- On February 21, 2024, Chartered Accountants Ireland and CPA Ireland, the two accountancy bodies announced their amalgamation.

- Here is why the merger is taking place and how it will affect Indian CAs who are members of CPA Ireland under the MRA.

What’s happening at both the Institutes?

- In January 2024, the President of CPA Ireland, Mark Gargan, announced the initiative to seek approval from members to merge with Chartered Accountants Ireland.

- Online voting began from 29th January 2024, until 14th February 2024.

- Members received instructions to access the Civica platform where they cast their vote early and participated in the SGM meeting online.

- A series of town hall events were organized to interact with members regarding the proposal, leading to 21st February.

- After extensive discussions on common goals, the strategic position of the profession, and tackling future challenges and opportunities, the Council made the decision.

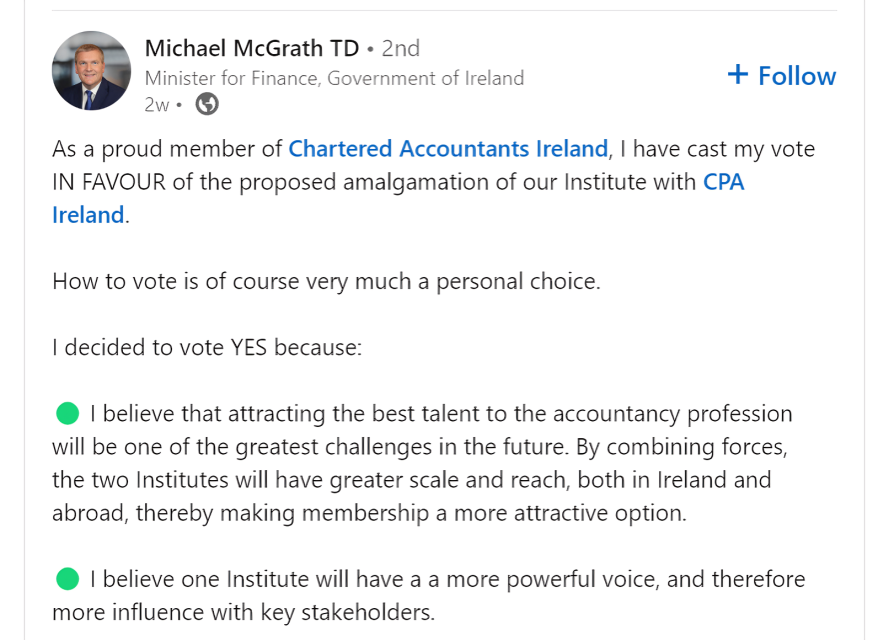

Why the merger?

The members of CPA Ireland and Chartered Accountants Ireland believe that this merger will bring the following benefits among others,

- Enhance the accounting profession’s future prospects by strengthening its ability to overcome challenges.

- Create a more efficient organization and offer greater benefits to members in a globalized market.

- It could benefit Small Accountancy Practices.

- Could meet the shared challenges of the future for the accountancy profession.

- Strong financial base and improvements to services for members by the pooling of both organizations’ resources.

About the Institutes

Founded in 1888, Chartered Accountants Ireland is the largest accounting body in Ireland. Chartered Accountants Ireland was established by Royal Charter.

It boasts over 30,000 members globally.

The Institute offers the Chartered Accountant qualification, a highly recognized professional designation in Ireland and internationally.

Established in 1926, CPA Ireland is another significant professional body for accountants on the island.

CPA Ireland was formerly known as the Institute of Certified Public Accountants in Ireland. The Institute offers the Certified Public Accountant (CPA) qualification, another widely recognized designation in the accounting and business world.

The accountancy body boasts approximately 5,000 members and students.

Did you know?

This isn’t the first time the bodies have proposed merging, as similar measures were taken in 2001 and 2004, but they were ultimately withdrawn before reaching the voting stage.

Pending integration process

The integration process is currently underway and is expected to be completed in the coming months pending regulatory and other approvals.

Additionally, Chartered Accountants Ireland members will have another vote at the Annual General Meeting in May this year.

Joint statements from the Presidents of the Institutes

Sinead Donovan, President of Chartered Accountants Ireland said:

“This is a vote of confidence in the future. Thanks to every member who engaged with us along the way and who turned out to vote in such numbers. Our work continues now to secure the legal and regulatory consents needed to deliver on this mandate for a stronger profession.”

Mark Gargan, President of CPA Ireland said:

“As one single Institute, we will be more strongly positioned to represent our members, to promote the profession, and to be a positive voice representing the public interest.

The move towards consolidation of professional membership organizations is gaining momentum globally, and Ireland will be a model for other professional bodies in this regard.“

Impact on Indian CAs with CPA Ireland credential under MRA

The Institute of Chartered Accountants of India (ICAI) and the Institute of Certified Public Accountants In Ireland (CPA Ireland) have a Mutual Recognition Agreement (MRA).

This agreement mutually recognizes the qualifications of each other and admits the Members in good standing by prescribing a bridging mechanism between the two Institutes.

Indian CAs who are members of CPA Ireland under the MRA will move over to Chartered Accountants Ireland.

There is no mention of what will happen to the MRA in the future.