- India now boasts over 1 lakh Chartered Accountancy firms (as of October 2025).

- But behind the headline figure lies a striking story.

- 7 in 10 firms are solo practices, and only a small group of larger firms dominates the country’s audit and advisory landscape.

Scale over size

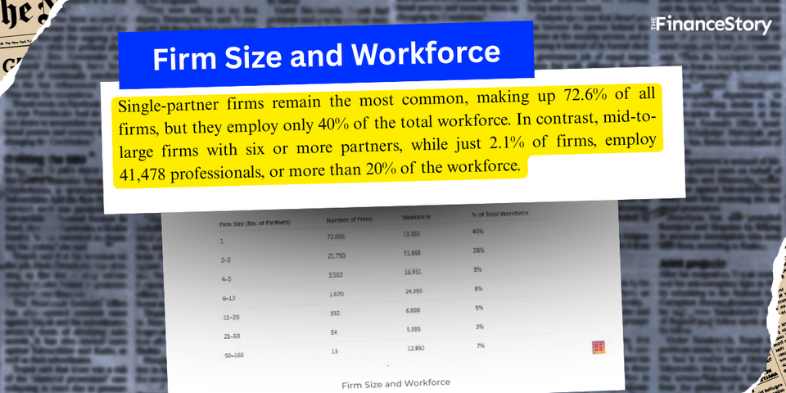

The Institute of Chartered Accountants of India (ICAI) data, first reported by ETCFO, shows that India is home to 1,00,138 registered CA firms employing 1,83,642 professionals

CA Firms with 6 or more partners may be few (2,129 or 2.1% of all registered CA firms), but they handle the lion’s share of complex audits, from listed companies to large conglomerates and banks.

Well, they also employ more than 41,000 professionals, representing over 20 per cent of the national audit workforce.

With the right governance structures, internal controls, and bandwidth, these firms are equipped to manage multidisciplinary engagements, something smaller practices often struggle to do.

| Type of firms | No. of firms | People employed |

| Sole proprietorship firms | 72,696 | 73,365 |

| Partnership firms/LLPs (2-3 Partners) | 21,750 | 51,868 |

| Partnership firms/LLPs (4-5 Partners) | 3,563 | 16,931 |

| Partnership firms/LLPs (6+ partners) | 2,129 (As of October 2025) | 41,478 |

| Sole-practitioners | 3,791 (As of early 2025) |

Also read: Shaadi.com for CAs? Yes, ICAI is building digital platform to help CA Firms

Smaller firms dominate by volume

Sole proprietorship firms, on the other hand, may make up over 72% of all registered entities and employ around 40% of the workforce.

But it has its downsides: While deeply rooted in local economies, they often lack the scale and resources to take on large, complex mandates.

Regional distribution of COPs

Even the Certificate of Practice (COP) numbers show the same pattern:

- West 32%: Leads with 7,877 partnership firms and 50,434 members (Powered by Mumbai, Pune, and Gujarat)

- Central: 21%

- South: 20%

- North 19%: Delhi NCR, in particular, continues to dominate the North’s audit ecosystem, housing a large concentration of mid-to-large firms.

- East 8%: Remains the smallest contributor in both firms and professionals.

Recognizing this imbalance

ICAI’s push for mergers, alliances, and firm networks is changing the game.

India now has 127 professional networks, structured as:

- 19 Alliance Models

- 6 Lead Firm Models

- 102 Network Models

These alliances allow firms to pool expertise, share technology, expand geographically, and bid for larger mandates, exactly how the global Big 4 grew their dominance.

A digital networking platform, expected by February 2026, will further facilitate collaboration, helping domestic firms scale and compete for bigger clients.

Wrapping up…

While India has a growing CA ecosystem, most of the heavy lifting falls on a handful of mid-to-large firms.

For smaller firms, consolidation and networking aren’t just options; they’re essential to stay relevant as India’s economy grows and compliance demands rise.

The CA landscape may be crowded, but the real power lies with the few that can handle scale, complexity, and client expectations, a lesson for the profession as it charts its next decade.

CA data precticesing

seeing a handful of mid-sized firms employ ~20% of the audit workforce tells me the profession is consolidating smaller firms must collaborate and upskill to win bigger, complex mandates.