- Hi, I am Guru Prasad, co-founder and Managing Partner at Guru & Jana Chartered Accountants.

- We have come a long way with a team of over 672, including 180+ professionals, and offices in multiple locations.

- But our journey began at a snail’s pace… For the better part of ten years, we wrestled with challenges and setbacks.

- What led to our transformation? Here is our story.

Stagnated growth for 10 years

I qualified as a Chartered Accountant in 1992, and like most CAs, I too started my career at a CA Firm.

In 2003, I was intrigued by the growth of startups in India.

Jana, my good friend, and I recognized the potential and decided to build our partnership firm to cater to their needs.

Jumping right in, we proudly set up our practice as Guru & Jana Chartered Accountants. And within a month three additional Partners joined us.

Now we were 5 Partners and a group of talented interns… It seemed like we were off to a promising start!

For the next 8 years, despite working tirelessly for 12 to 13 hours a day, we grew to a team of 50, of which 40 were article assistants.

We were finding it difficult to hire chartered accountants. Our annual turnover amounted to around INR 90 Lakhs to a Crore.

In simple words, we were 5 Partners, bringing in a revenue of only INR 8 Lakhs per month. It was not sufficient.

I knew something was not right.

What next now?

Figuring out my mistakes & pivot

I approached my mentor Mahatria and asked earnestly, ‘What are we doing wrong at Guru & Jana? Why are we not experiencing growth?’

He said to me,

- “Ensure that your CA practice is clean. If your practice is not clean, you won’t grow. The shortest distance between 2 points is a straight line.”

- “As a CA you possess knowledge of tax and corporate law but you lack the understanding of building an organization.”

This hit me hard and I knew it was the fact.

Exact strategies that led to Guru & Jana’s growth

Following his advice, I took a 12-month sabbatical and enrolled in the Advanced Management Program at IIM Bangalore.

I stayed back for an additional 2 months just sitting in the library and working.

As a result of this experience, my perspective significantly expanded.

It took us 3-4 years to implement his advice, but by 2013, our practice began to thrive and we achieved 80x growth in the years to come.

Now, we have a team of 650+ members, with close to 180 chartered accountants, cost accountants, company secretaries, ACCAs, and a fantastic team of lawyers.

Exact steps we took to go from a struggling firm to a top 20 firm in India.

Establish an organization

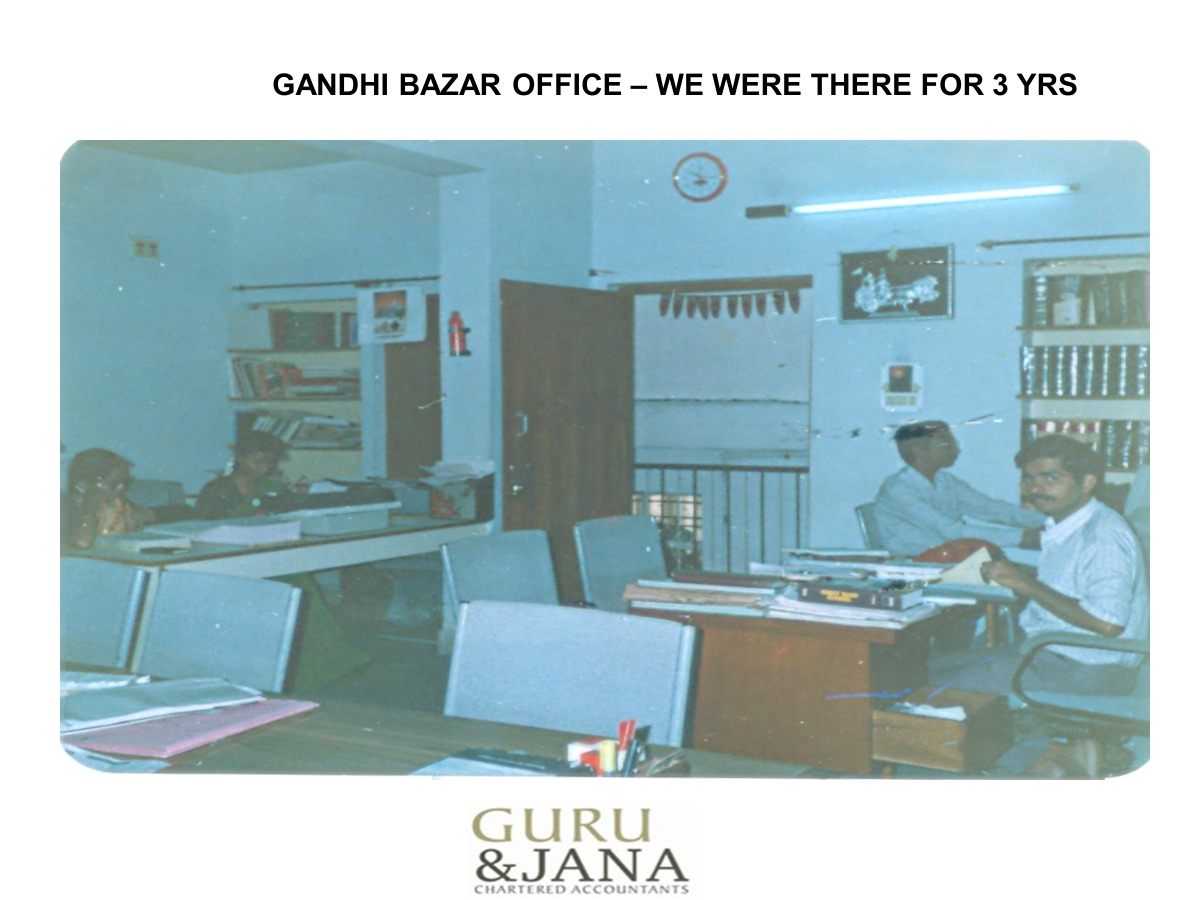

Our first biggest mistake was not having a proper office.

