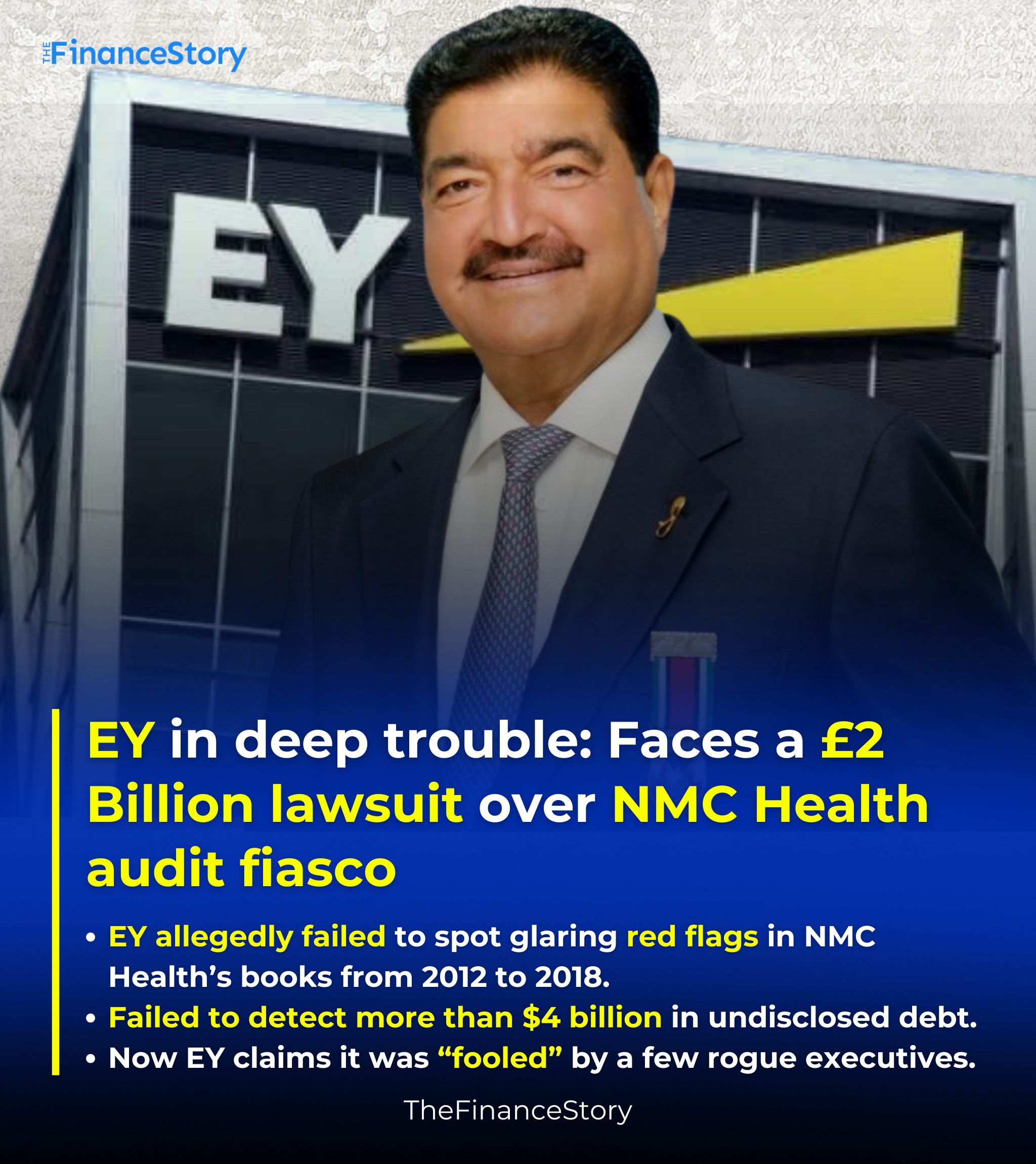

- One of the world’s top audit firms, EY, is being sued for £2 billion over its alleged failure to spot glaring red flags in NMC Health’s books from 2012 to 2018.

- We’re talking about billions in hidden debt, secret bank accounts, and fake financials — all signed off by EY….For six straight years!

- Now EY claims it was “fooled” by a few rogue executives.

- If that’s true — what exactly is the Big Four auditing?

So…Who exactly is NMC Health?

NMC Health was founded by billionaire B.R. Shetty in 1974.

What started as a humble clinic in the UAE became a healthcare behemoth — spanning the Middle East, Europe, and South America.

By 2012, NMC had listed on the London Stock Exchange and even earned a seat at the prestigious FTSE 100 table.

But in 2019, the curtain was pulled back…

Enter U.S. research firm Muddy Waters, who flagged major irregularities. What followed was a full-blown financial horror story:

An internal review followed — and then came the unthinkable:

- $4+ billion in undisclosed debt

- Dozens of secret bank accounts and unauthorized loans

- Widespread manipulation of financial statements

- Fraud that ran to the top

NMC collapsed.

Executives fled.

Arrest warrants were issued.

The stock was suspended and delisted.

HSBC and ADCB were left billions in the hole.

March 2020, Alvarez & Marsal was appointed as administrator to manage NMC’s assets and pursue recovery for creditors.

And who had been signing off the books all along? The Audit giant – EY.

The aftermath

Alvarez & Marsal, appointed as administrators in 2020, have now taken EY to court — claiming:

- EY “negligently missed” obvious red flags

- Failed to even check the general ledger

- Didn’t spot undisclosed borrowings

- Lost control over communication with banks

- Lacked professional scepticism toward top management

In short — everything you don’t want in an auditor.

NMC’s creditors have demanded nearly £2 billion in damages, to recover losses.

Also read: PwC & EY UK has seen 150+ Partner reductions

EY’s defence? “We were fooled too”

The auditor, who was tasked with identifying such discrepancies, failed to detect billions in fraud from 2012 to 2018.

However, EY insists it was the victim of a “sophisticated fraud” by a small group of executives and shareholders.

UK Watchdog steps in

Even the UK’s Financial Reporting Council (FRC) has opened a formal probe into EY’s conduct.

And now, with a £2 billion lawsuit underway, EY has started its formal defence as of May 21.

The trial is expected to run until October 2025.

The bigger question

When the watchdog fails — who watches the watchdog?

If billion-dollar frauds can go unnoticed under the nose of a global auditor, maybe it’s time to audit the auditors.