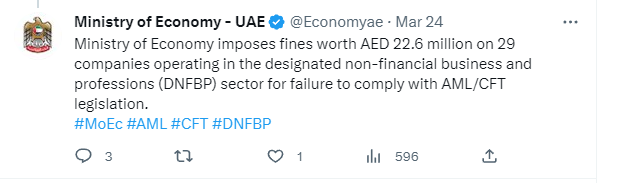

- The UAE’s Ministry of Economy has imposed a hefty fine of AED 22.6 million on 29 companies.

- They failed to comply with Anti-Money Laundering/Combating the Financing of Terrorism legislation.

- Does this bring any opportunities for Finance Professionals?

UAE fines 29 companies for breaching AML/CFT laws

The UAE’s Ministry of Economy (MoE) recently imposed a fine of AED 22.6 million on 29 companies.

The action is a part of the Ministry’s effort to combat money laundering and terror financing.

Those companies (names undisclosed) were operating in the Designated Non-Financial Businesses and Professions (DNFBPs) sector. They failed to comply with the Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) legislation.

DNFBPs are governed by AML regulations. And these regulations cover industries and professions beyond the financial sector which could be exploited for money laundering purposes.

Real estate agents and brokers, precious metals and gemstone dealers, auditors, and corporate service providers are among the designated non-financial businesses or professions.

Ensuring adherence to these laws is crucial for the UAE’s compliance with the international standards established by the FATF.

The importance of compliance in the UAE

Money laundering and the financing of terrorism are crimes that threaten the security, stability, and integrity of the global economic and financial system, and society as a whole.

And to handle all anti-money laundering matters and combat the financing of terrorism (AML/CFT), the Central Bank of the UAE established a dedicated department in August 2020.

AML/CFT serves three key objectives:

- Examining Licensed Financial Institutions (LFIs)

- Ensuring adherence to the UAE’s AML/CFT legal and regulatory framework and

- Identifying relevant threats, vulnerabilities, and emerging risks concerning the UAE’s financial sector.

The UAE ministry stated that 17 out of those 29 companies engaged in precious metals and gems-related activities. The other four corporate service providers and two auditing service companies violated AML/CFT legislation.

Those companies committed a total of 225 violations, including failing to adopt necessary measures and procedures to identify crime risks in their field of work.

They also failed to establish internal policies and procedures to check customer databases and transactions against names on the terrorism list. The list is issued under the provisions of a Cabinet resolution on the UAE’s list of terrorists.

The UAE tightening the inspections of businesses

Abdullah Sultan Al Fan Al Shamsi, Assistant Undersecretary of MoE for the Control and Follow-up Sector, and chairman of the committee for the imposition of fines on violators, shared his thoughts.

He stated that the Ministry imposed fines in an effort to supervise the DNFBP sector and ensure its full compliance with the legislation. The Ministry is intensifying field inspections on high-risk companies in all emirates of the country. It is providing intensive awareness and training support to the sector’s companies.

He further emphasized that full compliance with AML/CFT legislation is imperative to establish a safe business environment that is free of money laundering and terrorism financing risks.

This is a national priority that will enhance the competitiveness of the UAE economy at regional and global levels.

Safeya Al Safi, Director of the Anti-Money Laundering Department at the Ministry of Economy, added that the Ministry is determined to implement its annual inspection targets for the DNFBP sector.

To achieve this goal, they have doubled the number of field inspectors that will prepare technical inspection reports and submit them to the Investigation and Enforcement Department.

The department then will take necessary measures regarding the imposition of deterrent measures, including fines.

She also stated that the department’s work teams continue to effectively carry out intensive desk and substantive inspections in line with the inspection plan for 2023.

What it means for Companies and Finance Professionals in UAE

Regulatory compliance is about to become more important for businesses in the UAE.

To avoid such fines and reputational risks, now companies would have to take compliance seriously and establish a compliance program that includes regular training, monitoring, and reporting.

As of 2021, there were 450,000+ registered companies in the UAE, among which 80-85% are SMEs.

This means that there would be a need for Financial Professionals, with knowledge of anti-money laundering and counter-terrorism financing laws.

Their role is critical in ensuring that such a program is in place and is functioning effectively. By doing so, companies can avoid costly penalties, maintain their reputation, and enhance their overall performance.

Some of the job roles that may be in demand are:

Compliance Officers: Compliance Officers are responsible for ensuring that a business operates within the bounds of laws, regulations, and industry standards. Their primary objective is to ensure that the company complies with legal and ethical standards and that it avoids financial and reputational risks that could arise from non-compliance.

AML Analysts: AML Analysts are responsible for reviewing transactions and identifying suspicious activity that may indicate money laundering or terrorist financing. They typically use analytical tools and techniques to detect patterns and trends in transaction data.

Investigative Analysts: Investigative analysts are responsible for conducting investigations into suspicious activity identified by AML Analysts or other sources. They may work with law enforcement agencies to gather evidence and build cases against individuals or organizations involved in money laundering or terrorist financing.

Risk Managers: Risk Managers are responsible for identifying and assessing risks that companies face in relation to money laundering and terrorist financing. They may develop risk management strategies and advise senior management on risk mitigation measures.

These professionals should pursue relevant certifications, acquire skills and qualifications, develop expertise in specific areas, and build a strong network.

Wrapping up…

Did you know that just last year in 2022 the UAE’s MoE imposed a penalty of AED 3.2 million on six companies?

They fined the companies for, guess what? Violating the regulations of the Anti-Money Laundering and Counter-Terrorism Financing law.

Some exchange houses operating in the UAE have also faced penalties from the country’s central bank due to their failure to comply with anti-money laundering regulations.

We are not certain if this is the last of these cases. But the UAE has made a significant effort to combat money laundering and terrorism financing.

Looking to accelerate your career in finance? Fill up this form to talk to an industry expert