- The US is experiencing a talent shortage, with more than 300,000 accountants and auditors having left their positions.

- The number of young individuals pursuing the CPA qualification has also declined.

- To tackle the CPA pipeline situation, the American Institute of Certified Public Accountants (CPA) has unveiled a game-changing plan.

AICPA releases plan to address CPA pipeline challenges

The accounting profession in the United States is facing a massive shortage of talent.

Over the past two years, more than 300,000 accountants and auditors have resigned from their positions. The number of young individuals, particularly Gen Z, studying accounting and pursuing the CPA qualification has also declined.

To enhance the profession’s talent pipeline, the American Institute of Certified Public Accountants (CPA) has unveiled an expanded plan.

AICPA is one of the largest organizations, representing the accounting profession. The institution is actively fostering opportunities for dialogue and collaboration, to tackle the underlying challenges and develop a robust pipeline of future CPAs.

In order to accomplish this, the AICPA is partnering with stakeholders to implement short-term, medium-term, and long-term activities that target specific root causes of pipeline issues.

Encouraging students to pursue CPA qualification

The AICPA has worked closely with state CPA societies, accounting firms, the Center for Audit Quality (CAQ), State Boards Of Accountancy, and the National Association of State Boards of Accountancy to identify several crucial areas in the pursuit of talent.

Considerable attention, discussion, investment, and research are being directed toward a wide range of initiatives throughout the entire CPA pipeline.

These initiatives encompass various activities, including the CAQ-led Accounting student awareness campaign, the implementation of CPA Evolution, and the upcoming launch of the new CPA Exam in January 2024.

Through collaboration with stakeholders, the AICPA has pinpointed specific initiatives that address key areas of focus:

- Raising Awareness: Enhancing awareness regarding the accounting profession and highlighting the advantages of pursuing a career in accounting.

- Changing Perceptions: Addressing outdated perceptions and utilizing updated, positive messaging to resonate with current students.

- Training and Education: Providing top-notch accounting education and training opportunities.

- Collaboration with Educational Institutions: Establishing partnerships with colleges and universities to offer internships, scholarships, and other programs that entice individuals to enter the profession, alleviate financial burdens, and equip students with the necessary skills for success as CPAs.

- Firm Culture and Business Models: Empowering firms with resources to offer competitive compensation packages, attractive benefits, career growth prospects, and engaging work environments.

- Diversity, Equity, and Inclusion: Promoting inclusivity and diversity to attract and retain a broader spectrum of talent.

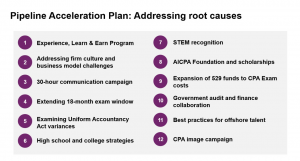

The plan expands upon an earlier eight-point draft that was released in early 2023. Key initiatives within the plan include the implementation of the Experience, Learn & Earn Program.

Closing…

“Building the CPA pipeline requires a united effort from all stakeholders tied to the profession,” Susan Coffey, CPA, CGMA, the AICPA’s CEO–Public Accounting, revealed in a press release.

She also mentioned that they need to work together to raise awareness about the rewarding accounting profession and address stumbling blocks that prevent prospective candidates from pursuing the CPA qualification.

AICPA holds a distinctive position to transform ideas into tangible actions.

While its plan provides a structured framework for progression, it is not the definitive solution.

This process is continually evolving and demands determination, foresight, and strong collaboration with vital partners to drive meaningful outcomes.

Now the only question is, “How successful will these game-changing plans and initiatives be, in solving the talent shortage in the US accounting profession?”