Are you looking for a RANK? This time we share the story of CA Umesh Jain who cleared CA Final at the age of 20 and achieved 29th All India Rank (AIR) in CA Final.

From Ordinary to CA Final Ranker

“I scored 127 Marks in CPT which is pretty average, not extraordinary. Then CA IPCC (2nd level CA exam consisting of 2 Groups, Group 1 & Group 2) I cleared both the groups separately – The 1st attempt I gave only Group 1 cleared it and then gave Group 2. However, in CA Final I got an AIR 29 rank,” says CA Umesh Jain from Jodhpur.

He is also a qualified Company Secretary (CS). Presently he is working with Reliance Industries as a Management Trainee and a very helpful human.

Now let’s come to the most interesting part of this story. How did I prepare for CA Final? Which Strategy did I follow during my exam leave?

- CA Final syllabus is VERY VERY VAST so all those who are intending to prepare for just 4 months and give the exams and clear it too, that’s not a good idea.

- My CA Final exam (last level CA exam consisting of 2 Groups, Group 1 & Group 2) was in Nov’16, so I got exam preparation leave from 15thJun’16. I had exactly 4.5 months to prepare for CA Final. However, typically my preparation for CA Final started immediately after passing CA IPCC.

- Consistency with studies matters the most and this was my key to success. So after clearing CA IPCC and starting my articleship I used to study daily every night for 2 hrs or so. Yes, there were days where I did not study but most days I did.

- I also used to spend time with my friends chit-chatting and catching up on a daily basis. As that is also needed to stay mentally fit. Living away from family (rem I moved from Jodhpur to Mumbai!) means having a set of good friends like family.

- On Sundays, I used to play cricket in my hostel and relax as well. But the key to my success could be the consistency of ‘ Studying daily for 1.5 to 2 hrs right from the beginning’.

- About CA Final Classes: Now I had also joined a renowned class in Mumbai for all the 8 subjects of CA Final, however, due to my articleship there were days where I just could not attend class for all the subjects. However, I had managed and attended maximum classes of practical subjects because I knew I could easily prepare theory subjects on my own. I missed most of the theory lectures like Audit, Law, ISCA.

- Next, we all should identify our STRONG and WEAK areas, because one should not spend their maximum time studying and revising STRONG areas only.

- For example, I love Direct and Indirect Taxation, but somewhere I had to restrict myself and allot more study time to those subjects which I do not like or I am weak in and prepare for those a lot more.

- So for all these things analysis plays an important role, then only your hard work can be converted into success.

- A GOAL without a PLAN is just a WISH – So I will urge everyone to please PLAN your studies according to your interesting areas, your hold on subjects and how in-depth studies you want to do.

- Please make sure that you guys make a DETAILED PLAN for examination leave and up to last exam day and do review your plan at least once in every fortnight to make sure you are heading forward according to the PLAN. So if the PLAN doesn’t work change the PLAN but GOAL has to be same.

Some Points to keep in Mind during Exam Leave and Exam Days

- Please make sure that you understand Basic concepts very clearly and thoroughly.

- Each subject has to be revised at least once (Preferably twice) during examination leave period.

- All practical questions should be practiced well before the exam and make sure you have a proper hold on that area. A lot of my friends could not complete their exam paper within the time frame and ended up losing 10-15 marks because of no writing practice.

- Identify at least 3-4 subjects in which you can score good marks 65-70 (Minimum) so that there should not be any problem at aggregate marks level.

- Prepare Self – Made notes for each subject. This will help you save your valuable time during exam days and also help for quick revision. I myself prepared notes for all theory subjects in order to make sure I don’t spend too much of my time in theoretical subjects during revision and focusing on practical parts.

- Make sure you go through Practice Manual very meticulously. Every attempt ICAI asks a lot of questions from Practice Manual.

- All Amendments in DT and IDT should be captured well conceptually as well as practically because ICAI has a trend of asking amendments every time which covers nearly 25 -30 marks in totality.

- I believe all theoretical subjects such as ISCA, Audit, and Law should be done continuously till exam day, otherwise scoring in these subjects is a bit difficult.

- Mock Test: I would like to urge everybody to please give MOCK Examination of ICAI very SERIOUSLY which will help you evaluate yourself and you would be able to identify how much shoes laces are still pending to be tightened. ICAI generally conducts 2 MOCK examinations, one should attend the first mock examination, which will give you enough time to identify your mistakes and subsequent prepare according. Also if you fail your mock exams do not worry. I failed my mock exams as well, I realized my mistakes prepared well and go an exemption in the real exam.

- One general question comes to mind – How many hours of studies required to become CA or for securing a rank – well this completely depends on the individual. Practice in each subject, memory power plays an important role but one must do at least 8 hours to effective studies in order to secure oneself.

- Make sure you don’t waste your valuable time on Social Networking during examination leave. Social Networking is a really nice platform, please try to utilize it for exam purpose – Update yourself with amendments, case laws, ICAI notifications.

- Lastly, I would like to request everybody to spend 10-15 minutes of early morning time in Meditation which will help you improve your concentration and it encourages a healthy lifestyle. This will definitely help a lot for examination.

Books that I referred to during the exam and would recommend you for CA Finals

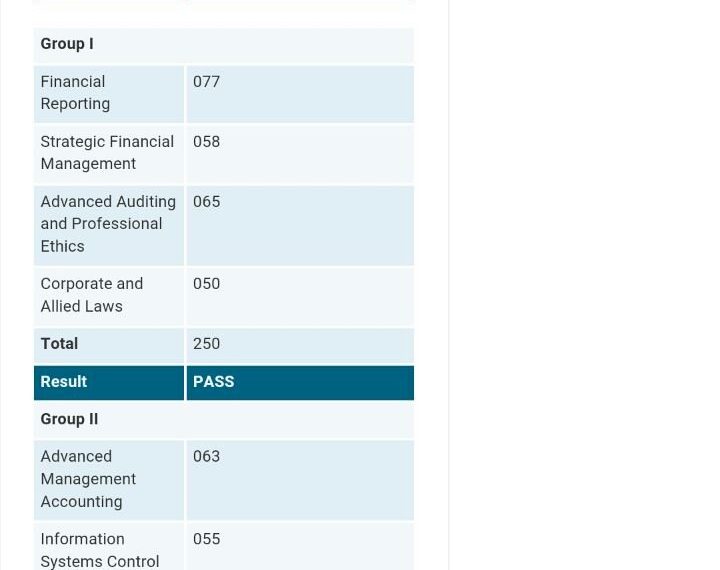

- Accounts – I referred Class notes and ICAI Material (Scored: 77 marks)

- SFM – I referred Class notes and ICAI Material (Scored: 58 marks)

- Audit – Standard on Auditing – Aseem Trivedi (Very crisp and exam-oriented book) and Surbhi Bansal for other parts (Scored: 65 marks)

- Law – I referred Class notes and ICAI Material (Scored: 50marks)

- Costing – I referred Class notes and ICAI Material (Scored: 63 marks)

- ISCA – One should go for Jignesh Chheda or Amit Tated (Scored: 55 marks)

- Direct Taxes – Durgesh Sir or Vinod Gupta book will help you understand DT concept very clearly. Also in Durgesh Sir’s book, you will be able to understand each topic through charts. It helped me greatly to revise on the last day (Scored: 66marks)

- Indirect Taxes – Yogendra Bangar – Many topics in IDT are interlinked in Service Tax, Excise, and Custom so this book has given me all provisions affecting a particular concept at the same place (Scored: 62 marks)

My Advice to all – Just Believe in Yourself, Do Your Best, Rest will be Taken Care by GOD,” he concluded.