- BDO UK and BDO Ireland are about to make it official…merger talks are in their final stages.

- If the merger goes through, it will create a £1.1 billion accounting super-firm.

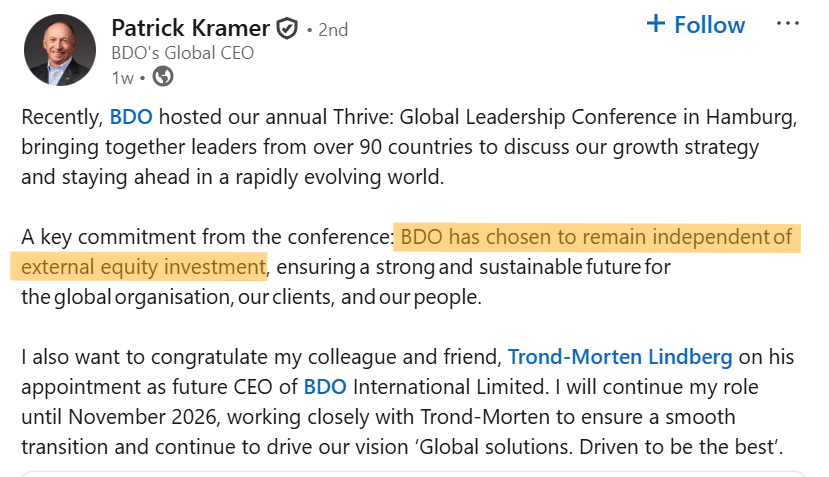

- But while others are chasing private equity money, BDO’s global CEO has drawn a clear line: “No external equity investors allowed.”

Stats you should know

BDO UK clocked £1.02 billion in revenue for the year ending July 5, 2024, marking an 8.6% jump from the previous year. That officially puts the firm in the “billion-pound club” for the first time!

While BDO Ireland’s exact numbers aren’t public, the firm reported 13% growth in FY2024 in the Europe, Middle East, and Africa (EMEA) region.

What’s really driving the merger?

Clients are changing.

The mid-market is going global.

Companies that once operated regionally now demanding sharper, more connected advice on complex cross-border deals and tax issues.

What happens after the BDO UK-Ireland merger

Once the deal goes through, together, BDO UK (18 offices) and BDO Ireland (Dublin + Limerick) will form a cross-border force of:

- 8,500+ professionals

- 542 partners

- Expanded capabilities across audit, tax, consulting, deals, and risk

The merger will also unlock bigger investments in tech, talent, and global opportunities, all without diluting partner ownership.

“This would be a landmark merger that demonstrates our ambition for our business, our people, and our clients,” said Mark Shaw, Managing Partner, BDO UK.

“BDO UK and Ireland have worked closely together for more than 40 years. This is the logical next step,” added Brian McEnery, Managing Partner, BDO Ireland.

Meanwhile, other BDOs are playing different games

In 2023, BDO USA (the sixth-largest accounting and consulting firm in the US) raised US$1.3 billion in debt financing from Apollo Global Management to enable an employee stock ownership plan (ESOP) and refinance existing obligations.

BDO India (estimated revenue ₹1,100 crore) is reportedly in talks to sell 15–20% of its non-audit business (tax, advisory, technology arms) to private equity to raise growth capital.

According to ET sources, BDO India is close to acquiring a “majority stake in a few Asia-Pacific member firms.”

Also read: RSM US-UK is doing something rivals aren’t: Avoiding Private Equity

Global Merger wave is sweeping accounting

From Europe to the US, several big and mid-tier accounting firms are merging sister firms, streamlining operations, and even tapping private equity to scale up fast.

KPMG UK & Switzerland: Merged to form a new US$4.4 billion cross-border firm focused on audit, tax, and advisory, on October 1, 2024.

KPMG Global: Restructuring globally by merging dozens of national partnerships into 32 by 2026.

RSM US, UK & Ireland: A transatlantic partnership was announced in October 2025. Leadership, investments, and partner pay are now integrated across borders.

FYI: RSM’s US arm has already merged with RSM Canada. RSM UK acquired RSM Ireland in 2023.

Grant Thornton US & Europe: PE-backed moves across France, Spain, Belgium, Ireland, UAE, Luxembourg, Netherlands, Switzerland/Liechtenstein, Channel Islands, and Cayman Islands…

They are creating a tightly integrated multinational advisory platform within their global network. (Recently New Zealand joined the club. Merger set to close by end-2025.)

Wrapping up…

BDO UK and BDO Ireland are in the final stage of sealing their merger.

All that’s left is a partner vote and regulatory approval before the deal goes live.

According to the Financial Times, a group of senior partners is exploring options for external investment in BDO, including private credit financing or minority stake sales to private equity.

Meanwhile, BDO International has made its stance clear: No external equity investors allowed.

“Choosing independence is a conscious decision made from a position of strength,” said Patrick Kramer, BDO Global CEO, in October 2025.

FAQs

1. What is BDO’s global revenue?

For the fiscal year ending 30 September 2024, BDO International reported global revenues of over US $15 billion (€13.9 billion), representing about a 7% increase in USD.

2. Which accounting firms have taken private‑equity (PE) money?

- Grant Thornton UK (2024): Investor – Cinven

- Baker Tilly US (2024): Investors: Hellman & Friedman & Valeas Capital

- Citrin Cooperman (2022 / 2025): Investors: New Mountain Capital (2022), Blackstone (2025)

- EisnerAmper (2021): Investor – TowerBrook Capital

- PKF USA (2024): Investors: Investcorp & Canadian pension fund