- Hi, I am Girish Vanvari, Founder of Transaction Square – A Tax, Regulatory, and Business Advisory firm.

- I was the National Head of Tax at KPMG India and at age 46 I decided to start my own; with faith in my vision, co-founders, and team.

- It wasn’t easy giving up my yearly salary of INR 3-4 crores; my family too made immense sacrifices!

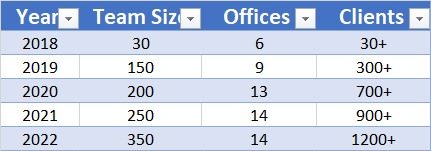

- Exactly 6 years later, we’re a team of 350+ with over 1400 clients and have advised on deals worth more than $20 billion!

Backstory

I didn’t exactly set out to conquer the world of Chartered Accountancy.

After wrapping up my Bachelor’s at Narsee Monjee, I found myself knee-deep in the CA course, thanks to my college mates.

I did my articles in Auditing, Tax was not my preference at all!

I got married early (even before I could clear my CA Final exams) and being an Auditor required me to travel a lot. I chose Tax over Audit, so I could spend more time with my wife and skip the travel. Love sure has a way of shaping our choices, doesn’t it?

Post-qualifying, in 1995 I joined Arthur Andersen in their Tax team and from day one, Tax had me hooked!

That was a time when India was booming with inflows, foreign direct investment was set up, and mortgages were discovered.

So Tax teams were not just advising people on tax, but we were looking at it as a business problem!

Fast forward, to 2004, I joined KPMG India.

I did very well in KPMG, thanks to the people and the opportunities that the firm gave me. (If you want to become something, KPMG gives you the opportunity. To date, it is the best firm in the country!)

What next?

Entrepreneurial leap at 46

Once I became a Partner I realized that as you grow in a Big 4 career, you are more responsible for marketing.

The targets among the Partners are more to deal with how much business you generate, how much cross-selling you do, and how you go and market your firm to the clients.

And after that, you become valuable because you’re the best salesman…You are no longer the best tax professional!

Deep down, I craved getting back to the nitty-gritty of tax work. The only way to do it was by starting on my own.

In 2010, I decided to quit and take an entrepreneurial leap. I even coined the name Transaction Square (inspired by Salisbury Square in London and Times Square in New York) and registered it.

….. But the opportunities at KPMG were tempting, and I continued to grow and thrive.

I kept working with the clients and also handling managerial roles. To that extent, I was a professional lead not just a marketing lead.

Eventually, I became the National Head of Tax at KPMG.

In 2018, at the age of 46, I decided to take the plunge finally.

Vikram Naik, Amol Khanna, Chirag Shah, and Saloni Khandelwal joined me on this journey at Transaction Square.

Transaction Square is a proper accounting, tax and regulatory firm, however, we have excelled in two areas besides the regular work we do.

- M&A restructuring: We have been in the top 5 for the last 5 years and ahead of a Big 4 last year.

- Family office-related tasks: Other than wealth management, we take care of whatever a family office needs; Liberalised Remittance Scheme (LRS), migration of residency, trust bills, family charter, family settlements, and so on.

Also read: Meet this Chartered Accountant Who is Thriving in Legal Management Consulting. And How You Can Too.

Also read: How this Chartered Accountant and Founder of an Advisory and M&A Firm Manages Crisis

Here is how we started

Right Co-founders

Initially founded by six individuals, all of us worked at the Big 4 and we eventually discovered our shared vision to create employment opportunities, make a positive impact, and deliver excellent service to our clients.

I had been leading some of them for 15 years, so there was mutual respect.

One co-founder eventually left to rejoin the industry after a few years.

Bootstrapped

We broke our Fix Deposits and other small savings until the business started self-sustaining. I even sold a second home we had in tier 2 city.

You have to live a bare minimum lifestyle and put every spare penny into building your venture.

My children also made sacrifices by foregoing their dreams to study abroad to support me in my entrepreneurial journey.

I was confident that we would manage because living in India doesn’t cost more than a couple of lakhs per month.

‘No matter what happens, I will find a way to support my family,’ I said to myself.

Because of my extensive professional background, this safety net was always there for me.

2018: Exciting and all about survival

We began in a humble 4-seater at a co-working space in Bandra Kurla Complex (BKC), Mumbai.

