- CA firm mergers are the new buzz, with small and mid-sized firms teaming up.

- ICAI is taking a lot of initiative to encourage mergers so Indian firms can achieve scale and growth.

- The latest?

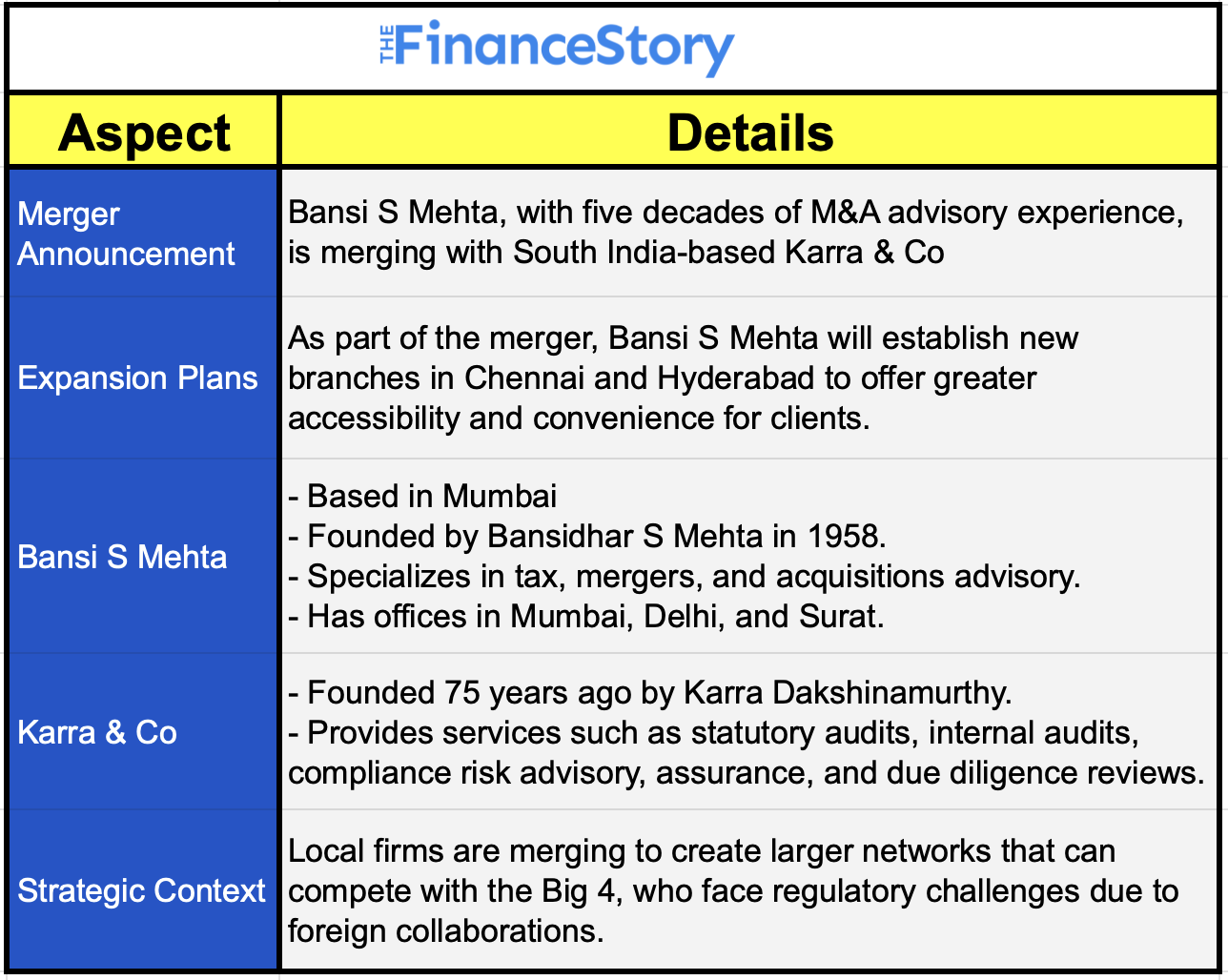

- Mumbai-based professional services firm Bansi S Mehta, with over 5 decades of expertise, has announced a merger with South India’s Karra & Co!

