- Hi! I am Jyoti H. Asrani, a Chartered Accountant (CA) from India and a Certified Public Accountant from the United States of America.

- As a curious child, I always believed that education is a privilege earned with one’s hard work and dedication. So, I did my Bachelor’s and Master’s in Commerce, and qualified as a CA at the age of 21!

- I always had a passion for international finance & taxation and wanted to be successful in the international sector. This prompted me to pursue CPA and I cleared all four sections of CPA on my first attempt in 2018.

- CPA(US) has opened up new opportunities for me both in India and USA and helped me achieve my long-term career goals.

- Here I answer all your questions about my CPA journey.

What was your motivation behind pursuing CA?

My parents always taught us, three siblings, to strive for excellence and not success. This encouraged me to be passionate and relentless in the pursuit of my goals

From an early age, I involved myself in my father’s business which exposed me to various aspects of the trade; be it research, analytics, logistics, and finance. Hence, I found myself very naturally opting to become a Chartered Accountant.

Due to my vigilance and approach, I was fortunate to pass the CA exams on my first attempt at all three levels at the age of 21!

Over the years, I have continued upskilling and exploring different pieces of training, and certifications and expanding my toolkit to become a thorough finance professional. I’m also a Certified Scrum Master!

Why did you pursue CPA after CA?

After my articleship with Ravi & Dev in Direct Taxation (Domestic), I took up an opportunity with Ernst & Young, a Big 4 firm in their International Taxation & Transfer Pricing Department.

It was here that I was exposed to the international side of the taxation world. I soon realized that there is so much more to learn about the world market. That’s when I decided that a global degree and experience would be perfect to enhance my current work experience.

By talking to a few seasoned professionals and friends, I got introduced to the Certified Public Accountant course. This brought my interest in CPA as it was an extension of my CA curriculum and would enhance my exposure to the global market.

Once I decided to pursue CPA(US), I had several questions – Where do register, what is the process, etc?

Which State did you choose for your CPA and why?

In order to be registered or be eligible to give the CPA examination, we need to have a minimum of 120 credits (as per the US educational system). So, it is recommended to check with the different state boards that are affiliated with the American Institute of Certified Public Accountants (AICPA).

One has to know which board recognizes their educational qualifications in India and accordingly they give the appropriate credits for it. For the conversion of credits as per the US system, we send it to educational consultants/counselors in the United States. They then send out evaluation or credit reports to the particular State we want them to send.

In my case, since my Chartered Accountant course was well recognized by the Arizona State Board, I decided to go for it.

They gave me a total of 186 credits considering my CA, MCom, and BCom qualifications. (I have to mention, that I am a firm believer in continuous learning and so even after qualifying as a CA I kept studying further which helped me in my credits!)

What was your preparation process for CPA? Would you recommend coaching?

I made a very strategic move to pursue my CPA certification and started planning for the same during my tenure at EY.

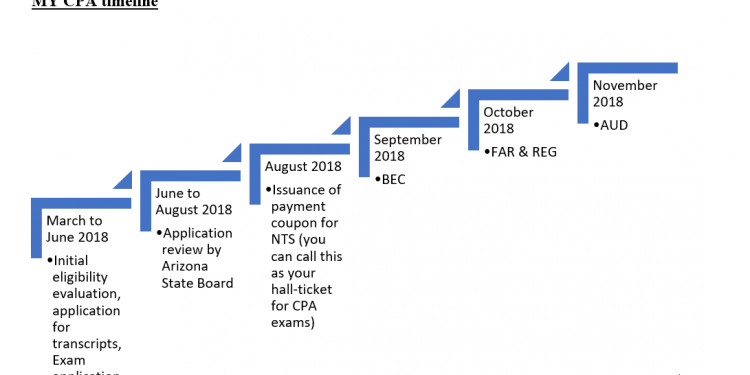

I gave myself a bracket of 9 months – March 2018 to December 2018 for registration, preparation, appearing, and clearing the exams in one go.

I was doing this to further my skill set and I did not want this to pull me down in terms of my career trajectory. So, I wanted to complete it in one shot.

