- Hi, we’re Aloke Ghosh (ex-CFO of Mahindra Holidays & Resorts, ex-Controller at Apple) and Francis Vidhayathil (ex-CFO of Drums Foods – Epigamia).

- After 25+ years in top finance roles, we asked, “What’s next?”

- So, in our mid-40s and early 50s, we launched FinAdvisors, a boutique fractional CFO firm to help scaling founders, unicorns, MNCs, and SMEs.

- We didn’t start with a clear trajectory for revenue or growth…. but things picked up.

Background

Aloke: I had aspirations to become a CFO and always gave my best in every role.

I was a hard worker engaging with the leadership on business aspects, forecasting, and sometimes joining analyst calls.

Effective communication and visibility to the right people were crucial in my journey. Continuous learning also played a significant role.

Over the years I played the role of a CFO, Head of Finance, and Controller for large organisations like Mahindra Holidays, Tech Mahindra, Reliance Communications, and Apple.

Francis: On the other hand, I never aimed to become a CFO.

I had smaller, personal goals like buying a house and possibly retiring as a director.

But as luck would have it, things turned out differently.

I achieved most of my early career goals within the first five years.

That’s when I realized I might not have set my career goals high enough and there was much more I could accomplish.

If you look at my LinkedIn profile, for 12 to 13 years, I was with the Mahindra group because I enjoyed that journey.

But subsequently, I kept changing jobs every 2-3 years.

I took up every opportunity that came my way, which eventually led to my first CFO role at TinyOwl, a software development startup for food delivery, that had acquired funding of $26.5M.

After that, I became the CFO at Drums Food, the company behind the Greek yoghurt brand Epigamia.

HR guys used to question me – You seem to be quitting your job and looking out for something different. Why is that?

At times, I questioned myself.

From corporate CFOs to Founders: Identifying a gap

Francis: One of my ambitious goals was to leave the corporate world by the age of 45.

While I was the CFO at Drums Food, I started thinking about my future and the goals I had set for myself.

At one point, I even considered becoming a restaurateur, but those plans fell through due to the COVID-19 pandemic, which in hindsight, was a blessing.

During this time, Aloke and I reconnected, (I was reporting to Aloke at Mahindra).

We realized we could combine our skills and passions to create something meaningful for the industry. But what could it be? We noticed a gap in the market for CFO services.

While many firms are offering virtual CFO services, they often lack a certain level of expertise.

- Great with compliance and accounting, but lacking the business support founders and CEOs need.

- Provide historical data and budgets but don’t engage closely with the management team to analyze data, conduct market research, or advise on strategic decisions.

- Many startups had CFOs who were more like advanced accountants with limited experience. They couldn’t afford a full-time CFO with the strategic expertise required.

That’s where we saw an opportunity.

We decided to start a boutique fractional CFO services – FinAdvisors was born in 2018.

Our USP? Team of experienced CFOs with 15 to 20 years of experience in Corporate Finance, strategy, business setup, compliances, fundraising, M&A, FP&A, JVs, and a lot more.

Starting out and building our clientele?

Aloke: Thanks to our experience, we had acquaintances or got access to some promoters who themselves called us.

So, we started with a little bit of an advantage.

Our first client was generating $300 million in revenue when they brought us on, and we helped them grow to $400 million.

There has been no turning back.

Strategy to build a CFO services firm?

Aloke: We didn’t start with a clear trajectory for revenue or growth.

Our focus has always been on using our expertise to serve the needs of our clients, whether they are small or large.

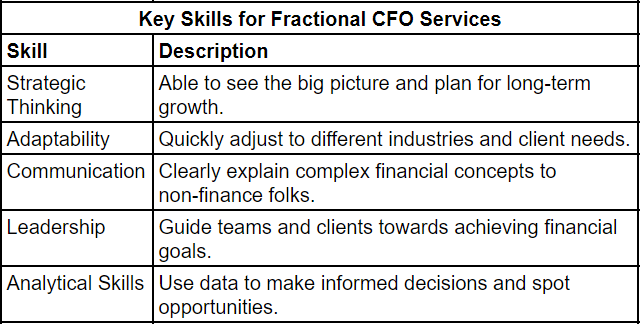

Have a solid industry experience

- Must have some amount of experience in the industry. It’s always preferred.

- There may be people who have started as a fractional CFO as their first job. But it may not be the right way.

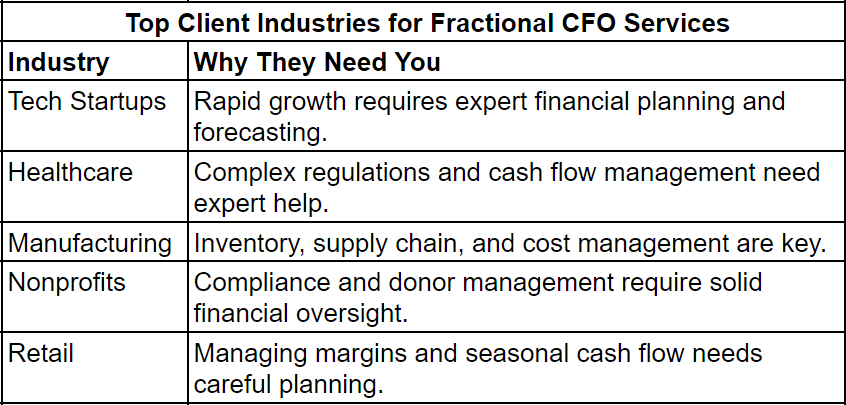

Marketing

For us, it was more of the referrals and the connections that knew us from before, that worked.