Built the team: We started our operations with a team of 30 members.

If you want to be the best in this profession, you can’t do it with 3-4 people on your team. We chose to recruit 30 people from the Big 4 firms, as well as individuals from other companies.

We aimed to create a blend of the Big 4 expertise and Indian culture, which reflects our unique identity.

MNCs had Big 4 fever, but we kept knocking on doors until they gave us a shot: When we used to approach these multinational clients, many of them told us that they only work with the Big 4 because their decisions are globally controlled.

However, there were always those rare instances where they couldn’t find a solution or someone couldn’t crack it, and they decided to give us a try. As a result, we gained many multinational clients who are now valuable to us.

So, we never gave up, and neither did we disrespect any of them who couldn’t give us work.

We were concerned about having enough money to pay their salaries. But we kept receiving more work so there weren’t many issues then. We did well and significantly grew in terms of our people and offices in our first year.

Giving up the Big 4 luxuries: Personal bringing a shift in my lifestyle and way of working was not easy!

During my time at KPMG, I had a chauffeur-driven car ready for me wherever I went, luxurious hotels, and secretaries.

Reflecting on it, I realize I made many sacrifices. Yet, when I compare myself with someone who struggles to make ends meet daily, my sacrifices don’t appear significant.

2019: We began performing well and saw the profits

2020

We were presented with the ‘Best New Firm in Asia’ award by ITR and advised on deals worth over $1bn.

This year the infamous COVID pandemic cornered all of us at home for a few months.

We ensured that we wouldn’t let our employees down. We supported them wherever they were, ensuring no one was dismissed.

2021 to 2023

This period was the best in our journey, as our brand’s visibility increased significantly. We started receiving good assignments.

We got back to the office as early as we could and worked towards carrying our practice through the pandemic, and managed to do just that! As a result, we gained many Indian clients who entrusted us with trust, wills, family charters, and family settlements.

2024 onwards:

The firm’s strategy is to be everywhere. So what I to tell my cofounders is that we should be wherever Indigo flies.

Wherever Indigo flies, there are entrepreneurs, there are HNIs as according to an airline’s strategy, they fly to cities where the money is.

So we chose that strategy, and now we have 14 offices.

If not for COVID, we would have been 25 or 30 locations by now.

Upcoming plans

Building our GCC (Global Capability Centers) in India: The main idea behind this is to utilise the talent in India to serve the global market and eventually expand to other areas such as research, diligence, or transfer pricing.

Our initial locations will be Pune and Ahmedabad. We are already in the process of building a team in Pune to handle valuations for the entire world from India.

We will be based in GIFT City. Hopefully, in the next 6 months, it’ll be ready.

Catering to the Indian market: We are currently focused on tasks within India and not considering expansion to other countries.

Focusing on ESG: There is a huge ESG opportunity. We’re working on a strategy to provide ESG-related services to our clients.

Wrapping up…

Currently, India’s progress is remarkable and it is expected to continue in the long run.

The economy needs a steady flow of money, as evidenced by the successful Follow-on Public Offer (FPO) of Vodafone, amounting to a significant sum of INR 18,000 crores.

With all these advancements, to ensure smooth financial operations, it is crucial to have effective accounting, tax, and regulatory systems in place.

So if you are considering starting your own to leverage these opportunities, here are my two cents:

It’s okay to start late: Unlike startups, in professional services, the longer you work with the Big 4 or any other firm, the more expertise, knowledge, and connections you gain.

Therefore, the later you begin, the greater your chances of achieving success. For professional services, it’s best to begin between the ages of 40-50, in my opinion.

Focus on quality and excellence: Our industry is competitive, however, it is essential to relentlessly pursue excellence and render quality services at all times to clients.

Looking at my competitors, many of them are hosting entrepreneurship awards, work sites, gala dinners, and big conferences. However, due to budget constraints, we were unable to conduct these events. Despite this, we maintain our relevance with clients through the quality of our work.

Have courage: Building a firm in the M&A advisory space has a significant barrier to entry; which is having the courage and guts, especially after having lived a comfortable life.

Many individuals only think about doing it, but very few take the leap and do it.

Never give up: You need to have the courage to chase your dream and most importantly, never give up.

Really grt! I would also like to start on my own . I have industry experience last

25 yrs + with special expertise in SEZ and STPI compliance