- Hi, I am Anshul Agrawal, Founder of June15 Consulting, a Toronto-based firm helping US CPA firms set up their offshore or as you may call “satellite offices” in India.

- Almost 50 US CPA firms have set up their satellite offices in India, as it’s preferred over the Philippines, Mexico, Argentina, and Poland.

- When I look at my revenue projections, I am aiming at somewhere between $10-20 million a year. Achieving this won’t happen in the next 1 to 2 years. However, that’s the magnitude of the opportunity.

Identifying the million-dollar opportunity

I come from Indore, a town in Madhya Pradesh, India.

After completing school, I went to the US in 2001 to pursue my MBA.

Following a few years of work experience in the US, I relocated to Canada in 2012 and established June15 Consulting.

Initially, our focus was on supporting Fortune 500 companies with comprehensive research, aiding in the launch of their groundbreaking products.

India became a significant market for us as many American companies sought access to the Indian market.

It was going great until the COVID-19 pandemic struck us. Naturally, people weren’t interested in investing in new products.

Out of the blue, an old client contacted me. His CPA firm, with $15 million in revenue, was struggling to find local accountants and thus decided to look at India!

They needed a professional who could help them understand India – its cultural differences, how to set up a team there, and which location to pick. And that’s where my role came in.

Though I had never done this type of work, my knowledge of both the US and Indian markets and cultures made me suitable for the job.

I decided to go ahead with it, and June15 Consulting began assisting US CPA firms in building their offshore units in India.

When I look at my revenue projections, I am aiming at somewhere between $10-20 million a year.

Achieving this won’t happen in the next 1 to 2 years. However, that’s the magnitude of the opportunity.

But why is it such a significant opportunity for me as a consultant?

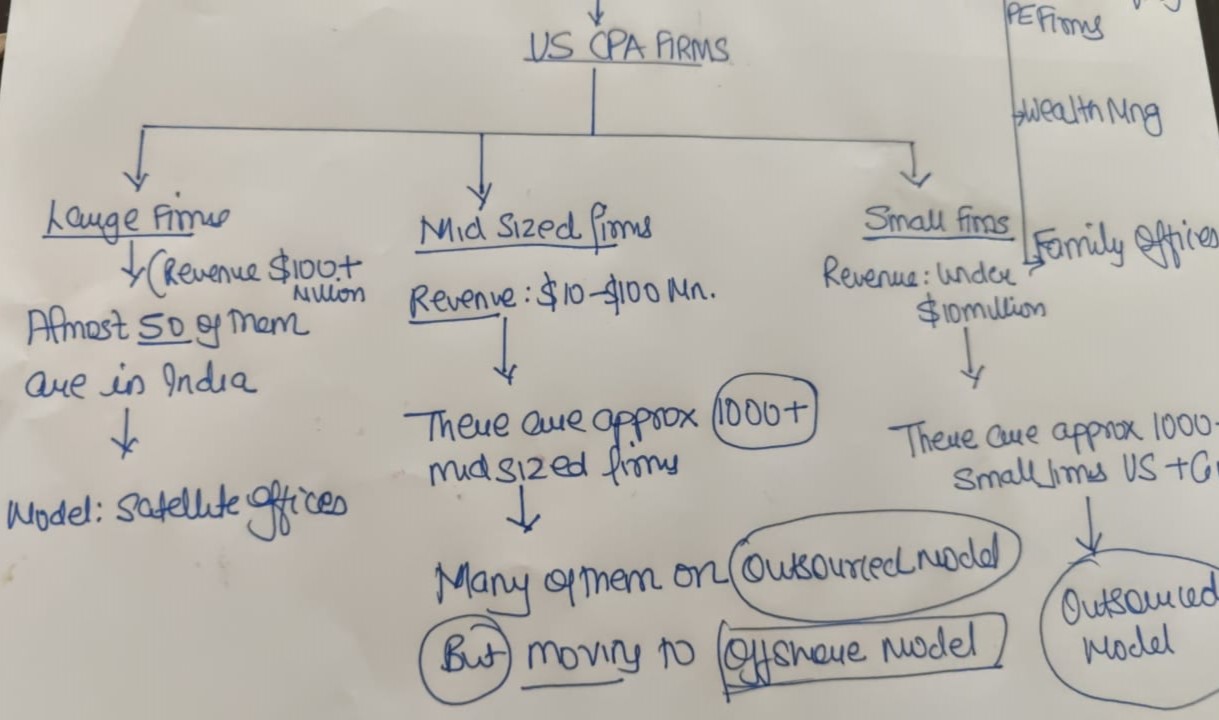

Mid-sized firms

There are around 1000 mid-sized CPA firms in the US with a revenue of over $10 Million to $100 Million. Firms like this are under pressure to increase revenue…. But Why?

- Clients are beginning to give more work

- Under a lot of pressure to expand their services beyond just tax and audit work; offering bookkeeping, HR consulting, and technology consulting

- Outgrown the outsourcing phase

The midsized segment is my sweet spot and that is what we focus on at June15 Consulting.

Small sized firms

From my research, there are more than 300,000 small accounting firms in the US and Canada.

