-

SEBI has slashed its forensic audit panel from 20 firms to just just 9!

-

The new panel will conduct forensic audits to check for fraud in the financial statements of listed companies.

-

Crucial role in maintaining market integrity and transparency.

- Surprisingly, Big firms like Ernst & Young, KPMG, and Grant Thornton Bharat are nowhere to be seen.

What is SEBI’s Forensic Audit Panel?

The SEBI Forensic Audit Panel is a group of firms chosen by SEBI to investigate fraud or irregularities in the financial statements of listed companies.

These audits help ensure transparency and trust in the Indian stock market.

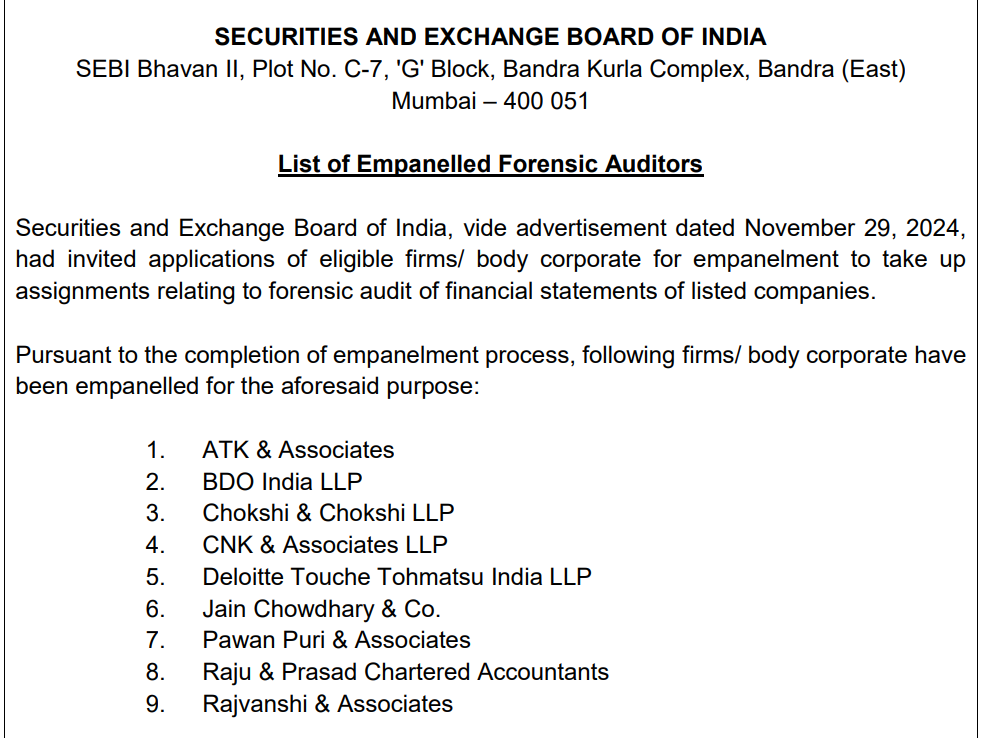

Here is SEBI’s forensic auditors’ new panel

1. ATK & Associates

2. BDO India LLP (reappointed for a second term)

3. Chokshi & Chokshi LLP (reappointed for a second term)

4. CNK & Associates LLP

5. Deloitte Touche Tohmatsu India LLP

6. Jain Chowdhary & Co.

7. Pawan Puri & Associates

8. Raju & Prasad Chartered Accountants

9. Rajvanshi & Associates (reappointed for a second term)

Who lost the spot?

It was mostly the big names like,

- Ernst & Young

- KPMG Assurance And Consulting Services

- Grant Thornton Bharat.

It’s worth noting that PwC wasn’t previously on the panel, unlike KPMG and EY. (Looks like PwC didn’t miss much after all!)

Also read: SEBI cracks down on 15,000 unregistered Finfluencers

What’s the reason?

No hard feelings, but as reported by Financial Express, SEBI made this decision to,

- Maintain a “short and manageable” list.

- Create a more streamlined and efficient panel, allowing for focused oversight and enhanced efficiency.

How does SEBI select its forensic auditors?

SEBI floated a public tender on November 29, 2024, inviting applications from top forensic audit firms.

This time SEBI set a high bar where firms were evaluated based on strict criteria, including

- Frequent past engagements with SEBI

- Strong track record over the past three years; especially if audits were completed on time.

- Number and complexity of past assignments

- The experience of key partners involved

- Team size and bench strength

Wondering what it takes for a firm to qualify?

Here are SEBI’s key criteria:

-

A minimum of 10 years experience in forensic auditing.

-

At least 10 partners or directors, with 5 actively involved in forensic audit work.

-

Completion of at least 15 forensic audits in the past three years, including 3 assignments from regulatory bodies, government agencies, or PSUs.

Firms that make the list will earn fees ranging from Rs 10-30 lakh per assignment, depending on the audit’s duration, the company’s size, and market rates.

Also read: SEBI and Adani controversy: India’s financial regulatory system is flawed?

Wrapping up…

This new panel replaces SEBI’s 2021 list and will remain in effect for the next three years. The regulator will open the empanelment process again after that.

This year’s outcome makes one thing clear — size alone doesn’t secure a seat at SEBI’s table.

FAQs

Who is SEBI’s new Chairman?

- Tuhin Kanta Pandey is the new Chairperson of the Securities and Exchange Board of India (SEBI).

- He succeeded Madhabi Puri Buch on March 1, 2025.

What is the main role of SEBI?

The Securities and Exchange Board of India (SEBI) is a statutory regulatory body of India.

It regulates the Indian securities market and protects the interests of investors in securities.