditional frameworks, adopting a new model of ownership facilitates the best structure for the Firm to drive growth and innovative solutions to our clients.

Michelle Thompson, CEO of Cherry Bekaert said in an official announcement,

“We are excited about Parthenon’s commitment to provide additional investment in technology, infrastructure, and other key areas that will enable us to better serve our clients,”

Solidify top positions

Seth Siegel, CEO of Grant Thornton revealed in a news release,

“The investment immediately enhances our value in the marketplace and enables us to accelerate our current strategy.

We’ll enjoy greater scale, resources and agility, while better positioning the firm to make targeted investments in talent, technology, infrastructure and enhanced capabilities.

Grant Thornton will further solidify our position as the industry’s platform of choice.”

Also read: From Citrin Cooperman to Armanino: How this CA built a career helping US CPA Firms looking at India

How will PE investments in the US create opportunities for India?

The offshore industry in India stands to benefit substantially from this trend, leading to job creation and economic growth.

Here is how:

Increase expansion of offshoring activities

Anshul Agarwal, founder of June15 Consulting, a company in Toronto, helps US CPA firms open offices in India. He’s seeing the results up close.

“I am noticing significant M&A deals in the CPA world. Private equity firms aim to acquire 2 or 3 smaller accounting firms and merge them into one large firm.

Once they have established the firm, they seek to enhance its value, and that’s where offshoring becomes relevant.

They want to cut costs and increase access to talent and India can fulfill both of these requirements.”

Competitive edge

India’s established reputation as an outsourcing hub will be further strengthened, making it a preferred destination for offshoring by PE-backed CPA firms.

Job creation and skill development

The influx of work from US CPA firms will create numerous job opportunities in India. This will also necessitate workforce upskilling to meet the demands of complex advisory and technological services.

Need for a broader range of services

As US CPA firms expand their operations in India, there will be a broader range of services offered by Global Capability Centers (GCCs), including advanced advisory and consulting services, in addition to traditional accounting and auditing.

Also read: How to find the names of US CPA firms for your Outsourced Accounting, Tax, and Auditing Firm?

Wrapping up…

After speaking to several CPA Firms that have set up offices in India, their big challenge is finding senior talent folks to lead their India office.

This entire situation of PE investing will create a lot more opportunities for Indian talent.