This is what I did:

- After brainstorming and networking with seniors, I got to know about a coaching class. I sought their assistance for registration compliance and also used their coaching material for the course.

- Given the timeline I had set for myself, I decided to visit my family in the States, and spend my preparation time (around 3 months) to avoid any travel complications later.

- My 5-month stay in the US was divided into 3 months of preparation and 2 months of appearing for all four sections.

- I got access to the online lectures, notes, and mock tests relevant to my attempt. The well-planned set of practice series and mock tests helped me boost my confidence before the final day!

In CPA, for which exam did you need additional guidance?

Being an Indian CA, many subjects were familiar to me such as Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), Regulation (REG), and Business Environment and Concepts (BEC), as we had studied them during the CA exam.

The challenging subject for me was Regulation (REG) as it is very different from Indian taxation and needs much more practice as compared to the other subjects.

My CPA scores (out of a total score of 100) in the order of exam scheduled/taken:

BEC – 84

REG – 84

FAR – 77

AUD – 78

Do you think you could have self-studied for the entire exam and skipped the coaching?

Given the CA qualification, I did not need any online training on the concepts for subjects like accounts, audit and business environment, and communication.

But for tax, since the Indian tax and US tax are different, we do require some training to understand the concepts.

So in short, I would say:

1. If one’s a CA and doesn’t have an unrealistic timeline of 6 months like me, then I would recommend self-study. Proper study material and practice tests (either paid or freely accessible for a limited period) to understand the exam structure would be enough. The concepts remain the same. One just needs to grasp the different logic or methods used by the US government vis-a-vis the Indian government.

2. If one’s not a CA, the classes do provide a strong foundation and guidance that make it easy to understand and apply the concepts.

Where did you give your CPA Exams and why?

I gave my exam in 2018 and had only two available exam locations – USA and Dubai.

I chose the USA for giving my CPA exam since I had my family in Boston, MA. This saved my living cost and I only had to worry about my travel and exam costs.

But now giving a CPA is as easy as any other international exam! NASBA has issued additional locations from where we can appear for these papers such as India, Nepal, England, Scotland, Ireland, Germany, and others.

One has to be careful about selecting and contacting the Board of Accountancy (or its designee) in the participating US jurisdiction to obtain application materials. The submission of completed applications and required fees should be as instructed. After receiving the Notice to Schedule (NTS), one may then use the NTS to apply to take the Exam in an international location.

(Press release available here – https://nasba.org/internationalexam/)

How does one fund CPA? Does your firm sponsor you?

Since my decision to pursue CPA was suo moto, hence, I funded it myself.

Many organizations in the accounting world in the US (and even India), especially the Big4s, sponsor the entire exam cost and the license after qualifying for CPA exams. Open communication with their employer.

How has CPA helped you after CA?

I now better understand the US GAAP, taxation policies, and auditing standards.

Networking with like-minded professionals in the tax, audit, and accounting industry prompted me to take the next big step in my academic journey – a second master’s!

During my application for Project Management to multiple universities abroad, I could see that CPA allowed me to take a waiver for multiple test scores such as GRE or GMAT.

At Northeastern University (NEU), I connected with the Tax Manager and found out about their requirement for someone in tax and finance compliance. My CPA played a crucial role in establishing my candidature for this role. Being a full-time management student at NEU, I was simultaneously using my CPA credentials to continue to work on my passion for finance!

The next milestone was getting professional experience in the US in an industrial scope. I started interning at a software company in Boston in their Business Development team. Here again, my CPA certification was put to use when I was pulled in to help the audit team with SOX compliances.

For me, CPA paved the way for plenty of career options in India as well as in the United States.

Most importantly, would you recommend other CAs to pursue CPA?

CPA(US) helped me significantly to achieve my long-term career goals. So, if it does help in your career, I totally recommend getting this additional certification in your tool kit.

Moreover, one only needs to worry about the funding part of the certification, since the syllabus is manageable, given the robust training as a Chartered Accountant.