Since the revenue of these firms is less than $10 million, they can achieve more profit from outsourcing their work rather than establishing an offshore office.

There are enough outsourcing companies in India catering to these small-sized firms, but the opportunity still exists.

By forming partnerships with 1 or 2 firms, you can secure work during busy seasons.

For anyone looking to enter this field, outsourcing serves as an excellent starting point.

Other financial services

There is a huge opportunity to help financial services firms like wealth management, family offices, private equity, and insurance companies set up satellite offices in India.

Smaller firms will consider outsourcing for Valuation, Due Diligence services etc.

Even a small project with them can lead to huge opportunities.

Our business model

When working with clients, I always assess their savings compared to their potential earnings. Then, I determine the fee based on that.

For example, if I save them $100, I might charge a $50 fee. This is why I believe the potential for success is significant, and there are various business models to consider in the offshore space.

Here is how the process unfolds.

The pre-contract phase

Connecting with the firm

During this phase, I connect with a CPA firm, usually through a mutual contact, and discuss the process.

We discuss the following topics,

- What will be the expenses for establishing an office in India?

- How soon can they expect a return on investment?

- If things don’t go as planned, how much money could they potentially lose?

Once we address all these concerns, they are prepared to sign the contract. After the contract is signed, I transition from consultant to a team member.

Post contract

1. Picking the location in India

We need to decide on a city in India, be it Bangalore, Mumbai, or Ahmedabad.

This decision is made based on a few factors,

- Type of office space: First we determine the type of office space we want. Should we choose a co-working space or have our own office?

- Team size: Then we need to determine the size of the team we want to establish in India.

- Additionally, we should consider our budget for overhead expenses.

Based on these factors, I usually suggest Ahmedabad for clients who want to set up a smaller team, around 25 or even less than 50 members.

If you’re setting up a large team, Mumbai or Bangalore might be better options. I usually recommend Mumbai due to its numerous advantages.

It’s a financial hub, has talent with excellent English proficiency, top-notch infrastructure, and I believe Bangalore has become pricier than Mumbai now.

2. Setting up the office

I then collaborate with an interior designer or contractor for quotes. If we proceed with office construction, the contractor manages the project.

3. Factoring the costs for the setup

The biggest cost component is the salary for the team being hired.

On average, a skilled accountant in India with experience working for a US firm earns around $25,000. For freshers, the salary range is between $12,000 to $15,000.

As for the Director of India, it varies greatly and can be as high as desired. If you’re setting up a team of 10, the total salary would be $250,000 – 350k

The overhead costs, including rent, are not significant. In Ahmedabad, rent is around $1 per square foot, while in Mumbai it’s around $2. Therefore, the main investment to consider is the salaries, which can be estimated at $25,000 per person as a good starting point.

4. Finding the right team

Next, we proceed to the recruitment phase. We need to hire a Head of Operations for our India office.

Once we finalize this position, we then proceed to assemble the desired team which depends on the needs of the CPA firm.

To accomplish this, I collaborate with recruiters in India and utilize my network. I also leverage LinkedIn to gather resumes.

5. Taking care of compliance issues

A network of strategic partners in compliance, technology, HR, and travel that make things easier for both our clients and us.

I team members in India who help with operations, including fraud management, which is a big concern for accounting firms.

One of the CA firms advises us on RBI, Foreign Exchange, and Transfer Pricing matters. Another CA firm helps with local compliance like GST and income tax.

6. Regulatory aspects

Regulations around setting up an offshore firm in India are complex but improving. Many processes are being digitized and unnecessary bureaucracy is being reduced.

To address this, we assist our clients by becoming their employer of record and handling all compliance matters until they are ready to manage them themselves.

7. Operational tasks

Next, we focus on operations, training both parties on collaborating. This involves extensive travel to India and cultural integration training. It usually takes 1 to 2 years for the client to be ready.

8. Final handover

Once they are prepared, we hand everything over to them.

Typical challenges as a consultant

Succeeding in my line of work comes down to 3 main things;

Experience: First you need to be able to prove to the client that you have the experience and expertise to help them navigate this process; such as your ability to communicate their vision to the India team.

Trust: A lot of CPA firms are extremely risk-averse. They don’t wanna do anything that makes their clients or their leadership feel nervous.

So my job is to build that trust, and that’s very challenging because it takes time.

Convincing the board is another part. There is more than one leader in a CPA firm. So getting everyone on board is a big challenge.

Takes time to build trust: I have been speaking with a CPA firm since last September or October, and we have still not concluded.

Differentiation: There are a lot of people in this field. So I have to figure out a way to differentiate myself from them.

Why are CPA firms considering satellite offices?

Shortage of accountants: Between 2019 and 2021 almost 300,000 accountants quit, which is significant.

The accounting shortage issue will not be resolved anytime soon, possibly not within the next 5 to 10 years.

Low approval rate of H1B visas: Many CPA firms hire international students right after school. Initially, they get 2 or 3 years of visa-free work in the US. However, after that, they need to focus on obtaining an H1B visa, which has a low approval rate of around 10 or 11%.

