-

- Sharing the journey of CA Bhavesh who is a qualified Chartered Accountant from The Institute of Chartered Accountants of India (ICAI).

- Bhavesh cleared CPT on the 3rd attempt, PCC on the 2nd attempt, and CA Final on the 9th attempt.

- Today he has his own Chartered Accountancy practice in Mumbai and is doing very well himself.

- He makes us believe that HOPE is something we should all hold on to.

Back story: Why I decided to become a Chartered Accountant

My dream of becoming a Chartered Accountant started when I was attending a felicitation program organized by our community. I saw the first CA from our community being felicitated.

I was in class 8 and it was this moment when I told myself in my mind – That one day I will be a CA too. And from there my journey of becoming a Chartered Accountant (CA) started.

I was an average student in school. After passing class 12 in 2004 I registered for the PE-I examination (now known as CPT), but somehow I was not able to concentrate and decided to complete my graduation before going ahead with CA.

I completed my graduation in 2007 and by that time the whole structure of the Chartered Accountancy course had changed.

My CA journey

CPT

- I gave my 1st attempt at CPT in November 2007, but could not clear. I gave my second attempt in Feb’08 and again could not clear. It was really discouraging for me and thought my dream of becoming a CA is over.

- Since I was already 22 years, I gave myself a last chance.

- I started preparing for my CPT 3rd attempt and executed according to the plan and cleared CPT on the third attempt.

PCC

- My first attempt at PCC (now known as IPCC) was in May’10, I failed the same as I was short of a few marks.

- It was still encouraging and I was hopeful.

- For CA PCC’s 2nd attempt I had only 1 month to prepare as I was busy with my articleship. However, with proper planning and dedication, I cleared my PCC in Nov’10.

CA Final

- I was just one step closer to achieving my CA dream, but it was not easy. Here is how it went:

- CA Final 1st attempt – Failed

- CA Final 2nd attempt- Failed

- CA Final 3rd attempt – Failed but go an exemption in Accounts

- CA Final 4th attempt – Failed

- CA Final 5th attempt – Skipped Group 2 and cleared Group 1. Just before this attempt I got engaged and was not prepared for the exams so I just gave CA Final Group 1 (Remember I had an exemption in Accounts Group 1) and I cleared Group 1 this time.

- CA Final 6th attempt – Failed Group 2

- CA Final 7th attempt – Failed Group 2

- CA Final 8th attempt – Failed Group 2. I was broken but never gave up.

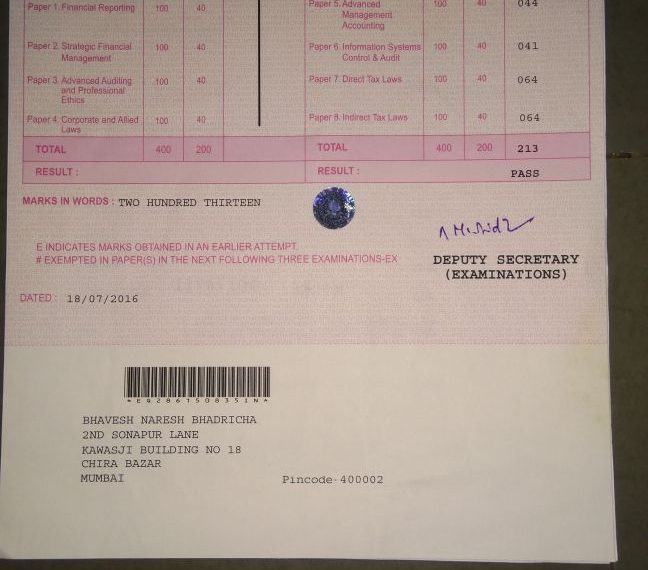

- CA Final 9th attempt – Cleared Group 2 and was a CA. I got married before this attempt. My family members suggested I skip the attempt but I insisted to take one more chance and started preparing for my attempt. I took suggestions from my CA friends and they suggested I keep 2 out of 4 papers very strong. So I decided to concentrate more on Direct Tax (DT) and Indirect Tax (IDT) and also changed my study materials.

Direct Taxation:

- I took video lectures by Professor Siddharth Surana.

- A few days before exams, Siddharth Sir used to come out with video lectures and a brief summary on Case Laws and Amendments in Finance Act which really helped me in preparing for DT.

Indirect Taxation:

- I studied from Bangar and Yashwant Mangal.

- Further, I practiced a lot so that my writing speed increased as Direct Tax and Indirect Tax papers are very lengthy.

- I scored 64/100 both in Direct Tax and Indirect Tax both and cleared my CA in May 2016 and achieved my CA dream.

- I attended seminars by Professor Yashwant Mangal organized by ICAI. It has helped me a lot.

Further, I referred to the Revision Test Papers (RTP) and Supplementary (Amendments in Finance Act) issued by ICAI.

During my CA phase, I had gone through many ups and downs in my life but never lost my focus on achieving my dream. I had faith in Me and in God.

My parents supported me all through my bad phase and had faith in me.

I also believe that my wife’s footsteps were lucky for me. Life is great now.

Wrapping up…

Believe in yourself. Never lose hope and never think of giving up because failure leads to success.

Practice a lot to improve your writing speed.

Show proper dedication and plan everything properly.