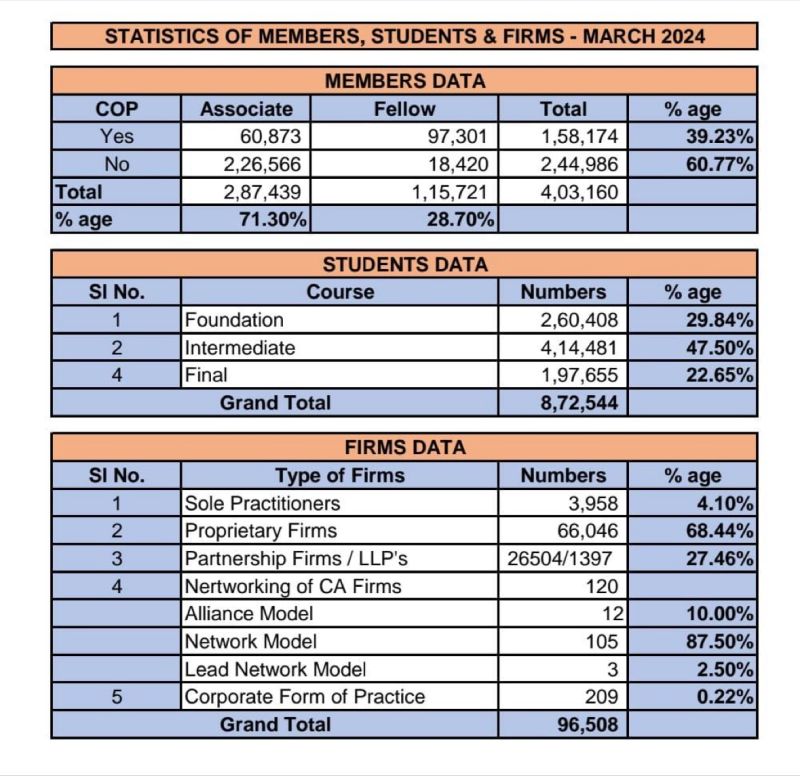

- India has over 96,000 CA firms — mostly small, regional, and undervalued…But things are shifting.

- Private equity is now eyeing professional services, especially firms with recurring revenue, loyal clients, and strong teams.

- Xeinadin’s (merged 122 independent UK/Irish firms overnight) rise in Europe shows what’s possible for Indian firms in this new era.

India’s Big Opportunity

India is home to over 96,000 CA firms—many with strong regional roots, deep client trust, and specialised expertise.

That’s a massive number but most remain small and siloed.

To put it in perspective (approx numbers):

-

US has about 13,000 audit firms and roughly 46,000 accounting firms overall.

-

UK has fewer than 6,000 (In the UK, 4,310 audit firms registered by the end of 2022).

-

China, in 2024, had just 12,152 firms in the auditing, accounting, and tax services industry.

With this kind of volume and fragmentation, India is primed for a wave of M&A activity.