Private Equity firms in the US are showing more interest in buying CPA firms. Then their main goal is to focus on generating more revenue and creating more value for the firm, which is possible through offshoring.

Cost-effective advantage: India allows CPA Firms to have a team that is not as costly as in the US, but just as smart. This enables them to adjust prices and offer new services to their clients.

Wrapping up

The Indian offshore business model has already been successful with over 50 CPA firms having offices there.

Despite offshore routes gaining traction, there is still a stigma attached to offshoring.

Around half of the US CPA firms that I have been talking to seem to be interested in establishing an office in India, the other half is being more cautious at the moment. That’s where lies an opportunity to step up and help them navigate through these difficult waters.

Overall, we are receiving a lot more positive responses from CPA firms in terms of willingness to discuss further.

I am Rebecca and completed cpa exam in june23. Will write my ethics exam shortly for completing license procedure. Interested in audit job in hyderabad. Last 5 years working in Deloitte in FP&A

Sir I am CA Manmohan Ramchandani from Bilaspur, Chhattisgarh, India.

I am interested in this proposal and i have a team of people. How to get connected to you for this opportunity. Kindly share the details

Good morning, I am a practicing CA from Bokaro ( Jharkhand) having experience of more than 20years. During these period I served 14years to PSUs and having expertise in IFRS (Ind AS). Currently having a team of more than 10 members and serving various MSMEs, bank audit, psu audit and many private clients. We are interested in any such collaboration with CPA firms from outside india. Please share the details how can we connect on this for further discussion. Retards, CA Arvind Kumar.

Hi I am Rajamani Ganesan practising CA with 36 years experience in practice. Was briefly employed in a large public sector company in BHEL BHOPAL. Our firm based in Bhopal with 7 partners has branch in Mumbai and I am the partner in charge in Mumbai. We have excellent contacts in Ahmedabad as we undertake assignments from Ahmedabad. We are interested to build a dedicated team in Mumbai or Ahmedabad. Will deliver results. Have experience in US GAPP . Pl contact. R. GANESAN +919425010752. THANKS

I am already into it and agree with the author. I can be reached out at imran.khan@ikandco.in

Hi Anshul,

I am Gaurav Mehrotra, qualified CA with 20 years experience. Heads a company who specialises in F&A outsourcing. My company is 17 year old, have 105 employees and 3 offices in India. Can we connect to understand the opportunity. I can be reached at Gaurav.mehrotra@blueconsulting.co.in

I am a CPA (Delaware) qualified in 2002. I have 22 years of post qualification experience which includes internal audit, reporring in public company. My contact is +91 99467 25257

I am a ca having experience of 25 years in taxation and accounting at hathras near agra, guide me on your proposal

Hi Anshul! I am Rajat Jain, a CA working in Deloitte USI for around 3 years. Firstly, I would to like start with saying its a wonderful article. Further, even at Deloitte I have noticed such growth of offshore model not just in US but europe and middle east as well. I would like to connect and understand more on this. Please contact over whatsapp 9032227168. LINKEDIN RAJAT BACHHAWAT and gmail – Justrajat111@gmail.com

Please connect, ykumarca@gmail.com or 9004163687

I am a chartered accountant based at Mumbai.

Hi I am Subbalakshmi,CA, Blr. Interested to know the details.

Hi , I am practicing CA from Guwahati Assam . I m interested, my mob no 919864023853

Hi Anshul

My name is Raoof Ahmed Khan from Hyderabad. I’m an IT professional with over 20 years of experience. I am interested in exploring this opportunity. You can contact me on 95506 54297

I am interested in exploring this opportunity further. Already consulting for US companies in India. Can ve reached out at- rahulsahni31@gmail.com

Hi….I am Gurleen Kaur Saini from Indore M.P. currently a CA finalist expected to clear my exam in July 24….I have 5 years of experience in Indirect taxation (incl. articleship). I am currently looking for entry level job. Kindly contact me for any vacancy gurleenkaursaini21@gmail.com

I’m shradha mahesh, a qualified US CPA. I was working in Deloitte USI for 2 years and Grant Thornton for 1 year. I am looking for a job where I can learn the entire process from client facing to filing tax returns. Please do let me know when we could apply for the same

Hi I am ca jaydip Limbasiya, chartered accountant. I am practicing traditionally and want to diversify in foreign accounting, book keeping and data entry.

I am having 3 staff among one is ca final.

If any suitable outsourcing is available then connect me at

Limbasiyaandassociates@gmail.com

M. No. 9510304958

Hello Anshul,

I am CA. Ravi Ashara from Rajkot, Gujarat and I am interested to tie up with cpa firm. I have enough staff to provide intime and valueable service to cpa firms. I have knowledge of QuickBooks And US Tax laws so that it will not take much time to understand me by them. Can you help me to establish such type of relationship with cpa firms. I will be a pleasure to connect and work with you. You may contact me on ravi24service@gmail.com and Mo : 9998869610

Hello ,

I am Anushri Patel , Licensed CPA since 3 years and have working experience of US and India Taxation and Bookkeeping for more than 10 years. We are a team of 10 members and would like to collaborate with US CPA for outsourcing us the work. KIndly let us know when can we connect