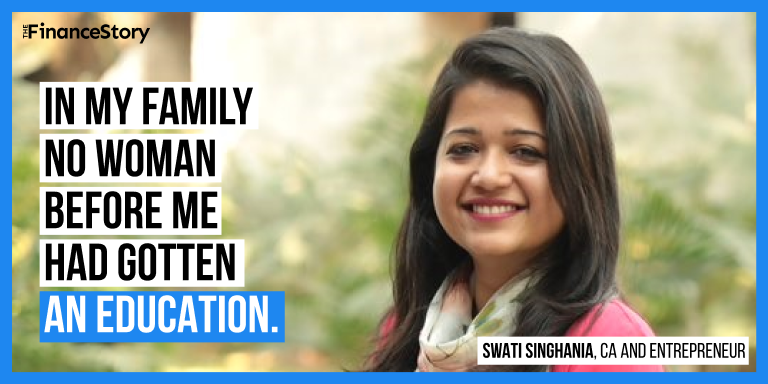

- Growing up in a small town and conservative society made Swati Singhania tough.

- Her father encouraged her to become a Chartered Accountant so that she could become financially independent.

- She battled the age-old misogyny while running a business in retail.

- Despite society trying to drag her down, she now runs her own firm S Singhania and Associates.

Paving the way for younger sisters

I come from a very small town called Muzaffarpur in Bihar.

While growing up we were going through financial trouble and none of the girls in the family had gotten any education.

My father really wanted the daughters to study and it was a path-breaking decision that my father had taken.

So from childhood, it was only about ”padhai, padhai, padhai” (study, study, and study). I have three sisters and a brother of which I am the eldest. Hence there were a lot of responsibilities resting on my shoulders.

If I could not make it then people would have said to my father “See, you took a wrong decision.”

Well, you know, this is what happens in closed-knit, conservative families.

That is why I had no option, but to work hard and succeed.

Back then the education system for women in Bihar was in a very bad state. My father decided that I should become a CA and he sent me away to Kolkata. That is how I chose Chartered Accountancy.

I qualified as a CA in 2005.

At the same time frame, I also completed my Bachelor in Commerce degree along with the Company Secretary certification.

I must also say that all three of us sisters are chartered accountants. It was a dream come true for my parents to be seeing their children soar high. My father would say, “I am glad that they are independent today. They do not have to be dependent on anyone.”

This was his high point.

My career path

During my articleship, I knew I did not like the typical audit work that many accountants go through. Rather I wanted to go into management accounting. That is why I chose to work with manufacturing organizations.

In all these manufacturing organizations I made sure that I did not get into the accounts department. I picked up the MIS department and project departments.

This experience at Linde India got me an opportunity to work at CRISIL.

Entering the entrepreneurial zone as a woman… not easy!

Around 2012 my family jointly decided to relocate to Calcutta. We needed a business for the family as the business in my hometown had to be shut down due to relocation.

That’s where I discussed with a friend the idea of starting a Consumer Durables business (Rajami Retail Private Limited).

My friend and I jointly invested in the business and my family looked into the day-to-day operations.

Back then being the eldest child I decided to take a pause in my CA career and take care of the business as well.

I started my entrepreneurial journey.

It is a perpetual struggle as a woman, especially when you are walking into a workplace where no other men are working beside you.

But I am always prepared for those weird questions that I often receive from men;

For example; when I was looking after Rajami Retail Private Limited, a very common response I received from men was “Mujhe boss se baat karni hai” (I want to talk to the boss)

When I used to tell them that “I am the boss.” They would refuse to believe that.

People expect that if there is a girl on the shop floor, she must be an employee and not the owner.

I do not know why some men have this impression that women cannot be financially independent and that they should marry someone and settle down.

Initially, it used to bother me for days and sometimes even break me.

Why? Because of comments like these from men and women alike “Is your family not making enough that you have to come out and earn?”

When I heard lines like that I felt like a brick was thrown at me, but it does not happen anymore. Because I have made myself financially independent.

When people tell me, “You are single and you are so ambitious about it.”

My response to most of them is “You did not make the country rich by getting married, right? At least I am trying to do that. So you should thank me for not getting married.

Building my CA firm against all odds

After six years of being a part of the business, I realized that it was well-managed and could do away with me being a part of it full-time.

I still held the dream of starting my own CA Practice and that is what I did!

I built my own CA firm, S Singhania and Associates in 2019, and I am an Insolvency Professional. My revenues from audit and GST filing are about 20-30 percent.

60-70 percent of my work goes largely towards work for startups.

We can all see the startup world becoming popular so we help them with due diligence, mentoring, and forensic audits for investors.

In the startup world, most of the founders come from an engineering background. They have no understanding of compliance.

What we offer to founders is to help them set up the basics to get the organization running.

Most of them are not even aware of basic things such as share capital or preference shares. We offer virtual CFO services to startups and also to investors.

I just wish when these startups become unicorns, they do not forget to send me a thank you letter sometime.

On leveraging social media

For the last six years, I wanted my knowledge to be out in the open but did not know how to do it. But, because of COVID and the time I had in hand, I launched my Youtube channel to inform people about finance. I am also active on Instagram, and LinkedIn.

In my channel, I try to answer small questions of a founder for instance “What is the debt-equity ratio?”

Now they can Google it or they can decide to see a one-minute video, of mine, to understand whether they should raise equity or whether they should raise debt.

Even a question like that is a difficult answer for startup founders.

Your social media presence these days is very important. It does not cost much to be on social media. Instagram does not charge us money. So it is very easy to get on social media and make good content.

What is difficult is to remain there and remain consistent.

Yes, there are mean comments, so just ignore them as I do.

Wrapping up…

I think my confidence is the result of growing up in a small town, setting up a business in a new city, and going through everything that I went through as an entrepreneur.

Remember that to be confident you have to create a mindset of “What would be the worst-case scenario if I take that decision?”

If you prepare yourself for it, the balance falls into place because you have trained your mind to be okay with it. Then in no time, you will become confident.