- On September 10, 2025, Oracle proudly projected that its AI cloud infrastructure revenue would skyrocket from $18 billion today to $144 billion by FY 2030.

- But what slipped under the radar? A brutal round of layoffs. And insiders warn: this is just the beginning.

- Oracle hasn’t published a neat single total, but industry reports suggest over 3,000 job cuts across the US, Canada, India, the Philippines, and more.

Where are the cuts hitting the hardest?

The layoffs cut deep into Oracle’s core business units:

- Oracle Cloud Infrastructure (OCI)

- Oracle Financial Services Software (OFSS)

Affected roles include,

- Marketing

- Engineering

- Operations

- Sales

- AI/ML functions

From directors to individual contributors, SVPs, and veterans with 15-20 years of service, no one was spared.

Severance packages sound reasonable on paper:

- 15 days’ salary per year of service

- Up to 1 year of medical benefits

Why now?

The official reason? “Organizational restructuring.”

The real reason?

- Relentless cost-cutting

- Streamlining operations

- A hard pivot toward AI-powered tools

Also read: India’s IT layoffs driven by Global Capability Centres, not just AI?

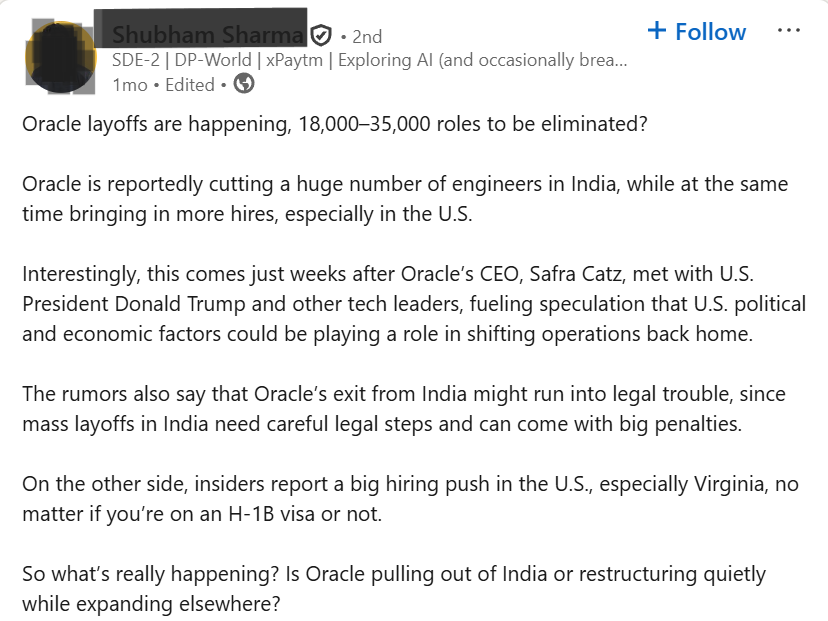

Rumours are swirling

Oracle is hiring aggressively in Virginia?

Rumours are doing the rounds that Oracle is ramping up hiring in the US, especially in Virginia.

This hiring spree coincides with political moves in Washington.

President Trump and his allies have been pushing for a “Hire American” agenda. The controversial HIRE Act, introduced in the Senate, proposes:

- A 25% tax on outsourced workers

- Eliminating tax deductions for companies that offshore jobs

And Trump’s former adviser, Peter Navarro tweeted: “Tariff the foreign remote workers. All outsourcing should be tariffed.”

If this becomes policy, Oracle’s India workforce could face deeper cuts while US headcount rises.

Oracle divesting from India?

Oracle employs around 160,000 employees globally, with 30,000 in India.

Some are also speculating that due to Trump’s “Hire American” agenda, Oracle is going to downsize their Indian workforce.

Why?

The controversial HIRE Act, introduced in the US Senate, proposes a 25% tax on payments to outsourced workers and eliminates tax deductions for companies using offshore providers.

Former Trump adviser Peter Navarro recently tweeted: “Tariff the foreign remote workers. All outsourcing should be tariffed.”

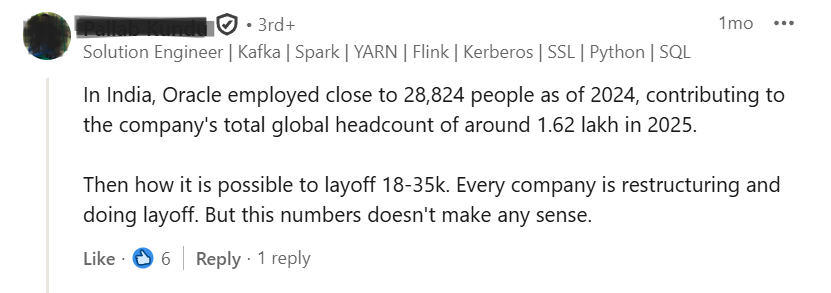

People are calling out the fake news

While these posts were enticing, many people on LinkedIn or Reddit were quick to point out the false claims.

One user wrote,

“I don’t think they can afford to hire from the US. Firing 5 from India and hiring 1 in the US doesn’t make sense if we look at the cost centre budget.

They are even moving people to WFH to reduce the cost centre cost. Also, the efforts are to reduce the dependency on third-party software, reduce the number of licences and force teams to use Oracle products internally.

So everywhere costs are being cut.”

Another one pointed out: “Layoff is possible, but exiting from India doesn’t make any sense.

Every Company needs profit, and increasing hiring in Western countries automatically increases the load on the company.”

Wrapping up….

Oracle is betting big on AI, streamlining costs, and reshaping its workforce.

AI push has already led to:

- A $300B, 5-year OpenAI deal that boosted Oracle’s market cap to $933B — making Larry Ellison the world’s richest man.

- $455B in locked-in revenues through Remaining Performance Obligations.

- Multi-billion, multi-year partnerships with OpenAI, Nvidia, Meta, and ByteDance.

FAQs

1. Is Oracle firing people only in India?

While the company has fired 100 people in India. The job cuts are global, impacting 3000 employees across the US, Canada, the Philippines, and other regions. The hardest-hit divisions include Oracle Cloud Infrastructure (OCI) and Oracle Financial Services Software (OFSS).

2. Is AI the reason behind Oracle’s layoffs?

Not entirely. While Oracle’s shift toward AI-powered tools is a major factor, cost reduction and organizational streamlining play a key role.

The company is also trying to reduce its reliance on third-party software by pushing employees to use Oracle’s internal tools.

3. Why did Oracle’s share price surge recently?

Oracle’s shares jumped after the company projected its cloud revenue to hit $144 billion by 2030, secured a $300 billion OpenAI deal, expanded key AI partnerships, and positioned itself as a major player in the TikTok US deal all signalling strong growth and investor confidence.