- SMEs and CPA firms in the USA are increasingly outsourcing work to India to cut costs.

- Meet Kavita Tapdiya Chakraborty, a Chartered Accountant who identified this opportunity almost 15 years ago.

- Here’s how she built an International Bookkeeping and Tax firm and turned it into a million-dollar business.

From Small-Town Dreams to Freelancing Success

I come from a small town called Malegaon, located in the state of Maharashtra, India.

As far as my memory takes me, I always wanted to be a Chartered Accountant (CA), because of the influence of my maternal uncle. He is a very renowned CA in Mumbai.

To make my dream a reality I moved to Pune, a bigger city.

Finally, in 1996 I qualified as a CA from The Institute of Chartered Accountants of India (ICAI). Guess what? I immediately got married. And as you know, priorities change after marriage.

I wanted to do my Ph.D. and become an academician but life had other plans. As a family, we relocated to Singapore, where I started working with a CPA Firm. From 1996 to 2008 I worked on assignments.

In 2008, we decided to come back to India.

After returning to India I had taken up a job with my first and last boss. I learned a lot from her and thought “I can be like her, and head a company.”

However, after an 8-9 month stint, I had to quit my job to take care of my younger daughter, who had asthma.

I started practicing as Kavita Chakraborty & Associates, but it was not a very satisfying experience (Did not get many clients.)

One day I told my husband, who works in the IT industry, “I don’t enjoy what I am doing. Shall I take up a job?” He gave me the great idea that I should register myself with a number of portals, and do outsourced assignments.

With his help, I registered myself on a portal called Freelancer (similar to Upwork) in 2008.

Transforming a Freelance Gig into a Successful International Bookkeeping & Tax Firm

I was spending over 18 hours a day on Freelancer (a platform similar to Upwork).

And after months of trying and trying at last in the 7th month, I got my first client from the UK, who agreed to pay $50.

In the beginning, I was the only one handling all the projects. But one year later I realized that this is what I want to do full-time.

I started building a team. I hired juniors who could help me with data entry, and accounting, while I looked after sales, deliveries, and interviewing people.

My focus was to only cater to US-based Small and Medium-sized enterprises, with bookkeeping, payroll, and sales tax services.

Eventually, we started acquiring clients from the US, Australia, Sri Lanka, and Singapore.

In September 2010 I gave up my Certificate of Practice and finally built Konnect Consultancy Services, with the help of my husband. Konnect is an International Bookkeeping & Tax firm.

Till 2012 I worked as a Freelancer, bidding on projects by the name of Kavita Chakraborty. I started by charging USD 4 per hour and took all kinds of work from any country. By then we were a team of 4, working in a very small 200 sq. ft. office.

That year I said to myself. “I won’t be able to make it if I can’t decide what I enjoy.”

The first best decision was to focus on one country, which was the US. We didn’t have that much money to hire a staff familiar with the laws of the UK, India, the US, or Australia.

The biggest game changer for Konnect was getting a Chartered Accountant on board, who has strong technical knowledge. His name is Mr. Nikhil Mehta.

From then on, he handled deliveries and clients, and I looked after sales and strategy.

In 2016, we onboarded a CPA as a Partner.

It was in 2016 that our growth increased and we knew we were on a path to success.

Zero Sales Expenses: How We Grew Without Traditional Sales Strategies

We do not have any secret sales strategy. If there is one thing I would like to give credit to is being persistent!

Here are a few steps, on how we acquired clients over the last decade.

Taking care of our clients:

- Believe it or not, our sales expenses were zero until 2016. We strive to add value to our clients’ businesses every day. This can include pointing out discrepancies in their payroll, analyzing cost trends, and identifying increases in sales.

- Whether they paid us $30-$35 a month or $3000, we made sure to give each one of them our time and attention.

Nuturing relationships:

- We tailored our approach to each client, recognizing that different businesses had different needs.

- Our focus has always been to nurture our existing client relationships, rather than constantly seeking new ones.

Building the team:

- We had built a good name for ourselves over the years, and people were happy to refer us. All the credit goes to our strong team.

- In 2016 we got our first Partner at Konnect, who is a CPA and our Sales Director in the US.

- He helps us connect with new US CPA firms and clientele.

With the help of these methods, we were able to increase our clients’ trust and satisfaction.

For sales, only last year I went to the US, until then everything was arranged from India.

I am happy to say that our first client is still with us, and many of our team members have been with us for more than five years.