We set up an office in Bengaluru, acquired the necessary infrastructure, and dedicated ourselves to cultivating an organizational culture.

Impeccable practice

We decided to shift our focus inward and prioritize self-improvement.

This step involved,

- Obtaining licenses for advanced technology tools

- Ensuring compliance with legal requirements

- Implementing effective policies

- And more importantly, selecting our assignments cleverly.

Adopt tech

In the beginning, we did not even have laptops for our employees. (And we were talking about becoming one of the top 20 firms in India.)

Without the necessary tools to streamline our processes, it becomes increasingly difficult to retain team members.

We invested in our infrastructure mindfully and saw our success unfold.

Chose clients smartly

I remember in 2009, all of us 5 Partners sat down.

I told them ‘Let us only accept private limited companies as our clients from now on. This will help us secure a wide range of assignments, including compliance, and income tax among other related tasks.’

My Partners were genuinely angry with me, to say the least – “We are still growing. We are earning money with a 50% margin through those individual clients, how can we give them up?”

However, I was very adamant about my decision and opted to give up anything that was not profitable in the long term.

We initially started with four or five companies, and through their recommendations, gradually expanded our client base.

No “I” in Team

I would say this is the biggest mistake CA Firms make and we too did the same – Possessing the mindset of “It is MY contribution to the firm.”

If you have a firm where the partnership sharing is based on what sales you are getting for the firm, it could be a little worrisome.

We began to consider the bigger picture and worked as a team.

Manage attrition

I failed miserably when hiring but you will have to take a chance when hiring employees.

Whatever you do you will have attritions. It is natural for your team members to chart a different course eventually. Be willing to let them go.

The only way you can keep people from leaving is by showing them a career path in the organization. Show them why they should stick with your firm.

Secondly, train them. And remember, we as employers are not doing any favour by training as we also complete our deliverables.

The third aspect is, when somebody chooses to leave, let them go with happiness. Don’t let them go with remorse in their mind, because that way you would not build a good relationship.

Keep in touch with them. One fine day when they get fed up with the bigger firms they will come back, possibly.

Respect different mindsets

While we are all part of the same organization, differences in mindset and maturity levels between employees can exist.

We have to be mindful of those differences and respect individuals’ sentiments.

CA firms looking to scale?

The accounting profession is thriving. The Institute of Chartered Accountants of India (ICAI) is making significant contributions to this profession.

India is experiencing a kind of renaissance in this field. Just look at their digital progression today compared to 2008.

The market is now open for you to seize the opportunity.

Here is my advice:

Don’t worry about Big 4s who have access to tech

The larger firms have the advantage of more technology, more knowledge, more management bandwidth, and more money. But the democratization will happen when a startup picks it up.

Initially, all this Artificial Intelligence / Machine Learning (AI/ML) would make an impact, but the business models are also changing so fast. So, that huge learning curve is not going to be there.

A few years ago, only the large players used to employ SAP, and today everybody from Surat to Jammu Kashmir is implementing Zoho.

The times have changed. It is not going to have such a big impact on any of us because the market we are addressing will not be impacted so badly.

Keep it simple

Today, there are hundreds of tools for the audit function; be it Assure AI, or tools offered by ICAI – The Institute of Chartered Accountants of India, free of cost.

How do you implement that, that could be the tech stack for you.

If your tech stack has six tools you are going in the wrong direction. However, if your technology stack has only one tool but you have nine implementation strategies, you are going in the right direction.

Do not be scared of oversight

The more regulatory oversight, the better. You should take it as a big opportunity.

With increased oversight, if a listed company falls under National Financial Reporting Authority – NFRA, it would be the perfect time to step up and offer NFRA audits.

Stop the ‘I am a small firm’ mindset

Let go of the mindset that you are “Just a small firm.”

You can easily kick off your practice with a capital of INR 10 to 12 Lakhs and make INR 40 to 42 Lakhs of revenue, in the blink of an eye.

So, if you are considering building your firm, then now is the time to go about it.

EY, KPMG, and other Big 4 firms built their success over 100 years. You have to be patient to achieve that kind of growth.

Opportunities for new service lines

AI and automation are becoming more widely adopted, and sustainability reporting and assurance are gaining increasing importance.

CA firms should brace themselves for significant transformations.

Wrapping up

If you want to build a successful CA firm in India – continuous learning, specialization, embracing technology, building a strong team with culture, and making strategic choices are very important.

But most important is perseverance and dreaming big.

The new India presents great opportunities and CA Firm will see growth so let us all make the most of it.

Exceptional insights Guru. Thanks for sharing it with the fraternity.

Awesome Success story. Hearty congratulations to Guru, Jana & the whole team. I wish & pray for them for glorious years ahead.

This is awesome, thank you Guru

Very inspiring and motivating Guru.. Thanks for creating great place to work.. wishing most and more…