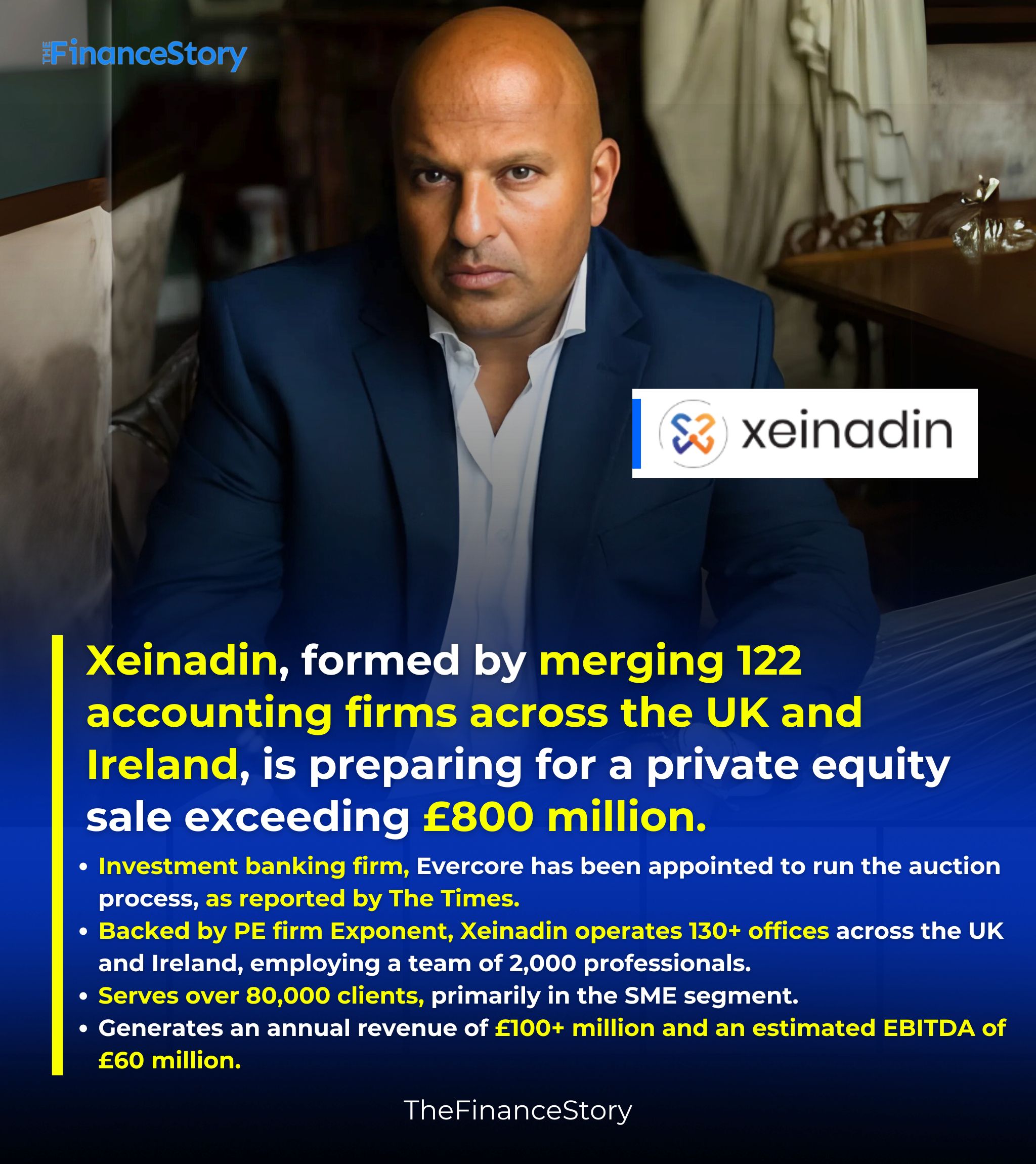

Global Case Study: Xeinadin

In 2019, a maverick entrepreneur, Feisal Nahaboo, pulled off what was arguably the boldest consolidation in professional services history.

- He merged 122 independent accounting firms across the UK and Ireland—on the same day.

- The result? Mid-market accounting firm Xeinadin – Now one of the Top 20 accounting firms in the UK.

- And no, he’s not a CA or even an accountant.

- Within just 256 working days…The partners started seeing returns.

- In 2022 UK’s private equity firm Exponent came knocking…Valuing the group at £300Mn!

Since then, Xeinadin has gone on an acquisition spree—absorbing high-quality practices like,

- Raffingers (London, Mar 2025)

- JCS Accountants & Mudd Partners (Apr 2025)

- Haines Watts offices (late 2024)

- KBG Accountants (Ireland, May 2025)

Fast forward to 2025

Today, Xeinadin is a multi-disciplinary business advisory group, with:

- Over 80,000 clients in the small and medium businesses (SME) segment

- 130+ offices across the UK and Ireland

- A team of 2,000 professionals

- Annual revenue of £100+ million

- Estimated EBITDA of £60 million

Next? Potential sale to another PE firm

The deal is expected to exceed £800 million!

Backed by private equity firm Exponent, Xeinadin has enlisted advisers from Evercore to run the auction process, which is expected to begin in the coming weeks.

What made this merger possible?

At the heart of this revolution was Nahaboo’s innovative – Overnight Multiple Merger Model (OMMM).

The model is:

- Debt-free

- Low-risk

- High-yield, particularly in terms of profit after tax

- Designed to preserve the autonomy and entrepreneurial spirit of each merged firm

Xeinadin isn’t an outlier. It’s part of a much bigger trend.

Across the UK and the US, private equity is actively courting accounting firms!

Just look at these moves:

- 2024: Grant Thornton, the UK’s sixth-largest auditor, sold a stake to private equity firm Cinven, a London-based private equity firm, valuing the firm at approximately £1.5 billion.

- 2024: Evelyn Partners sold its professional services unit to Apax.

- 2025: AAB, a mid-market accountancy firm with over 1,000 employees offering audit, tax, and restructuring services has been put up for sale. The price tag: £250 million.

Financial Times report suggested that up to 10 of the 30 largest U.S. accounting firms could soon be PE-owned:

- 2021, EisnerAmper received a private equity investment from TowerBrook Capital Partners

- On June 30, 2022, Cherry Bekaert was acquired by Parthenon Capital through a private equity deal

- 2024, Baker Tilly acquired strategic investments from Hellman & Friedman and Valeas Capital Partners.

- Citrin Cooperman experienced two major private equity transactions

- 2024, Armanino LLP accepted a minority investment from Further Global Capital Management.

- Sikich secured a $250 million minority investment from Bain Capital in October 2024.

- November 2024, PKF O’Connor Davies secured a strategic growth investment from Investcorp and PSP Investments.

- Cohen & Company announced a strategic investment from Lovell Minnick Partners in October 2024.

And the list goes on…..

Are Indian CA firms getting PE interest?

- Milind Kothari’s BDO India is restructuring from an LLP to a private company and is open to raising funds

- Grant Thornton Bharat is reportedly exploring private equity to grow its non-audit businesses

- Zerodha’s Nikhil Kamath made a strategic investment in KNAV (CEO Vaibhav Manek), which has a revenue of USD 35 Million!

- Jamil Khatri’s Uniqus raised total funding to $42Mn; valuation has doubled with each round, now at $250M (₹2,087.5 crores)

We also know several firms that are already acquiring firms—quietly but solidly.

Wrapping up…

It’s safe to say, that the traditionally conservative world of accounting with scale, tech, and recurring revenues is now a hotbed of:

- Strategic investments

- M&A activity

With the scale of firms here, India is primed for a ₹5,000 Cr accounting brand.

PE is ready. The question is — are Indian CA firms bold enough?

FAQs

Why is private equity suddenly interested in accounting firms?

Accounting firms offer stable, recurring revenues, deep client relationships, and scalable service models.

As traditional industries saturate, PE firms are seeing accounting as a low-risk, high-return opportunity — especially with the potential for tech and advisory expansion.

What makes an accounting or CA firm attractive to investors?

Key factors include:

-

Recurring revenue (e.g., monthly retainers)

-

Scalable operations

-

Tech adoption (cloud accounting, automation)

-

Strong client base

-

Niche specialization (cross-border, tax, forensic, etc.)

-

Capable leadership and succession planning