A merger was not a goal of Akshay Purandare and Kunal Narwadkar when they started Purandare & Narwadkar in 2015.

Everything came full circle in 2022 when they were approached by Kirtane and Pandit for a merger and by mid-2023 they merged.

Going forward to attain exponential growth, several Indian CA firms will opt to merge with larger firms or maybe vice versa.

Here’s how Akshay and Kunal did it.

Back story

In 2011 right after qualifying as a Chartered Accountant I established my solo practice.

Over the years I realised that growing a proprietorship practice to a larger scale would be difficult.

I reached Kunal Narwadkar to join me in building my firm. Kunal and I go along, I was his senior when he was doing his articles from Kirtane & Pandit and we collaborated on various projects.

When I approached him with the proposal, ‘Would you like to join me to start our firm?’ He immediately jumped on board and Purandare & Narwadkar came into existence in 2015.

Together, we meticulously prepared a five-year plan detailing:

- Client acquisition targets

- Expansion of our service offerings

- Billables

- Profitability

- Staff growth

- Improvements to our office infrastructure.

Over the years we received numerous offers from mid-sized and large firms for a merger and a merger was not part of our five-year plan.

We decided to focus on our 5-year plan and then think ahead.

Fast forward to 2022. We successfully attained nearly all the parameters we aimed for.

By now we realised the impact of Artificial Intelligence (AI) and Blockchain can have on the future.

We understand that over the next 5-15 years we will be experiencing more technological advancements.

Investing in the right technology, and the best talent will enable us to adapt to these new changes.

To take our practice to new heights, there were two options in front of us, merger with a domestic firm or joining an International Network… We were clear on a Merger.

What next?

Shortlisting firms whom we could merge with

By 2022 we had garnered many offers from small and mid-sized firms. Their discussions mostly centered on financial terms, along with employee considerations, and the continuation of specialized services post-merger.

For us, the primary intention of a merger was never solely about financial gain. It was always about:

- Achieving higher levels of professional excellence

- Offering different services to our existing clients,

- Expanding our geographical reach to serve potential clients.

Though the firms were amazing, none of them aligned with our vision.

In Nov 2022 we attended the World Congress Of Accountants hosted by ICAI (The Institute of Chartered Accountants of India).

We ran into some senior Partners of Kirtane & Pandit, a leading CA Firm. Since we had done our articles with the firm we had a good relationship with the firm’s Partners and Management.

One thing led to another and the Partners mentioned the idea of a merger.

While having the conversation, we were certain that this was the firm we wanted to forge partnerships with.

For three main reasons:

- Deep understanding of the inner workings of the organization, be it work ethic or work culture. (We were sure that our firm would get along seamlessly with Kirtane and Pandit.)

- They focussed on the synergistic benefits rather than solely on monetary aspects.

- Be part of the brand of Kirtane and Pandit, which is a renowned Accounting, Auditing, and Consulting firm in India with a 60-year-old legacy.

It was decided.

In 2023 we merged with Kirtane and Pandit, leading to a new beginning.

You could say it was a match made in heaven.

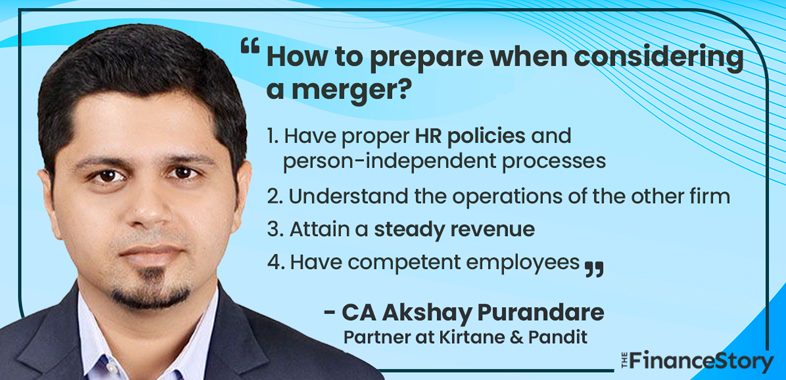

How to prepare when considering a merger?

When preparing a firm for a merger, networking with partners and managers of larger CA firms can be valuable.

It can help you understand the differences in their practices compared to smaller and medium-sized practitioners

Here is how you can prepare for a merger:

1. Have proper HR policies

There are a lot of things that are being done differently by large CA firms compared to small firms, like they have a strong in-house HR team and documented HR policies.

There could be employees who are working with the firm for over 10-15 years, but you don’t know what is their new balance, what are their gratuities to be paid off etc.