One area where CFOs or finance folks consider themselves weak is marketing. So, that is a skill they also need to develop.

One thing that has worked for a lot of other firms, not necessarily in the CFO services, is the visibility of the promoter.

Making your presence felt in various good forums like Confederation of Indian Industry (CII) or NASSCOM or good seminars has landed people clients.

Besides that, there are a lot of marketing agencies that help you in finding clients. For us, somehow it did not work out so well.

Complementing skill sets

Francis: I bring industry experience and subject matter expertise

Aloke offers a different skill set and perspective.

Suresh complements us with an entrepreneurial, tech-backed approach that’s unique.

So, having team members that complement each other is crucial.

You can tell your client – I can tackle 3, or 5 of your problems directly, and for the rest, I have a team of experts. This way, I provide you with a one-stop solution that covers everything.

This method works out perfectly for clients.

Differentiator

From a differentiator standpoint, the commercial aspect is crucial.

You need to strategize and offer unique models, like equity, variable pay, or payoff models.

Additionally, if you specialize in funding, exit strategies, or turnarounds, provide clear examples of your success in these areas. This targeted approach can meet the specific needs of founders and entities and help you stand out.

Be flexible

Aloke: If Francis or I ever thought that because we’ve been in executive roles dealing with senior board members, we shouldn’t meet with promoters or other such people, it wouldn’t work.

You have to be extremely flexible in this aspect.

Pricing Models for CFO services?

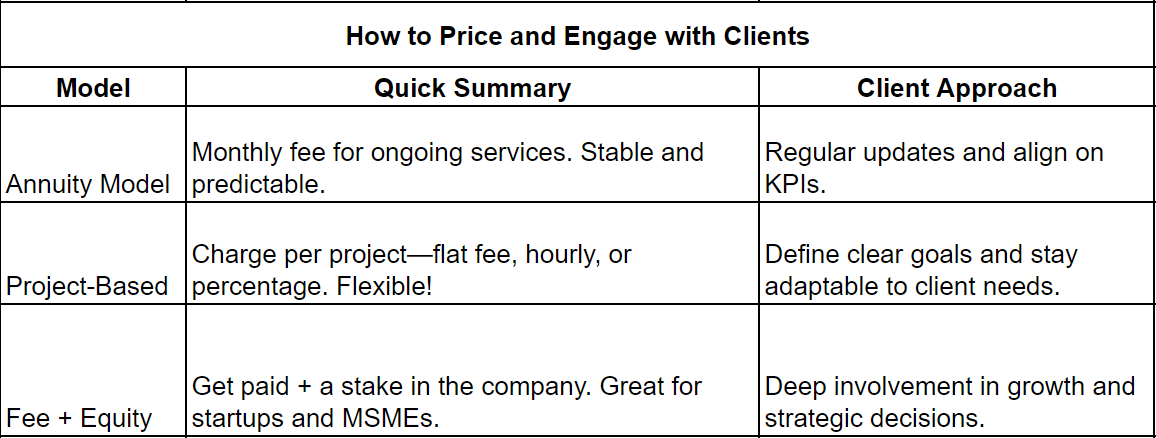

Annuity model (Retainer)

Aloke: We primarily use an annuity model, which means we charge a monthly retainer fee to our customers.

This model suits us because it provides stability and helps us manage our operations more effectively.

Francis: For recurring services like CFO services, a retainer model is typically appropriate. It involves:

- Monthly MIS

- Internal business reviews

- Compliance checks.

Project-based pricing

Aloke: Depending on the project, we might use a percentage-based fee, a flat project fee, or an hourly/daily rate.

The choice of model depends on the nature of the project and the client’s requirements.

Fee+equity model

Aloke: In some cases, especially with MSMEs and startups, we’ve worked on a fee-plus-equity model.

This means we charge a fee and also take an equity stake in the company. We haven’t used this model extensively, but we’re open to it, particularly for startups or when planning an exit strategy.

It’s about finding the right balance that works for both us and our clients.

Depends on the kind of services provided

Francis: The type of pricing model you choose depends on your core strengths.

For example, if your strength is in fundraising, this won’t be recurring.

It’s about leveraging your expertise and choosing a model that aligns with your business goals.

Also read: Left my full-time job to become a Fractional CFO on Toptal: You can earn 3 to 10 Times Your Salary!

How are KPIs and metrics tracked and measured?

Aloke: We focus on long-term KPIs.

For example, a significant KPI might be the exit of a business within a specific time frame. This involves preparing for due diligence, guiding the process, and ensuring readiness for public issues if needed.

