-

The Public Investment Fund (PIF) and 100+ of its companies have been told to stop giving PwC any new advisory projects, including strategy, M&A, tax, and finance transformation.

-

This ban takes effect immediately and will last until February 2026.

-

Yes, this is a big deal as PIF is one of the region’s biggest spenders on such services!

First, what is the purpose of PIF in Saudi Arabia?

The Public Investment Fund (PIF) is a sovereign wealth fund of Saudi Arabia, Center of Saudi Arabia’s Vision 2030 (valued at $1.3 trillion!), a strategy aimed at diversifying the economy beyond oil.

The fund has invested heavily in sectors like artificial intelligence, clean energy, entertainment, sports, and tourism.

Saudi Arabia PIF’s Foreign investments include,

- Blackstone

- AccorInvest Group

- French Private Equity Investment

- Lucid Motors Inc.

- Jio Platforms Ltd.

- Softbank Group Corp

- Reliance Retail

- Uber Technologies Incorporation

Also read: PwC Australia lays off over 300 employees after leading bank breaks off 55-year audit relationship

How big is PwC Saudi Arabia?

PwC has been expanding rapidly, employing over 2,500 people in Saudi Arabia (overall Middle East 12000 employees)

It operates multiple offices across Saudi Arabia:

- Riyadh: Central hub for PwC’s operations in the Kingdom.

- Jeddah: Situated in Jameel Square on Al Tahliah Street, it caters to clients in the western region.

- Al Khobar: Located in the Al-Hugayet Skyline Tower, serving the eastern province.

- Dhahran: Operating within the Saudi Aramco complex, focusing on energy sector clients.

- AlUla: In February 2022, PwC inaugurated an office in AlUla’s cultural oasis urban zone, marking its sixth office in the Kingdom.

Saudi Arabia is the largest consulting market in the GCC at $3.2 billion.

Also read: PwC fires 1,800 employees. What’s driving Big 4’s major U.S. layoffs?

Is the ban a Big Deal for PwC?

This is no ordinary fund.

PIF is a $925 billion sovereign wealth fund that owns stakes in many of the country’s major megaprojects and, of course, Vision 2030, such as:

- Neom: A $1.5 trillion futuristic city on the Red Sea coast.

- AlUla: A 7,000-year-old UNESCO World Heritage site is being transformed into a global tourist hub.

- Diriyah: A historic area undergoing a multibillion-dollar redevelopment.

- Red Sea Global: A luxury tourism project focusing on sustainable development along the Red Sea coast.

- Qiddiya: An entertainment, sports, and cultural destination near Riyadh.

- Roshn: A national community developer focusing on modern residential communities.

PIF has played a crucial role in driving growth for global consulting firms in Saudi Arabia (like McKinsey, Boston Consulting Group, including the Big 4s).

Why? To develop and execute these megaprojects worth billions and billions!

And PwC has established a significant presence in Saudi Arabia, aligning its operations with the Kingdom’s Vision 2030 initiative.

To give you some statistics, in the 12 months leading up to June 30, PwC UK’s Middle East revenue surged 26% to $2.5 billion. Why? Mainly because of projects in Saudi Arabia!

Now with this Ban, PwC will surely lose a major chunk of its Middle East revenues.

However…PwC is not new to being banned/suspended!

Australia ban

- PwC Australia was banned from receiving new tax-related contracts for three months due to its misuse of confidential government tax plans.

- The firm came under the spotlight after a former tax partner leaked confidential tax drafts meant to prevent corporate tax avoidance.

- At least 67 current & former PwC employees were named in the leak.

Similarly, in 2024, China imposed a six-month ban.

EU markets: In 2023, PwC was called out in 2023 for actively helping Russian nationals to avoid EU sanctions and asset freezing!

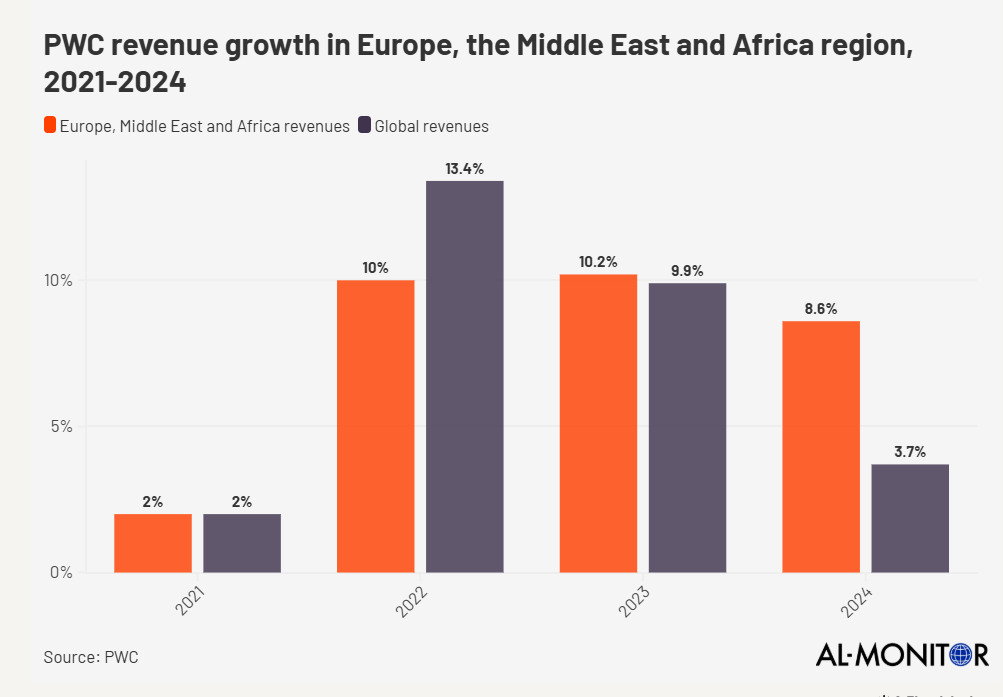

But despite all of this, PwC’s global revenues have seen a growth of 4.5% leading to $55.4 billion in 2024!

What’s next for PwC Saudi?

What’s next for PwC Saudi?

Now, PwC is doing everything in its power to restore its relationship with Saudi Arabia and its sovereign wealth fund, according to Reuters.