- On 31st January RBI instructed Paytm’s Payments Bank subsidiary to halt accepting new deposits in its accounts or wallets starting from March.

- RBI’s action comes after multiple warnings to Paytm regarding questionable transactions between its popular payments app and its lesser-known banking division.

Paytm vs Paytm payments bank

Paytm is like a digital wallet and online store that many people use in India. It helps with things like topping up your phone, paying bills, and buying stuff online.

Paytm Payments Bank is a different part of Paytm. It works like a regular bank, giving people savings accounts, debit cards, and other banking services.

What actions did the RBI take against Paytm?

The RBI has barred Paytm Payments bank from conducting the following activities after 29th February,

- Accept deposits

- Provide credit services

- Assist with fund transfers to customer accounts, prepaid instruments, wallets, FASTags, or National Common Mobility Cards.

Why RBI cracked down on Paytm Payments Bank?

- The Reserve Bank of India conducted an audit of Paytm Payments Bank and found several issues with their know-your-customer (KYC) processes for onboarding new clients.

- Paytm Payments Bank had extensive related-party transactions with other Paytm group companies. This led to concerns about potential conflicts of interest and the bank’s autonomy.

- The complex shareholding structure and IT concerns also add to RBI’s crackdown on the bank.

What operations will not be affected?

The bank is permitted to provide credit interest, cashback, or refunds into these accounts at any time.

Customers are also free to withdraw or utilize their balances in these accounts without any limitations.

Paytm’s wallet application and UPI services connected to accounts from other banks will not be affected by this deadline.

Only the services associated with the payment bank accounts are expected to be affected.

About Paytm Payments Bank

Paytm was founded in 2010 and went on to get listed on the Indian Stock exchanges in Nov 2021.

Paytm Payments Bank started operations in 2017 and is an Indian payments bank that operates under the umbrella of Paytm, a mobile payment company.

Paytm Payments Bank acts as a key banking partner for Paytm. For instance, funds deposited in Paytm’s popular digital wallets are held with Paytm Payments Bank.

The bank houses all of the parent’s 330 million wallet accounts, according to Macquarie Capital, meaning money held in them is deposited with the payments bank.

CEO, Founder, and Directors of Paytm Payments Bank

Vijay Shekhar Sharma – Founder and Part-time Chairman

Surinder Chawla- MD and CEO

Dr. Srinivas Yanamandra – is a Director on the Board

Bhavesh Gupta – Director

Arvind Kumar Jain – Independent Director

Pankaj Vaish – Independent Director

Ramesh Abhishek – Independent Director

Shinjini Kumar – Independent Director

Manju Agarwal – Independent Director

Owners of Paytm Payments Bank

One97 Communications owns a 49% stake in the Paytm Payments Bank.

The remaining 51% is held by Paytm Chief Executive and founder Vijay Shekhar Sharma.

What next?

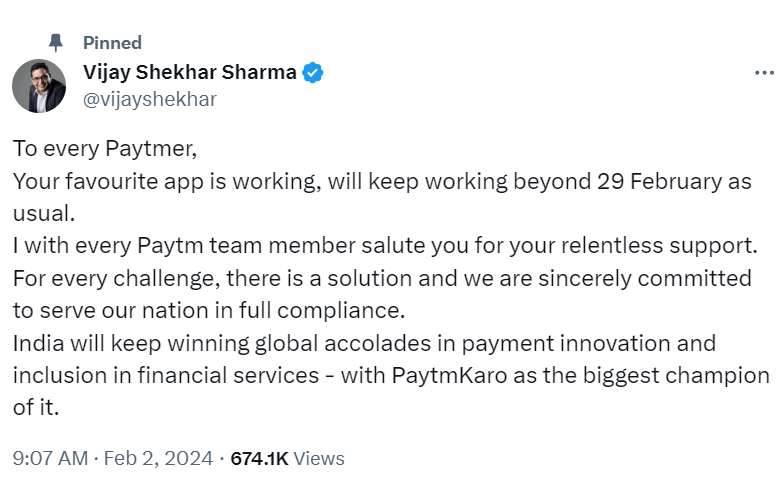

Paytm has announced that it will promptly adhere to the RBI’s instructions by discontinuing its collaboration with Paytm Payments Bank and exclusively partnering with other banks.

Paytm’s shares dropped by 20% following the Indian regulators’ order to suspend a significant portion of its operations.

The company anticipates a potential negative impact of 3 to 5 billion rupees ($36 million to $60 million) on its annual EBITDA.

Source: Reuters and Moneycontrol