If you are opting for a merge and you don’t know these numbers then it becomes very difficult.

2. Person-independent process

We always had strong processes in place that were not dependent on a particular person. We made it kind of a person-independent process.

Today we are getting this particular review by one team member, tomorrow we may have another team member.

Clients were okay because processes were not changed, and hand holding was always there.

3. Understand the operations of the other firm

You must understand how the firm you are merging with operates. These encompass various factors and could be as basic as the maintenance of financial records (accrual basis versus a cash basis), preparing books of accounts, and maintaining MIS.

These may seem like such small parameters but make a huge difference in the long run.

4. Map revenue to employees

You have to prepare your budget for the next financial year and understand your financial commitments.

Also, mapping your revenues to employees is an essential step. This includes evaluating how much revenue each employee generates.

This also includes monitoring the contributions of your Partners.

5. Assess services from clients point of view

Assessing the Partners of the other firm, and their service lines is important.

For example, if the firm you are merging with specializes in the public sector, it can become an additional service for you to offer to your existing clients.

6. Maintain a steady revenue

Thinking from the other firm’s perspective, a steady revenue is critical. It’s essential to have the right mix between continuing revenue and one-time engagements.

Overreliance on one-time engagements can pose challenges during a merger.

7. Have competent employees

The firm you are merging with will also look at the quality of the human resources you have within your firm.

Over the last 10 years, we have achieved notable accomplishments, that’s to our excellent team.

I strongly believe that this recognition played a significant role in larger firms reaching out to us for potential merger discussions.

How to communicate a merger to your employees?

It’s quite challenging to communicate a merger to your employees and clients.

One day, you’re part of one firm, and the next day, you have different managers, Partners, and clients.

Fortunately, our employees were very enthusiastic upon hearing the news. They learned about Kirtane and Pandit, listening to stories from our articleship days.

We turned the merger into a celebration and expressed to our employees that their dedication allowed us to provide excellent services to our clients. They helped us build our firm’s reputation in the market.

In the early stages of the merger, we shared the challenges with our employees, aligning them with the new processes and requirements.

They gradually accepted their new firm. Because at the end of the day, they would get to include a prestigious brand name on their CVs and work with Kirtane and Pandit’s large-scale clients.

Communicate merger to your clients

Communicate with clients early in the process.

Explain the benefits of the merger, such as expanded services, resources, and expertise. Address any concerns and provide a clear transition plan. Retaining key clients is crucial for a successful merger.

Difference between a merger and an acquisition?

A merger is entirely different from an acquisition.

Recently a lot of Indian practices were sold to other CA firms because the Proprietors or old Partners of the former firm didn’t have a succession plan. They did it as a means of taking care of their clients and employees.

When you sell off your practice to another firm, that’s what you call an acquisition by the latter firm.

In terms of a merger, it’s more of a fusion of firms. The partners, clients, and employees of the merged firm become integrated into the merger firm.

It is a growth-oriented path, where the merged firms gain a global platform to provide services they had always wanted.

How long does the entire merger take?

There isn’t a timeframe for a merger to happen as it truly depends on the specific circumstances.

Many factors come into play, including your clients, employees, Partners, and the openness of the other firm’s Partners to the merger.

In the case of a CA firm merger, it also involves the entire cycle of closing your billings and delivering your services.

Therefore, it’s a lengthy process and cannot be completed within a month. It can take between 6 months to 18 months.

Will CA firm mergers become regular in India?

Merger is a relatively new concept when it comes to Indian CA firms.

Neither the Partnership Act of 1932 nor the Limited Liability Partnership Act of 2008 defined mergers and acquisitions in this context.

Therefore, ICAI had to step in to enable CA firms to compete effectively in the global arena.

The ICAI issued the first rules and regulations regarding mergers and demergers of CA firms in 2005. These rules were later amended in 2008, 2013, and 2019.

There is no ‘one rule for all’ in a merger of CA firms. Each firm has its unique approach and no fixed parameters. That’s why the deals may unfold differently.

Nonetheless, it’s an effective pathway for firms to attain local and eventually global growth. From what I see the number of mergers is only going to increase.

Wrapping up…

Before proceeding, it’s crucial to assess the objectives of the merger and, the merger aligns with your long-term business strategy.

Ensure that the larger firm shares similar goals, values, and a compatible company culture.

Finally, have a clear long-term strategy for the merged firm. Outline your growth plans, target markets, and service offerings.

You must ensure that you have these numbers, systems, and policies readily available within your organization.

Being well-prepared in this regard will enable you to seize any opportunities that may arise during the process, whether it involves a large or medium-sized entity.