Investment Team vs. Finance Team in a VC Firm

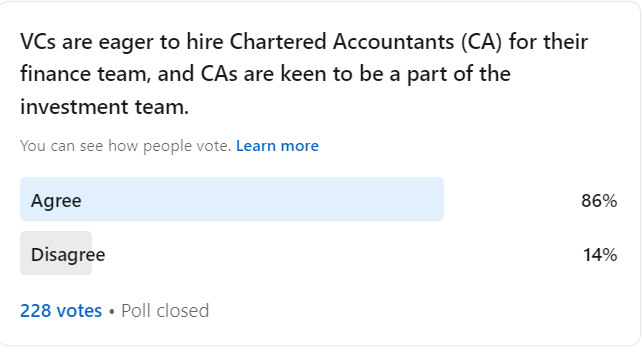

In a recent poll, we asked Chartered Accountants (CAs) whether they would like to join a Venture Capital firm’s Finance or Investment Team.

Surprisingly, 86% of respondents chose the Investment Team.

Many believe that finance professionals need more interaction with investors and founders, which is more of a backend role. However, this perception needs to be more accurate.

The Finance Team handles more complex financial tasks that are beyond basic bookkeeping. They manage higher-level financials, such as due diligence and structuring deals.

While we agree that the investments team is the investments team, the sponsorship, deals, and eventual gains stay with the investor, thus making it a lot more lucrative. However, the finance team is not just any support team, especially in today’s time.

To shed light on this topic, we had the opportunity to speak with CA Ankush Bhutra.

After working for a decade in renowned firms such as EY, BMR, and Deloitte, specializing in Transfer Pricing and International Taxation, he sought to apply his expertise in a different industry.

He decided to join Blume Ventures, an Indian VC fund with an AUM of over $600 million, as a Financial Controller.

The day-to-day responsibilities of the finance team in a VC firm vary depending on the size of the firm and the stage of the companies it invests in. However, some everydaFirmOpportunities responsibilities include:

1. Fund structuring

The first responsibility of the Finance Team is fund structuring.

Right from the conceptualization of a fund, several key considerations must be made.

These include,

- Determining the fund’s corpus (total capital), its expected lifespan, and the chosen location for setting up the fund

- Designing the fund structure

- And deciding whether it will be established as an LLP (Limited Liability Partnership), a trust, or another form of legal entity

The financial arrangements between the Limited Partners (LPs) and the General Partners (GPs) must be defined.

This initial phase of fund structuring encompasses all these aspects and is crucial in shaping the fund’s overall framework.

2. Finalizing the fund structure

After finalizing the fund structure, the next step is to proceed with the fund registration process, which involves registering the fund with the appropriate regulatory authority.

Once the complete application is drafted, it is filed with the relevant authority.

Following the successful establishment of the fund, the focus shifts towards onboarding investors. During this stage, there may be various inquiries and requirements that arise.

These can include,

- Know Your Customer (KYC) procedures

- Certifications that investors need to provide

- Determining the class of units

- Specifying the currency in which the investor will contribute funds.

I would like to make decisions and reach agreements on all these aspects before proceeding further in the onboarding process.

3. Fund is Live

The next step is to address what occurs once the fund is live or operational.

The first responsibility is the management of cash flows.

As investors begin to contribute funds, the clock starts ticking on calculating the Internal Rate of Return (IRR).

Then, it becomes crucial to assess the organization’s agility in deploying the funds into appropriate investments and doing so efficiently.

As the fund progresses further, reaching its final close, it becomes necessary to,

- Establish proper accounting practices and reporting procedures

- Ensure accurate and transparent financial disclosures within the fund’s financial statements.

4. Valuation aspect

Another crucial aspect that needs to be considered is adopting appropriate valuation standards.

Valuation has become increasingly critical, especially with regulatory scrutiny intensifying in this area. It can be subjective and must be widely discussed and analyzed.

As part of the finance team, you would take the lead in coordinating with valuers to ensure accurate and reliable valuations.

- This involves gathering data from portfolio companies

- Overseeing the management information system (MIS)

- Analyzing the data

- And collaborating with the valuers to determine the appropriate value.

Ensuring transparency and accuracy in this process is crucial for the fund’s operations.

5. Exit funds

There will eventually be situations where investors may choose to exit the fund.

So, knowing how you effectively handle investor exits or the movement of units is crucial.

As the fund approaches the end of its life cycle, managing the exits, winding down the fund, and distributing proceeds to investors is an essential part of the Finance Team’s responsibilities.

Closing…

The Finance Team plays a critical role in the success of a VC firm, be it investment decisions, managing risk, and achieving its investment goals.

It is a great learning opportunity for many looking to join the VC ecosystem. And in the present funding scenario, the role of finance professionals in a VC firm must be supported.

To conclude, in addition to these core responsibilities, communication skills are essential for success in the finance team of a VC firm. They communicate effectively with various stakeholders, including investors, advisors, and regulators.