- Hi, I am Vaibhav Manek, Co-founder and Partner at KNAV.

- In the late 90s, we saw a golden opportunity in the US-India corridor.

- A chance meeting with Khozema, Nishta, and Atul led to KNAV’s launch in Mumbai in 1999…Within three months, we expanded to the US.

- Today, KNAV is ranked among the top 300 CPA firm in the US and operates in seven countries.

Idea: Tapping the US-India Corridor

In late 1997, after qualifying as a Chartered Accountant, I saw an ad for the US CPA program and decided to pursue it.

I jumped at the opportunity and joined a group of 30-40 professionals in a CPA review batch, including Nishta, an investment banker, and Khozema and Atul, who had established CA firms.

They were all 10 years into the profession with established careers while I was the newbie and had just started my firm.

It wasn’t until we travelled together to the US for the CPA exams that we became good friends.

After the exams, I extended my stay to visit my brother and dive deep into the business landscape between India and the US!

I saw a BIG untapped US-India corridor opportunity.

When I returned to India, we brainstormed what to do next.

Our initial idea was to introduce US GAAP into the Indian practice scene and work with our clients on this front.

But then it hit us: “Why not capitalize on the US-India corridor opportunity?”

Few firms were prepared to meet the specialized needs of Indian companies expanding to the US and vice versa.

We saw a massive gap and decided to dive headfirst into it.

In January 1999, we founded KNAV – a partnership firm, figuring things out as we went along…It marked the beginning of an exciting journey!

Mumbai to the world: Scaling our cross-border firm

It all started in Mumbai.

Initially, all four of us – Khozema, Nishta, Atul, and I, travelled frequently to the US, ensuring we had the necessary visas and licenses.

And guess what? In the first week, we landed marquee clients, being in the right place at the right time.

Geography was key, so our strategy focussed on Indian companies in the US and US companies in India.

- Khozema and I stayed in India to focus on multinationals

- In the second year, we opened an office in New Jersey (then relocated to Atlanta for the warmer weather), with Atul and Nishta moving there to handle US subsidiaries.

Current Presence: After 25 years, KNAV has a presence in seven countries: the US, Canada, UK, the Netherlands, India, Singapore, and the Philippines.

Expansion Strategy:

- Client Needs First: We expanded our presence based on where our clients needed us, rather than opening offices first and then looking for clients.

- Economic and Strategic Decisions: We chose locations based on economic opportunities.

All we wanted to do was make a difference for some of our existing clients and then see where it goes.

And that’s how we created a proper full-service accounting firm!

Overview of our service lines

At KNAV, we operate within three main categories: audit, tax, and advisory. Within this, we have sub-service lines:

Audit

Country-Level Audits: We perform audits in each country where we operate. This includes local and international audits.

(For instance, when an Indian multinational expands globally, it requires a trusted and credible audit firm. Under FEMA regulations, the Reserve Bank of India mandates that a subsidiary must have its accounts audited by a local auditor for compliance, such as APR filings.)

Special Purpose Audits: We conduct internal audits, management audits, and forensics audits.

Financial Due Diligence: For investors, we perform quality of earnings reviews and analyze forecasts, projections, and financial statements to assess business viability and impact on deal valuation.

This involves detailed financial diligence, ensuring businesses are on the right track, and helping investors understand the full picture

Tax

Our tax service line is laser-focused on three key areas:

- Help clients comply with regulations

- Optimize their tax savings

- Ensure robust tax documentation.

What sets us apart is our approach to tax compliance.

Before filing any tax return, we prepare a detailed tax position paper. This document outlines the tax positions taken—whether deductions are claimed or not—and explains the reasoning behind each decision.

The client signs off on this paper, ensuring they fully understand and agree with the approach.