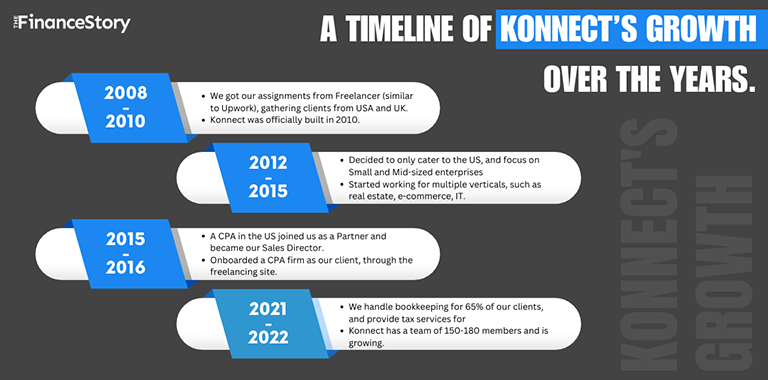

Timeline of Konnect’s growth

Here is a breakdown of our journey so far.

2008-2010

- We got our assignments from the freelancer website, gathering clients over time.

- Konnect was officially built in 2010.

- Hired mostly local B. Com, and M. Com graduates and trained them on the job.

2011

- Offered services to countries such as USA and UK.

2012- 2015

- Decided to only cater to the US, and focus on Small and Mid-sized enterprises

- The number of clients increased to 40-50.

- Started working with multiple verticals, such as real estate, e-commerce, construction, and IT (Information technology).

- Assigned different groups of accountants, to handle the needs of different verticals within the company.

2015 – 2016

- A CPA in the US joined us as a Partner and became our Sales Director.

- Onboarded a CPA firm as our client, through the freelancing site (Till 2016 we received assignments from freelancing sites).

2018

- Focused more on- providing all services under one roof, from basic accounting to analysis to sales tax, and payroll.

2020

- By 2020 we were catering to 11 CPA firms for Tax return preparation and 7 mid-sized bookkeeping firms.

- We reached an 80-plus team.

- Served 175 SMEs for Bookkeeping

2021-2022

- We handle bookkeeping for 65% of our clients and provide tax services for 35%.

- Konnect is now a 150-180 member team and growing.

Strategies to enter the US Bookkeeping and Tax Outsourcing Industry

Outsourcing is not a new concept in the US. The industry continues to grow.

Bookkeeping and tax services are becoming a huge market. Both SMEs and CPA firms are increasingly outsourcing work to India to cut costs without compromising on quality.

And with the rise of remote work and virtual collaboration, you can easily acquire clients from anywhere in the world.

Outsourcing has two key categories:

- Serving the SME sector

- Offering white-label products to CPA firms who can then serve their own clients.

Decide who you want to cater to.

Choose a specific service to focus on:

- Firstly, identify your core competencies such as tax, auditing, accounting, and so on.

- If you want a CPA firm to outsource their tax work to you, then make sure you understand the different tax forms, such as 1040, 1120, and 1065.

Know who you are selling to:

- Do your research on the prospective client and figure out where he or she needs your help. Then prepare a pitch accordingly.

- If you don’t know who you are selling your service to, it’s not going to work.

Finding the work:

- Upwork is doing really well, so consider registering yourself with the platform.

- Start by working with a small business owner or entrepreneur on their books and gradually build your experience.

- You can use LinkedIn to approach your potential client. Remember that selling is an art, so take some time to think about what you will write.

- When searching for projects, be sure to read and understand the details before choosing. Only take up the work that you can complete.

- Start with simple tasks like data entry then eventually say that you can do their accounting.

Know your team:

- It’s important to understand that not every accountant can be a tax expert, and not every tax expert can read a balance sheet.

- Take the time to get to know each member of your team and their strengths. Then assign tasks based on their individual skills and expertise.

I’ve noticed that many Indian CA firms try to do outsourced work on the side, but this approach is not effective. You need to give it your full focus and attention.

Also read: How to find the names of US CPA firms for your Outsourced Accounting, Tax, and Auditing Firm?

Closing…

If you’d asked me “What is the secret recipe for building Konnect?” I would’ve said, it is 13 years of hard work.

Using our expertise, experience, EQ, and IQ, to take care of our clients, and team members is what made Konnect what it is today.

But challenges were also a part of our journey; a lack of funding and great talent are two of them.

We never took a loan from the bank or looked for an investor. Between 2016 – 2018 I took a very small amount, (around INR 35,000 – 45,000) as my salary. Fortunately, my husband took care of most of the household expenses.

In retrospect, if I had taken some funding from an investor, my life would’ve been a little better.

In the midst of a talent shortage, my vision is to pick up rural/small-town men and women and train them. They bring honesty and sincerity to work, which has helped and is helping us grow.

Looking to accelerate your career in finance? Fill up this form to talk to an industry expert

I have been working for 21 years in accounting, taxation and appeals in india. I have office measuring 1800 sqf at Bhopal in Indial pursuing EA. Want work outsourced