- Grant Thornton US, backed by New Mountain Capital and armed with fresh €850m debt, is snapping up its own “sister firms” across Europe.

- The latest catch? GT France (€288m revenue, 2,800 people) and GT Spain & GT Belgium (€135m combined)

- That’s €423Mn in EU revenue, about 6% of the global GT network now in the US camp.

- Guess what…GT Australia, the country’s 8th-largest accounting firm, is also exploring a stake sale!

GT US & Private Equity

The story of GT US’s global ambitions began in March 2024, when it sold a significant stake to Private Equity Firm New Mountain Capital.

That wasn’t just about capital; it was a signal the firm wanted to go global…And FAST!

By January 2025, GT US acquired Grant Thornton Ireland Advisory and tax business, creating the Grant Thornton Multinational Platform — a transatlantic hub for advisory and tax services.

In rapid succession, GT US acquired sister firms:

- GT UAE

- GT Luxembourg

- GT Netherlands

- GT Cayman Islands

- GT Switzerland, Liechtenstein (220 professionals)

- GT Channel Islands (300 professionals)

Acquisitions are advisory/tax businesses rather than full national firms. Audit largely stays local.

The UK factor

GT UK had its own offer on the table from GT US, but chose to go with PE firm Cinven instead.

Well, this created a sort of rivalry between the two sister firms.

Unlike Deloitte or PwC, Grant Thornton isn’t a single global firm. It operates as a network of independent partnerships, each locally owned but sharing a brand.

For years, that model worked, but with private equity in the mix, the “friendly sibling” approach is breaking down.

So basically, now there are two camps at GT:

- GT US (backed by PE New Mountain Capital) → pushing for one integrated global platform: Same tech, same systems, same client experience.

- GT UK (Backed by Cinven) → wants a looser network, where firms keep local control but with PE cash to expand.

Germany slipped away

GT Germany was meant to be GT US’s crown jewel.

But in September 2025, GT UK and Cinven won over Grant Thornton Germany, a €249m firm with 2,000 people.

This gave GT UK a strategic foothold in Europe’s biggest economy and blocked GT US from sweeping the continent.

New update

New update

On November 5, 2025, Grant Thornton New Zealand became the latest member firm to join Grant Thornton Advisors LLC.

The firm brings 300+ professionals and $40 million in annual revenue into the picture. The deal is set to close in late 2025.

Guess what…

Grant Thornton Australia, the country’s 8th-largest accounting firm (with $384M revenue), has hired Greenhill to explore a stake sale.

This could potentially be one of the biggest deals in Australia’s accounting sector!

GT Bharat, the wild card?

Back in India, GT Bharat is doing very well: ₹1,050 crore ($125M) in revenue. (Source ICRA)

In an interview, CEO Vishesh Chandiok mentioned the firm is aiming for $2B by 2030.

To fuel this growth, GT Bharat will have to explore capital raises or private equity partnerships.

Chandiok mentioned in another interview with the Financial Times: “We are open to acquiring a material interest in our US or UK firms as and when their private equity owners decide appropriate.”

Facts you should know

Grant Thornton now operates in 147 markets with a global team of over 73,000 professionals.

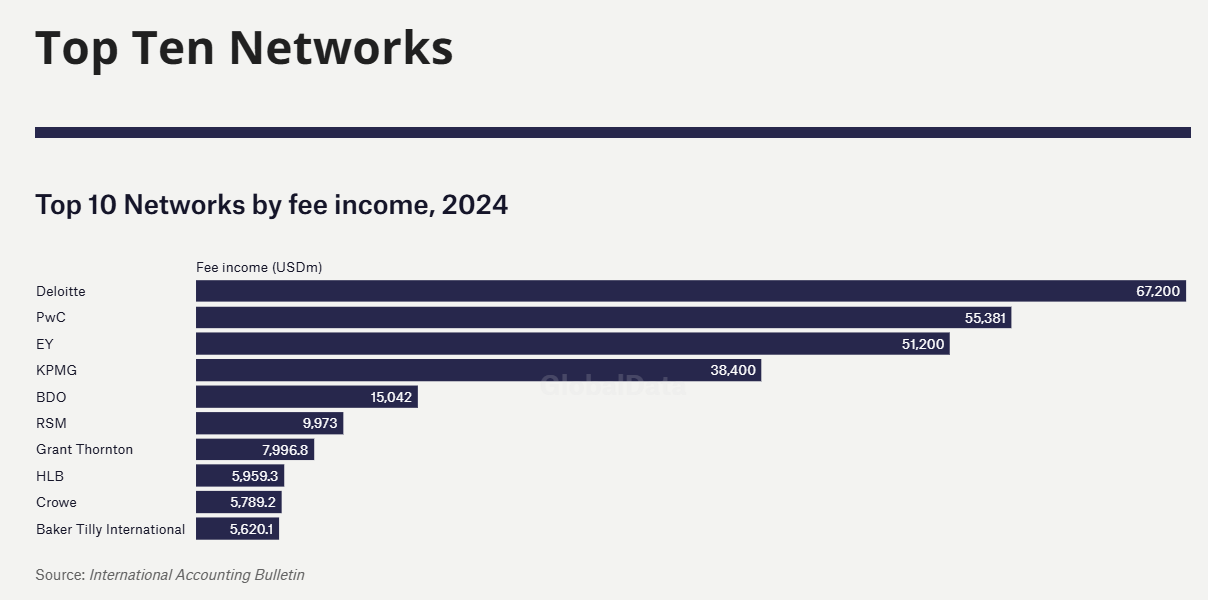

In FY24 (ending Sept 2024), GT International hit $8 billion in global revenue, growing +8.8% YoY — the fastest among the top mid-tier firms.

They were closely followed by BDO (+7%) and RSM (+6%), showing strong momentum across the board.

Nearly two-thirds of GT firms crushed it with double-digit growth.

Top markets?

- India: +25%

- Germany: +17.6%

- Canada: +11.5%

- Netherlands: +10.8%

- Ireland: +10.3%

- Australia (It grew revenue by 7 per cent in the 2024-25 financial year)

Wrapping up….

Grant Thornton is no longer just a network of member firms collaborating; it’s now PE driving a global strategy.

- €423m of Europe now sits in the US camp

- Germany is Cinven + UK territory

GT US and GT UK are charting their own paths…And “Consolidation” appears to be the inevitable path for Grant Thornton’s global ambitions.

Meanwhile, GT Bharat, the fastest-growing arm (+25%), is emerging as the next focal point?