Advisory

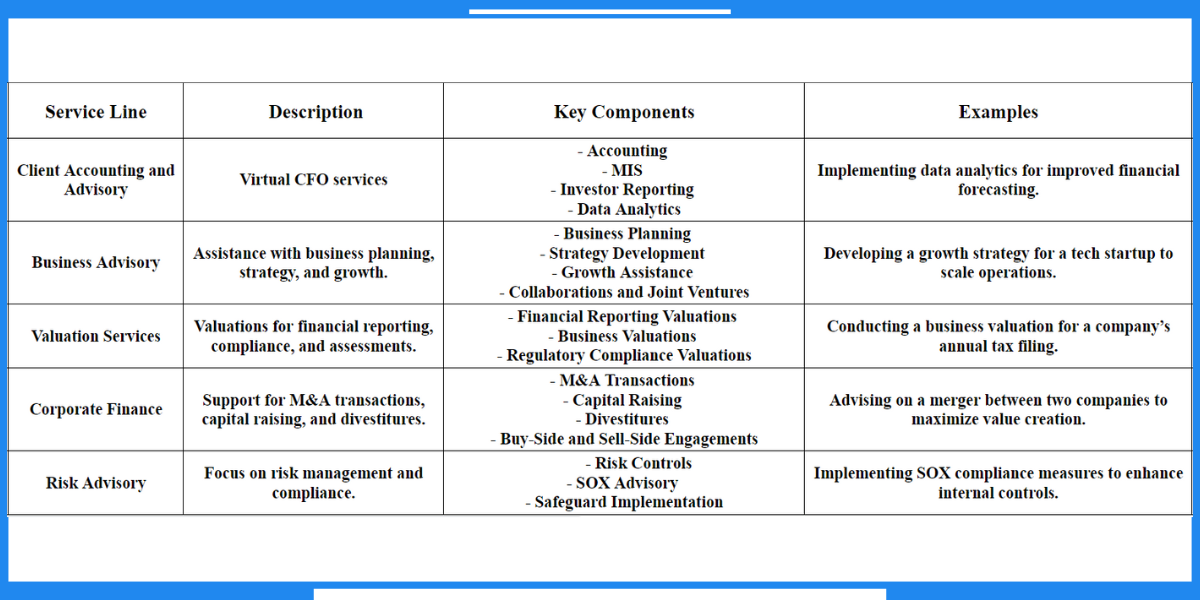

Now advisory is a wide term, but we are focused on 5 things:

- Client Accounting and Advisory: Virtual CFO services, including accounting, MIS, investor reporting, and data analytics to support business growth.

- Business Advisory: I lead this service line. We assist with business planning, strategy, and growth, helping clients scale their operations effectively and make informed decisions about growth – organic and inorganic, including collaborations and joint ventures.

- Valuation Services: Financial reporting valuations, business valuations, and regulatory compliance valuations for purposes like company filings and tax assessments.

- Corporate Finance: supports M&A transactions, capital raising, and divestitures, working on both buy-side and sell-side engagements.

- Risk Advisory: Focus on risk controls, SOX advisory, and ensuring businesses have the necessary safeguards in place.

Sector trends we observe

- Audit is following with a solid 10-15% increase

- Taxation is also making strides with 15-20% growth.

- But the real star of the show is advisory – growth rates of 25-30% across various countries!

How do we operate?

One Firm approach

Our partners and teams are structured according to service lines, which span multiple geographies.

However, we don’t view ourselves just geographically.

We operate as a “One Firm,” meaning that clients in the US, UK, or Singapore may receive support from our global teams, including those based in India.

This allows us to leverage a global delivery model that offers cost-effective solutions without compromising on service quality.

Tailored client understanding across regions

Our teams understand the unique expectations of clients based in different regions—whether in California, the UK, or Singapore.

This regional expertise ensures that we provide the right services that cater to the specific needs of clients from different industries.

Industry-specialized audit teams

We’ve developed specialized audit teams focused on specific industries, ensuring expertise in areas like:

- Banking, Financial Services, and Insurance (BFSI)

- Pharmaceuticals, Healthcare, and Life Sciences

- Auto Components and Industrials

- Technology and Entrepreneurial Ventures

- PE-VC Funded Companies

- Public Companies

Why? Although the final audit output is consistent across industries, the processes and requirements differ significantly. And we prefer a tailored approach to client needs.

Bringing the right team members to the table

The success of our model is based on having the right team members, who are specifically chosen for each project and brought to the table at the right time, no matter where they are based.

Globally deployable team

At KNAV, our teams are globally deployable, with the right visas like H1 or L1 or country-specific work permits for international audits.

We strictly avoid using business visas for work travel to ensure full compliance with local regulations.

Being certified and licensed is essential, for both auditing and taxation

We’ve seen Chartered Accountants in India sign off on US audits without proper local licenses. That’s a recipe for disaster and brings disrepute to the profession.

If you wanna be in the game, follow the rules….Strictly!

Pay-for-performance model

We hired a senior adviser who helped us create this model, ensuring it’s equitable for everyone.

So many times junior Partners may earn more than senior partners, or an assistant manager may advance faster than a senior manager.

It’s beyond ranks, titles, and entitlements. It’s based on merit and performance.

Manage operations for cross-border teams?

We use various tools and all our tools are licensed and integral to maintaining a tech-driven, consistent practice across our firm to name a few:

Audit Tools

- Thomson Reuters Audit Platform – For consistent global audit processes.

