- For years the Big 4s, Accenture & consulting giants made billions by riding the AI and tech consulting wave.

- They branded themselves as “AI Transformation leaders.”

- Now, OpenAI enters AI consulting, working directly with enterprise clients.

- Accenture & other consulting firms are…Very, very nervous!

- Welcome to AI-as-a-Service, where “tech builders are becoming the new consultants”.

Big 4s & peers rushed into tech consulting

Traditionally, the Big 4 (Deloitte, PwC, EY, KPMG) ruled audit, tax, and compliance.

But those businesses are mature, heavily regulated, and now increasingly automated.

To chase growth and higher margins, they rushed into AI and tech consulting:

- Built AI Centres of Excellence

- Hired thousands of AI/data consultants

- Partnered with model providers like OpenAI, Microsoft Azure, Anthropic, Google Cloud

- Sold frameworks and roadmaps to guide AI strategy

It worked.

Who dominates AI Consulting (so far)

Accenture, with its technology-first roots, surged ahead. Meanwhile, Big 4s, McKinsey, BCG, IBM, and others also doubled down on AI.

| Company | Global Revenue (FY24) | Global AI & Tech Consulting Revenue |

|---|---|---|

| Deloitte | $67.2B | $25B+ (Consulting ≈ 50%), 40000+ AI/data team |

| PwC | $55.4B | $3B+ in AI, cloud (FY24); Invested $1B+ in GenAI |

| EY | $51.2B | > $2.5B in GenAI & tech (estimated) |

| KPMG | $38.4B | $1–2B (AI + cloud focus) |

| McKinsey | $18.8B | Projects: 40% of future revenue will come from AI |

| Accenture | $64.9B | $3B+ GenAI bookings (FY24); $1.5B AI revenue in Q3 2025, 80k AI experts |

| Palantir | $2.87B | $1.3B from Commercial AI stack |

| Infosys | $19.3B (FY25 est.) | 200+ GenAI agents; 400+ AI projects |

| TCS | $30.2B | AI/GenAI in 33% of projects |

| Wipro | $10.4B | $5.4B bookings; AI used in 50% of deals |

| Capgemini | €22.1B (~$24B) | €1.1B estimated; 5%+ AI/GenAI bookings |

But now OpenAI enters Consulting….

The company behind ChatGPT is no longer just licensing models or building cool tools.

OpenAI is embedding elite Forward-Deployed Engineers (FDEs) — ex-Stripe, Google, Palantir — directly into client teams.

They’re building:

- Custom GPT-4o models

- Domain-specific copilots

- AI agents that automate complex workflows

Pricing starts at $10M+, with clients like Grab and the U.S. Department of Defence already onboard (Reportedly signed a $200M+ AI contract).

More enterprise deals are on the horizon.

Their pitch? “No slide decks. Just working AI inside your systems.”

OpenAI follows an “AI-as-a-Service” approach, inspired by Palantir.

OpenAI’s Consulting push puts the Big 4 in hot water

Direct competition in the AI advisory space: Big 4 firms have historically bridged the gap between business and technology. They translate needs, draft roadmaps, and then coordinate with tech vendors.

OpenAI no longer needs a Deloitte or EY to “bridge the gap” between business and tech. It builds and deploys AI directly.

This overlaps with the Big 4’s traditional AI advisory and implementation space.

Margin erosion — OpenAI is faster, leaner: Big 4s charge millions for strategy decks and long delivery cycles. OpenAI delivers results in weeks with lean teams — undercutting traditional fees.

OpenAI threatens the Big 4’s lucrative consulting fees, especially in AI strategy, automation, and digital transformation projects, which were BIG revenue for Big4s

Clients bypass traditional firms: Clients now ask, “Why pay millions to a consulting firm when I can just pay OpenAI to build and deploy the thing?”

Top AI talent leaving: OpenAI’s tech-first culture is poaching top engineers, and it’s getting harder for Big 4s to compete for elite talent.

Clients re-benchmark delivery speed: FDEs can ship production-grade AI in weeks. Traditional consulting teams take quarters. Clients are re-benchmarking expectations, and legacy firms are falling behind.

Now, with OpenAI going direct to clients, traditional firms are pushed down the value chain, becoming:

- AI auditors

- Compliance reviewers

- Integration partners

Still relevant, but no longer the “AI transformation leaders”.

What happens next?

Yes, the Big 4 will be impacted. But don’t expect a sudden collapse.

The Big 4’s consulting work spans far beyond AI, encompassing audit and regulatory advice, as well as complex industry consulting. This gives them a cushion against immediate disruption.

Meanwhile, tech-focused firms like Accenture face sharper disruption.

Who competes with OpenAI Consulting?

| Tier | Competitor |

|---|---|

| 🔴 Core | Palantir |

| 🔴 Core | Thinking Machines Lab |

| 🔴 Core | Tribe AI |

| 🔴 Core | Fractional |

| 🟡 Partial | Anthropic |

| 🟡 Partial | Microsoft / Google / AWS |

| ⚪️ Legacy | Big 4s / Accenture |

Wrapping up…

The next consulting giants might not be McKinsey, Accenture or Deloitte.

They might be OpenAI, Palantir, Anthropic…The “tech builders” themselves.

They don’t sell advice. They deliver working AI.

A clear trend is emerging: Technology companies are now “blending tech and consulting” into one business.

FAQs

What is OpenAI’s new AI consulting service?

OpenAI has launched a high-value AI consulting service that embeds elite engineers (Forward-Deployed Engineers) directly with clients.

They build custom GPT-4o models, AI workflow agents, and domain-specific AI copilots to deliver AI-as-a-Service solutions starting at $10 million projects.

What industries are adopting OpenAI’s AI consulting solutions?

Industries including defence (e.g., U.S. Department of Defence), ride-hailing (e.g., Grab), finance, legal, and operations are using OpenAI’s AI consulting services for automation, data annotation, and building AI copilots.

How does OpenAI’s AI consulting compare to Accenture’s AI services?

Accenture employs tens of thousands of AI experts and generates billions in AI revenue.

OpenAI offers direct access to the original AI models and elite engineers who built them, enabling faster, more customized AI integration.

What is the future of AI consulting with companies like OpenAI entering the space?

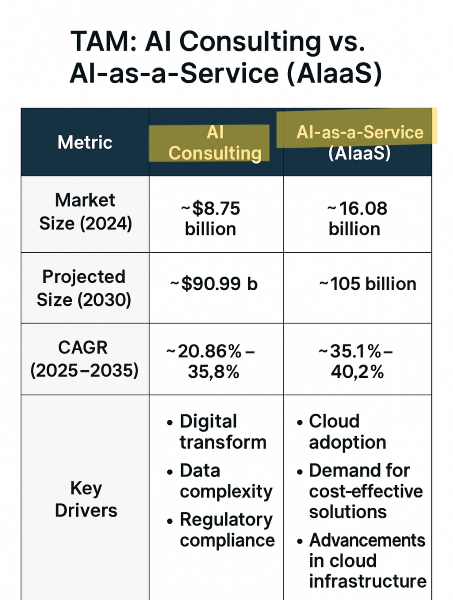

AI consulting is moving towards “AI-as-a-Service” models where technology providers directly deploy AI solutions within enterprises.

This reduces reliance on traditional consulting firms and reshapes the consulting value chain.