- In July 2025, Capgemini snapped up WNS, a pure-play BPO with 65,000 employees for $3.3 billion.

- The WNS team will now sit inside Capgemini’s Global Business Services (GBS) unit.

- But this isn’t just an M&A headline.

- It’s the biggest shake-up in outsourcing, consulting, and shared services in decades — a bold move into the $1.5 trillion “Services-as-Software” space, where AI doesn’t assist the work…it does the work!

AI disruption in the outsourcing/ BPO model

For years, the outsourcing industry ran on one formula: Low-cost labour + scale + automation = efficiency.

For instance: With WNS acquisition, Capgemini adds just 5% to its revenue ($1.5B on $25B)…but inflates Capgemini’s workforce by a jaw-dropping 19%.

That’s your red flag right there — a reminder of how incredibly labour-intensive traditional BPO / outsourcing still is.

Enterprises are demanding more — faster, smarter, AI-driven operations that go beyond “doing the task” to “delivering outcomes”.

And that’s exactly what the Capgemini-WNS deal is doing, rolling out Agentic AI-powered intelligent operations.

Also read: Accounting firms, ripe for AI-led rollups: Yes, new target for Venture Capital

Why did Capgemini acquire WNS?

- “Domain-specific process knowledge” across BFSI, insurance, healthcare, procurement, travel, and TMT.

- 400+ clients, generating $1.3 billion in annual revenue with 18.7% operating margins.

- Strong client retention and flexible, innovative commercial models.

- Deep roots in North America and the UK—both strategic markets for Capgemini.

Important to note: WNS also has a sizable portfolio of AI tools (80+ AI Assets), BUT its capabilities are not yet market-leading.

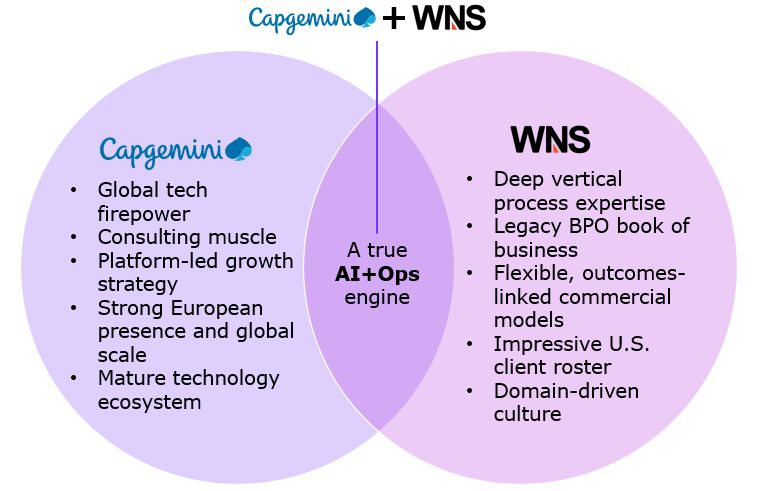

On the other hand, Capgemini is great at tech, automation, and AI.

Capgemini, with WNS in its corner, can now convert legacy BPO contracts into Services-as-Software offerings.

In short, WNS employees will continue similar work, now supercharged with Capgemini’s tech stack.

Yes, Capgemini is tapping into $1.5Trillion market

This is a new kid on the block: “Services as Software”, coined by Phil Fersht, CEO of HFS Research (Ex-Gartner and Ex-Deloitte).

So, don’t confuse it with SaaS.

Here’s the difference:

| SaaS (Software as a Service) | Services-as-Software |

|---|---|

| Gives you tools to do the job yourself (e.g. QuickBooks to do your accounting) | Agentic AI DOES THE JOB FOR YOU (e.g., an AI agent that files your taxes, reconciles your books, or handles customer queries with no human) |

That’s exactly what clients want today!

Specifically, the Global Agentic AI market is projected to reach $24.5 billion by 2030.

Also read: PwC clients asking an awkward question – Where’s our AI Discount?