- MindBridge – AI-driven tool for enhancing audit accuracy.

- Confirmation.com – For audit confirmations.

- Suralink – Data-sharing platform for privacy and accuracy.

- Sharepoint – For data privacy and sharing.

- Caseware – For data analytics and high-quality audit documentation.

Tax Tools

- S&P – Global database for transfer pricing and benchmarking.

- Capital IQ – For competition benchmarking.

- Prowess – Local database in India for transfer pricing.

- Corporate Finance and Valuation: Various databases for valuation and corporate finance.

Also read: From Citrin Cooperman to Armanino: How this CA built a career helping US CPA Firms looking at India

Challenges in our daily operations

Growth can become stagnant if not continuously pursued, especially in a competitive environment.

Immigration Issues: Regulatory and immigration challenges can affect staffing and talent acquisition, impacting operations in international markets.

There will be competition; some clients may feel that we are more expensive compared to a local firm.

Demonstrating value through high-quality service and clear communication of our unique benefits.

Challenges in client acquisition and client growth. While there are challenges in acquiring and growing clients, there are also ample opportunities. For example, losing 20% of clients could be offset by gaining 30-40% more by consistently demonstrating technical expertise.

Regulatory challenges. Increasing regulations in various countries, such as the NFRA in India and the SEC in the US, require meticulous compliance.

In auditing, ensure every document is thoroughly reviewed before signing off. Your audit file must be clean and complete—signing off is a big risk.

People challenge. We’re in the people business, right culture is crucial. Implementing effective performance appraisal systems, offering competitive remuneration packages, and occasionally paying above the market rate to attract top talent.

In short, we overcome all these challenges with the right set of processes and, more importantly, the right mindset.

Wrapping up

Honestly, my advice to everyone out there is:

Have a mindset for growth. It starts with that.

You don’t need crores of rupees to start; it’s just travelling and accommodation expenses. You have to sustain the initial months till you get your first clients there, that’s why you have to be able to invest a little bit.

Try to stay focused. Do not spread yourself too thin. If you have a strong expertise in tax, focus on tax advisory and then expand into advisory.

Have appropriate licenses: It all comes down to whether you are qualified and licensed to enter markets like the US, UK, or other international areas.

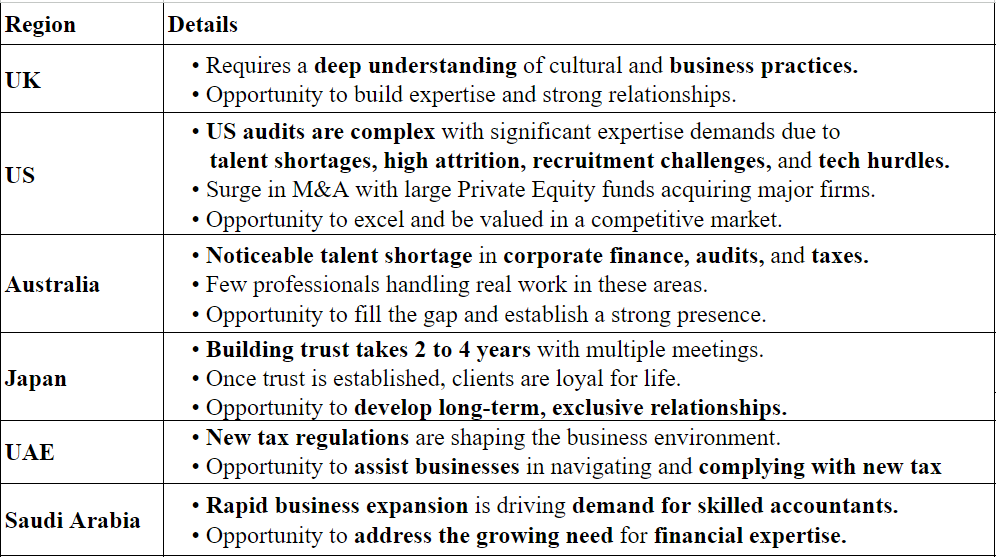

The corridor business model: Pick a jurisdiction: By “corridor,” I mean specific regions like the US-India, UK-India, Indo-Singapore, Indo-Canada, UAE, Riyadh, Australia, and Japan.

ICAI has signed MRAs with various countries—to explore those corridors.

You can’t target 20 or even 5 countries at once. Focus on one, then expand, building expertise in each while understanding both the opportunity and culture.

Network actively to build connections and partner with referral sources

….There’s no better time than now to start your overseas practice.

There’s no need to rush; instead, focus on identifying that sweet spot and growing strategically.