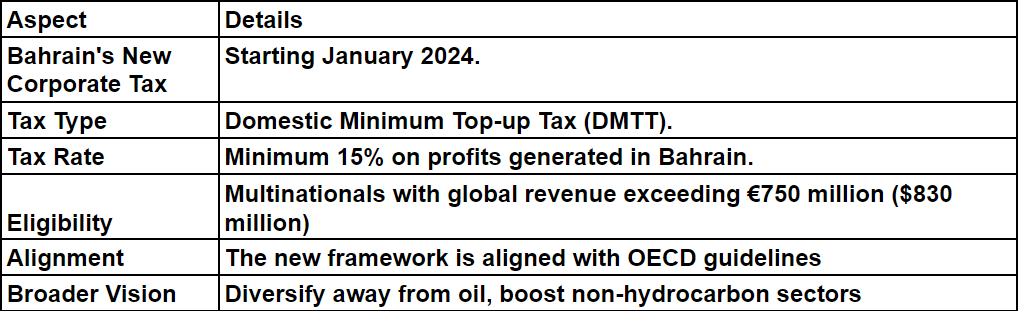

- Bahrain is introducing a 15% Corporate Tax.

- Come January 2025, this new tax is set to target multinational giants with global revenues exceeding €750 million ($830 million).

- This strategic shift aligns the Gulf nation with global taxation reforms.

GCC corporate tax comparison

- Oman: 15% for all taxpayers other than Omani proprietorships and limited liability companies (LLCs) that fulfill the conditions of small and medium enterprises (SMEs).

- UAE: 9%, effective from June 1, 2023 (GCC’s lowest corporate tax)

- Kuwait: Flat 15% corporate tax on total business profits. Applies to “foreign” (non-GCC) entities & non-GCC owners in GCC entities. Thus, the scope of corporate tax in Kuwait is limited. It is not applicable across the board on all corporate profits.

- Qatar: 10% corporate tax on companies’ net profits.

- Saudi Arabia: 20% tax on resident capital companies and non-residents with a permanent establishment.

(Note: The calculation is complex and this is for reference only.)

Current Taxes in Bahrain

VAT: 10% value-added tax was introduced in 2019 on most goods and services.

Excise Tax: Implemented in 2017, this tax applies to specific goods such as tobacco products (100%), energy drinks (100%), and soft drinks (50%).

Import Duties: Bahrain charges import duties on most goods, with rates varying by product type.

Oil and Gas Sector Tax: For businesses in the oil and gas sector, a 46% tax rate is applied to net profits.

Corporate Tax Details

- A 15% minimum tax on profits for large multinationals.

- This new tax targets firms with global revenues over €750 million ($830 million) for at least two of the last four years. The goal is to align with global taxation reforms and boost Bahrain’s economic diversification.

- Companies must register with Bahrain’s National Bureau for Revenue, which also manages VAT and excise taxes.

Also read: Bahrain-UAE Double Tax Treaty to be signed in 2024: Exciting news for businesses in both countries

Global Alignment

- Bahrain’s tax framework follows OECD guidelines, ensuring a minimum 15% tax on profits globally.

- The reform, adopted by 140+ jurisdictions, aims to boost global tax revenue by $220 billion annually.

Also read: Oman to become the first Gulf country to introduce Personal Income Tax?

Impact on Bahrain’s Economy

- Supports Bahrain’s push beyond oil, aiding sectors like finance, tech, and tourism.

- Part of the 2021 reforms, expected to drive GDP growth to 3.6% in 2024.