Why a merger?

This partnership brings together two legacy stalwarts in the accounting and advisory industry.

Mumbai-based Bansi S Mehta shared this on LinkedIn during its announcement:

About Bansi S Mehta

Bansi S. Mehta & Co. was founded in 1958 by Mr. Bansidhar S. Mehta.

Today they have grown into a powerhouse in the world of professional services practice, especially mergers and tax advisory.

Bansi S Mehta has been instrumental in major corporate deals, such as,

- The merger of Piramal Enterprises with Piramal Capital and Housing Finance

- Demerger of Madura Fashion and Lifestyle from Aditya Birla Fashion and Retail

- Merger of HDFC Limited with HDFC Bank

Their lines of services include,

- Direct and Indirect Taxation

- Audit and Assurance

- Mergers & Acquisitions

- Accounting Advisory

- Corporate Advisory

- International Tax and Transfer Pricing

- Sustainability Advisory

Leaders

- Bansidhar S. Mehta Founder and Chief Mentor

- Yogesh A. Thar Partner

- Paresh H. Clerk Partner, Mumbai

- Krupa R. Gandhi Partner, Mumbai

- Drushti R. Desai Partner, Mumbai

- Ronak G. Doshi Partner, Mumbai

- Ojas A. Parekh Partner, Mumbai

- Anjali A. Agrawal Partner, Delhi

- Ankit B. Agrawal Partner

- Ushma A. Shah Partner

- Monark B. Padmani Partner, Surat

About Karra & Co.

Karra & Company has grown to become one of the most respected firms in South India. It was founded in 1939 by Karra Dakshinamurthy,

For over eight decades, they have built an impressive legacy in,

- Accountancy

- Statutory audits

- Compliance

- Risk advisory

- Assurance

- Due diligence reviews

- Taxation

- Corporate Affairs

- Management & Consultancy

Leaders

- Premkumar Karra: Has considerable expertise in joint ventures, assurance practice, and advice on foreign investments in India.

- R. Sivakumar: Specializes in bank audits, public sector audits, corporate management, and internal audits.

- R. Sundar: Specializes in personal taxation and has been advising clients on investment, taxation, insurance, and audit-related activities.

- K. Sathiyanarayanan: Currently handles the internal audit of a health care service provider, statutory audits of a leading local daily and magazine, and Internal Audits of corporations. He also advises organizations on matters about compliance with Service Tax, Provident Fund & ESI.

- K. Rajalakshmi: She is actively involved in statutory audits of companies especially Information technology companies and investment companies. Also has hands-on knowledge of the internal audit of the pharmacy division of the healthcare major which has approximately 1900 standalone pharmacies across the country.

Renowned mergers that took place in 2022-2023

2022: Raipur-based CA Practice OP Singhania & Co. merged with Singhi & Co.

2023: Three CA Firms merged with Kirtane & Pandit, a 60-year-old Accounting, Auditing, and Consulting firm in India.

The firms include

- Mumbai’s R U Kamath & Co.

- New Delhi’s PGSJ & Co.

- Pune’s Purandare & Narwadkar

ICAI’s initiative to encourage mergers

To facilitate mergers, the ICAI has made two significant changes to its guidelines.

- Firms will have up to 10 years to separate if a merger doesn’t work out, instead of 5 years, allowing them to retain their original names and firm registration numbers.

- An LLP can now become a member of another LLP, allowing both to pool their resources and bid for large-scale projects while maintaining their individual identities.

What this means for the Indian firms…

Now this creates an opportunity for local Indian firms.

Local accounting firms are joining forces to compete with the dominance of the Big 4 firms.

Mergers like these will help local firms capture more business within India’s borders and offer clients a trusted alternative to foreign-affiliated firms.

Source: Economic Times