- It’s Diwali season… no wait! It’s crackdown season for some Indians.

- Around 100 Indian high-net-worth individuals (HNIs) have received notices from the Income Tax Department. Why? Failing to properly declare their properties in Dubai.

- Here’s a deeper dive into the news as reported by the Economic Times.

What’s happening?

Recently, some wealthy Indians who own property in Dubai, UAE received notices from the Indian Income Tax department.

The Foreign Asset Investigation Unit (FAIU) of the I-T department is casting its net over Dubai’s glamorous skyline.

The department is asking them to confirm if they properly declared these assets and if the money used to buy them came from legitimate sources.

How did the I-T department get a hold of this information?

Thanks to an information-sharing pact, UAE authorities have handed over the list of 100 property owners.

These Indian passport individuals haven’t yet spent 90 days in the UAE.

Tax authorities seldom get such direct access to offshore property details, usually restricted to bank accounts, stock investments, or trusts.

But with data on Dubai’s property dealings now in the mix, it’s a new game altogether.

What if you spend less than 90 days in Dubai?

According to UAE law, if you spend less than 90 days in the UAE within a year, you don’t qualify as a UAE resident.

So, suppose you’re an Indian citizen spending under 90 days in the UAE.

In that case, you’re generally considered a resident of India for tax purposes, and any overseas property you own needs to be declared on your Indian tax returns.

Also read: Fake financial reports used by UAE companies to raise money

Residency loopholes & treaty protections

Spending over 90 days in the UAE gives individuals residency status, and staying 181 days opens up tax treaty protections.

This treaty benefit complicates matters for the taxman, as the UAE might not disclose information on residents covered under the treaty.

What’s happening now?

The Foreign Asset Investigation Unit (FAIU) of the I-T department is performing what they term a “hygiene check” to ensure money funnelled into these Dubai properties has been properly taxed and disclosed in the Foreign Asset (FA) schedule on Indian tax returns.

Dubai’s tempting payment plans

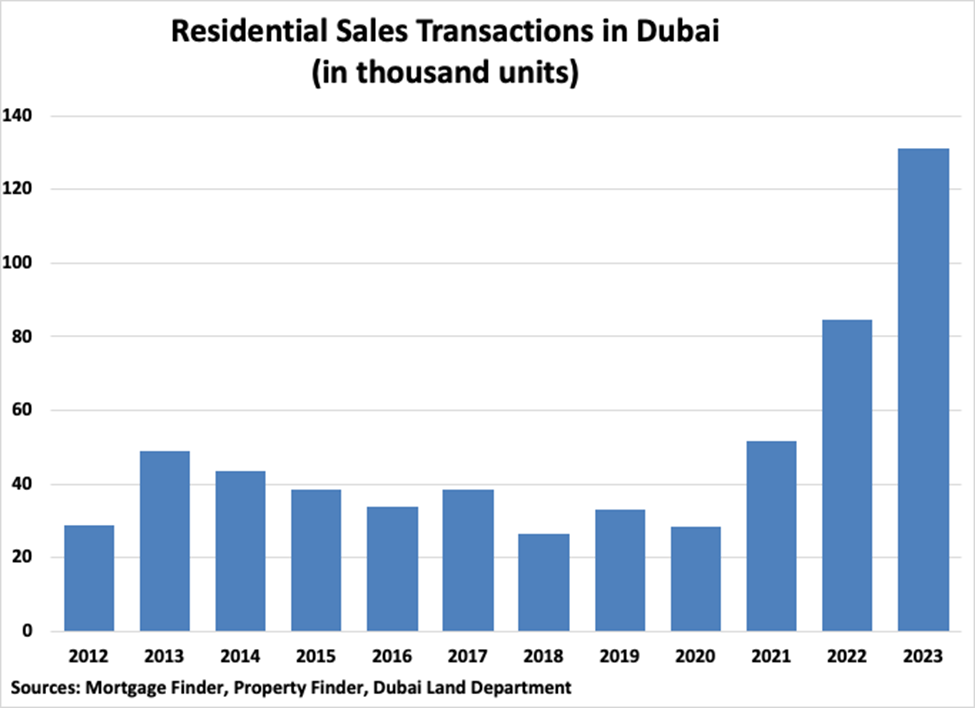

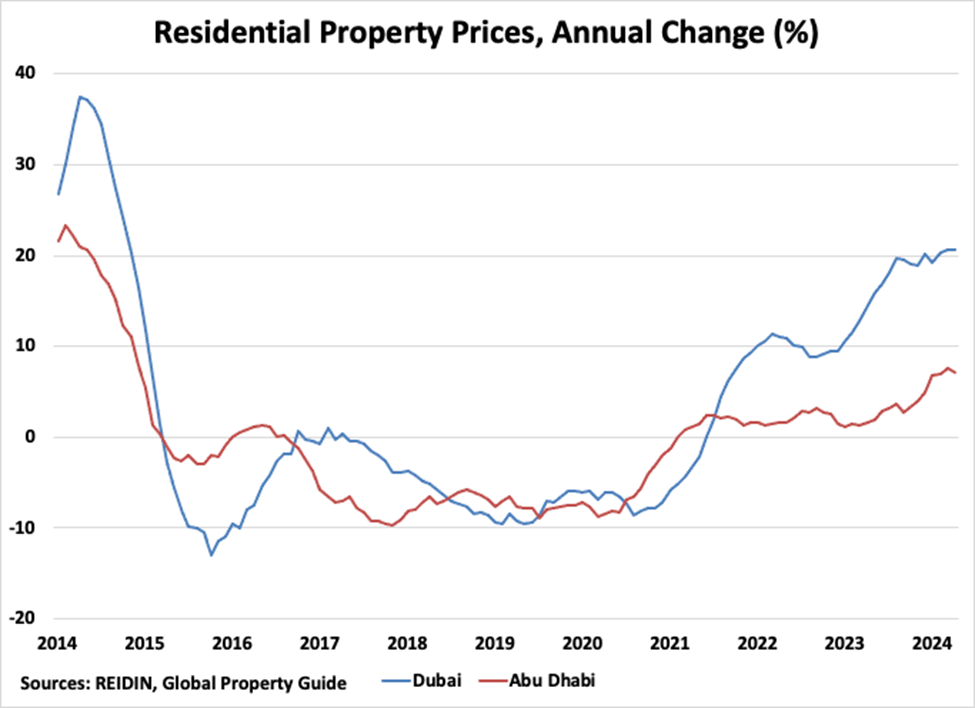

According to the report from Economic Times, many Indians were lured into Dubai real estate with offers as low as a 10% down payment and easy instalment options over 4-8 years.

Resale opportunities: Some investors sold their rights before project completion, cashing in on price appreciation without ever holding the property.

Expert Insight: “The UAE may not readily disclose data on residents benefiting from the tax treaty. So, this operation mostly impacts non-resident property owners,” Siddharth Banwat, partner at S Banwat & Associates LLP told ET.

Also read: UAE Mandates Women’s Inclusion on Corporate Boards by 2025

The LRS loophole: How investment rules come into play

India’s Liberalised Remittance Scheme (LRS) allows residents to invest up to $250,000 per year in overseas assets. However, there’s debate among tax professionals about whether certain Dubai deals fall within its scope.

This remains the primary gateway for Indian residents eyeing foreign properties, although cases may vary.

The Common Reporting Standard (CRS) hasn’t typically included real estate data. But, recent Dubai projects, especially studio and 1-BHK apartments, have attracted middle-income Indian buyers, prompting new attention on international property disclosures.

The repercussions

If sources are unverifiable, fines and taxes could add up to more than the value of the properties themselves.