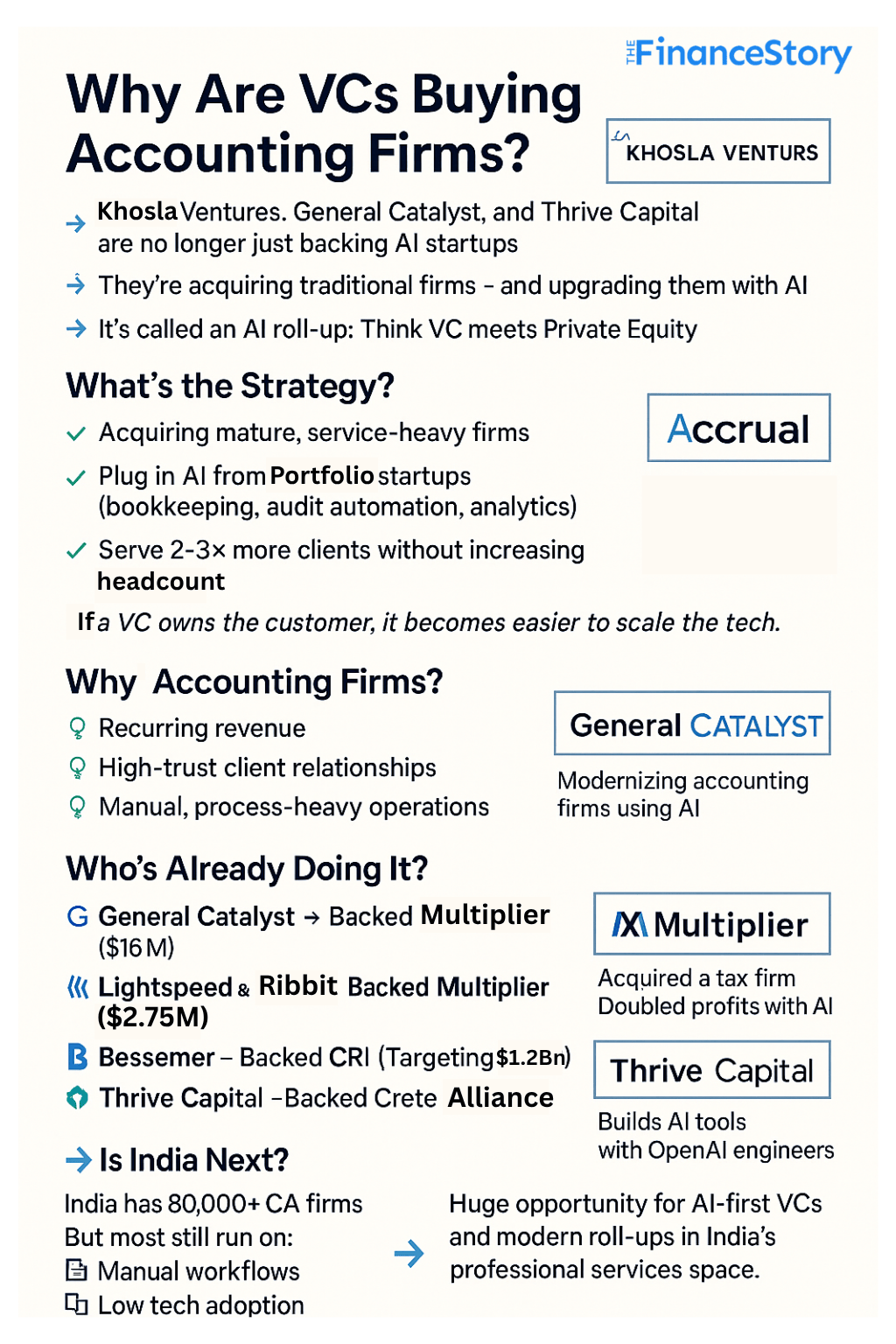

- Venture capital used to mean backing bold tech startups with big growth potential.

- But now, VCs are switching gears — buying mature, cash-generating businesses in areas like accounting, tax, and advisory, and supercharging them with AI.

- It’s a new playbook that’s blurring the lines between VC and private equity.

What are they doing?

According to a TechCrunch report (May 23, 2025), global VCs like Khosla Ventures, General Catalyst, Thrive Capital are:

- Acquiring traditional businesses, like accounting/tax/professional services firms, call centres etc.

- Plugging in their portfolio AI startups (e.g. audit automation, AI bookkeeping, risk analytics)

- Boosting margins and scalability — without bloating headcount

“If a VC owns the customer (like an accounting firm), it becomes much easier to scale the tech they’ve already invested in,” Samir Kaul, General Partner, Khosla Ventures

Yes — it’s the rise of AI-led roll-ups.

Why VCs are targeting Accounting, Tax firms

Because they have what most tech startups don’t:

- Recurring revenue

- Process-heavy operations

- Trusted relationships with clients

- Deep client trust

- And in DIRE NEED of an infusion of AI and Automation

Also read: VCs investing $500Mn to acquire & build AI-first CPA firms

Meet the VCs powering AI-driven accounting roll-ups

General Catalyst: Backed seven such roll-up companies, and one of them is Accrual.

Founded by an ex-Brex CTO, Accrual raised $16M to acquire and modernise accounting firms via AI automation.

Marc Bhargava (General Catalyst) says the goal is to enable firms to take on 2–3× more clients using AI—not to reduce staff.

Lightspeed and Ribbit Capital

Noah Pepper, ex-Stripe APAC lead, founded Multiplier in 2022 to sell software to tax accountants—but pivoted after realizing AI’s potential to transform professional services.

Instead of building SaaS, he acquired Citrine International Tax, integrated AI tools to cut manual work, and more than doubled profit margins.

That success led to a new strategy: acquire service firms and scale them with AI, like a PE-style roll-up.

The company has raised $27.5M from,

- Lightspeed

- Ribbit

- SV Angel

Bessemer Venture Partners

CRI (Carr, Riggs & Ingram): CRI is a regional CPA firm, raking in $500M annual revenue.

It received AI-focused investment from Bessemer Venture Partners and PE firm Centerbridge.

And it is now targeting $1.2B via automation.

Crete Professionals Alliance

Founded in 2023, Crete Professionals Alliance is also following in their footsteps.

- Acquire majority stakes in well-run local CPA firms

- Keep founders involved with minority ownership and leadership

- Preserve the firm’s local brand and client relationships

- Works directly with OpenAI engineers to build custom tools for: Audit test automation, Memo writing and data mapping, Financial reporting, Workflow optimization

Crete is backed by:

- Thrive Capital (led by Josh Kushner)

- Bessemer Venture Partners

- ZBS Partners (co-founder Jake Sloane’s firm)

Also read: Hundred Accounting Firms Merged Overnight – Now Eyeing £800Mn PE Deal

Is India next?

Get this: India has over 80,000+ CA firms. They have credibility, client access, and strong fundamentals.

Yet, there are a few challenges.

Most Indian firms still operate with:

- Manual-heavy workflows

- Limited tech adoption

- Low scalability

That’s exactly what VCs and AI-first founders want to change.

As AI tools mature and success stories mount in the U.S., Indian VCs may not be far behind in pursuing a similar playbook in accounting, advisory, and compliance services.