Another point to note…

Lines between BPO/outsourcing and Consulting are blurring.

Will Capgemini’s WNS acquisition disrupt the Big 4?

Big 4s (EY, Deloitte, PwC, KPMG) doubling down on AI. Also, Big 4’s managed services arms are growing aggressively in finance, tax, and compliance.

- Deloitte and EY are building AI-powered shared services

- PwC’s “new equation” is about combining people + tech (Big push on managed services)

- KPMG is embedding AI into audit and F&A operations

This creates direct competition in finance transformation deals, intelligent operations, and GenAI-driven consulting.

The Big 4’s India GCCs (Global Capability Centres) or managed services hubs may face:

-

Pressure on margins

-

Talent wars (as Capgemini may scale up fast)

-

Client switching if Capgemini undercuts with AI-based pricing models

So what’s next? Maximise Business value with GenAI

In 2024, HFS Research surveyed 1,000 global enterprises. And this is what they concluded:

- Within 5 years, 60% of firms plan to replace traditional services with AI

- 48% are already restructuring outsourcing contracts to be outcome-based

- 72% want AI-first solutions, not just automation add-ons

So what should you do…

CA & accounting firms

- Build or partner with AI-driven tools for F&A, reconciliations, and compliance

- Add platform thinking to your service delivery

- Educate clients on AI-led efficiency, not just cost savings

BPO/outsourcing providers

- Don’t just train more people — train the AI

- Move away from FTE-based pricing

- Invest in AI operations teams, not just delivery teams

Consulting firms

- Productize your services into AI-delivered solutions

- Lead with outcomes, not manpower

- Be ready to compete with tech giants

- Well, we know it is easier said than done – but AI/ Agentic AI is the future.

Capgemini x WNS is not just a deal

Is it the beginning of the end for traditional outsourcing?

Is it the start of a new era, where AI runs operations, and firms that embrace “Services-as-Software” will lead the next decade?

FAQs:

Capgemini vs WNS

WNS is a global business process management (BPM) company.

Translation? They handle “behind-the-scenes” AKA outsourced work for large enterprises — accounting, finance operations, customer service, market research, claims processing, and more.

It was founded in 1996 as a spin-off of British Airways’ captive process and back-office activities.

Currently employs over 65,000 people across 64 delivery centres (primarily in India).

Capgemini is a French multinational IT giant specialising in consulting, technology, and digital transformation. They help companies modernise using AI, automation, cloud, and data.

How big is GBS within Capgemini?

Capgemini GBS runs outsourced operations like finance, supply chain, and customer service for global clients.

It sits inside the Operations & Engineering unit.

| Business Unit | Share of Group Revenue (FY 24) | Key Functions |

| Applications & Technology | 62% | Core IT services – custom software, systems integration, application maintenance |

| Strategy & Transformation Consulting | 9% | High-end business consulting, digital strategy, AI/GenAI consulting |

| Operations & Engineering (GBS is here!) | 29% | Business Services (BPO), Infra & Cloud, R&D/Engineering |

Who are Capgemini’s Competitors?

| Competitor | How They Compete with Capgemini |

|---|---|

| Accenture | Direct rival in consulting, tech, and outsourcing. Competes for large digital transformation and AI-led enterprise deals. |

| TCS, Infosys, Wipro, Cognizant | Compete in global IT services and BPO. Strong on delivery scale, pricing, and offshore execution. Frequent rivals in tech outsourcing. |

| Deloitte, PwC, EY, KPMG | Compete in finance transformation, managed services, tax ops, and compliance. Rapidly adding AI and automation to delivery models, overlapping with Capgemini’s new GBS focus. |

| Genpact, EXL, Concentrix, Teleperformance, HCLTech BPO | These are WNS’s traditional BPO rivals. Now compete with Capgemini in domain-specific outsourcing (F&A, insurance, claims, customer ops) — but Capgemini enters with a stronger tech edge. |