We also create dashboards that include financial, operational, and sales metrics to track progress. These dashboards help us and our clients monitor how these metrics evolve month-to-month.

Francis: Most of our engagements are on a retainer basis, so we have regular check-ins.

We provide dashboards to management and boards, covering accounting, compliance, reporting, budget versus actuals, forecasting, and cash flows.

This ongoing communication helps avoid situations where a client suddenly feels that their needs haven’t been met.

KPIs can be adjusted as needed.

Importance of legal backing for fractional and virtual CFOs

Francis: In many cases, we insist on having legal support to back up the decisions made by fractional CFOs. This not only protects the fractional CFO but also the entire management and board.

We ensure that agreements and documentation are thorough to cover:

- Work performed, risks involved, and fees earned.

- Additionally, we include ourselves in insurance policies such as CGL (Commercial General Liability) or PI (Professional Indemnity) insurance to provide individual protection, similar to what a full-time CFO would have.

Aloke: For statutory requirements, particularly in listed companies, FinAdvisors does not directly engage in the appointment of key management personnel.

We support the CFO role but do not assume the statutory responsibilities.

Legal complexities often arise more with overseas clients, where differing legal frameworks can complicate agreements. However, we have developed solutions to handle these challenges effectively.

What are your plans for scaling?

Aloke: We aim to collaborate more with:

- VCs and private equity firms: Focusing on identifying investment opportunities, guiding invested companies, and preparing them for exits.

- Plan to enhance our efforts in English-speaking countries such as the US, and the UK

- Evaluate opportunities in regions such as the Middle East and Singapore.

Also read: Ex-CFO turned founder reveals massive opportunity for Virtual CFOs

How big are the CFO Services market opportunities?

Aloke: In India, there are approximately 4 crore MSMEs, which could increase to 7.5 crores. However, many MSMEs may not fully understand the role of a CFO, so there is a need for awareness.

Internationally, especially in Western countries, there is a recognized shortfall in CPAs and a growing demand for CFO services due to an ageing population.

This presents significant opportunities for CFO services overseas.

Francis: Large clients are increasingly open to fractional and virtual CFO services as the market evolves.

The traditional expectation of a CFO being physically present is changing. While securing initial clients may be challenging, having a specialized offering can lead to long-term success.

Marketing CFO services internationally presents challenges, particularly in establishing trust and demonstrating value remotely.

While we have faced difficulties, attending seminars and networking has provided valuable insights.

Also read: This CFO quit the corporate world to enter the Outsourced CFO space. Here are his learnings.

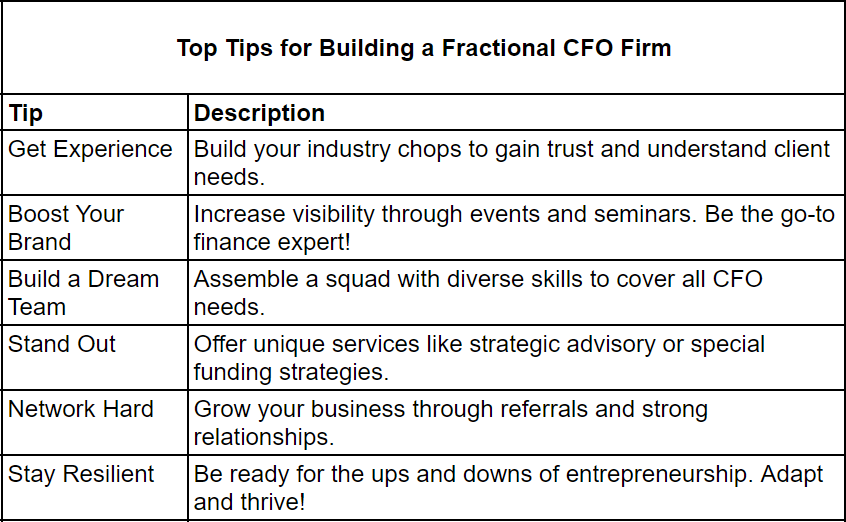

Are you wired to navigate the uncertainties of revenue?

Francis: You would be surprised to know that even my parents did not back me when I revealed my entrepreneurial ambitions.

They were concerned as to why a guy with a good job at hand would venture out.

Technically, a salaried employee runs on that 1st of the month paycheck.

Whereas, in the entrepreneurial journey, you may need to wait for 6 months to 1 year for your 1st paycheck.

Are you cut out to say that, yes, I will survive? Prepare yourself for all the ups and downs, and rewire your mindset, then there is no stopping you.

Aloke: We have done much more work on annuity than project-based work. But when a newcomer is starting, there could be uncertainties regarding when you start generating revenue.

You may have a cycle where your earnings could go up heavily, or go down.

So, one should know both the good side and the bad side of this because it’s not a regular job.

Big question – Can you make more money than in your C-Suite job?

Francis: It is very much worth it. I would say that it’s much better than what I used to earn in my corporate life.

Now, when I look back, today I have multiple clients whom I can look forward to. I’m not running away from anyone.

Ultimately, all said and done, you don’t need to report to a boss!

Be prepared for a challenging journey. Success will require persistence.