- JPMorgan’s CFO Jeremy Barnum has urged leaders to freeze hiring…Thanks to AI.

- Expect a 10% cut in operations roles (In fraud, account services, and statement processing.), as confirmed by Consumer Banking Chief Marianne Lake.

- The bank appears to be aligning with CEO Jamie Dimon’s advice: “Attrition is your friend.”

What’s the news?

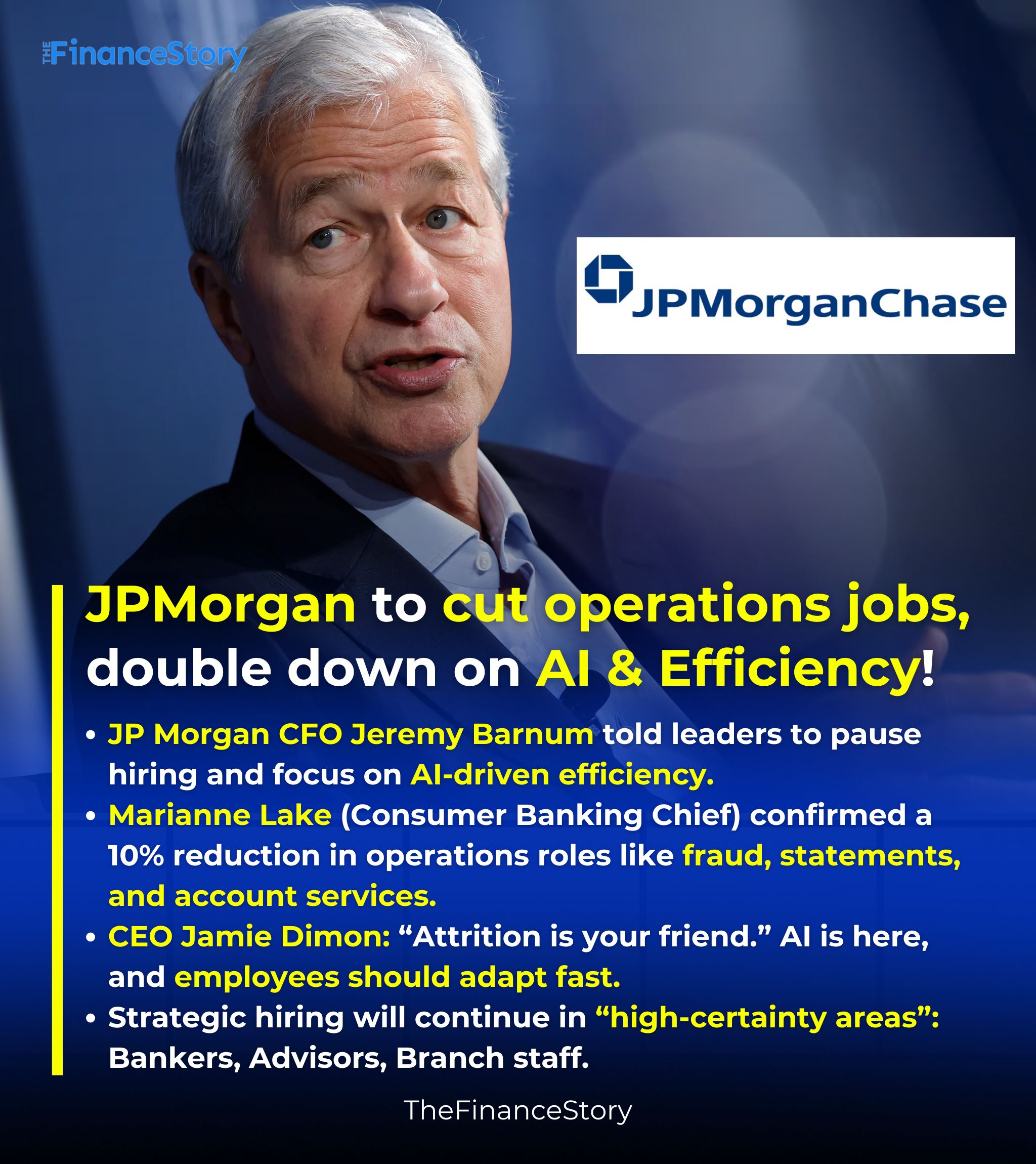

It was your usual annual investor day in New York, when JPMorgan’s CFO Jeremy Barnum dropped the bombshell of a news. (Kind of)

“At the margin, we’re asking people to resist head count growth where possible and increase their focus on efficiency,” Barnum said.

Expect 10% job cuts at JP Morgan, in Operations

Shortly after, Marianne Lake, CEO of Consumer and Community Banking, swooped in.

She announced the plan to reduce 10% of their operations staff (handling fraud, statements, and account services).

Lake believes that AI will enable a leaner model.

She went ahead saying that’s a “conservative estimate.”

Hiring will continue in…

But, there is some good news.

If you work in roles directly linked to revenue—such as bankers, advisors, and branch staff—you may be spared.

The bank plans to continue hiring in these so-called “high-certainty areas.”

Key trends to watch:

- AI-led efficiencies are replacing hiring as a growth strategy.

- Selective hiring remains in roles directly linked to business growth.

- Operations roles are most at risk, with job cuts already projected.

- JPMorgan is doubling down on its ‘return to office’ mandate, to drive productivity.

- The bank continues to show strong performance, with stock up 37% in the past year and $58.5B in net income in 2024.

- Barnum said JPMorgan is still on track to deliver a strong 17% ROTCE and annual spending of $95 billion.

Wrapping up…

If you are keeping count, JPMorgan’s headcount grew 23% over five years, reaching over 317,000 employees by the end of 2024.

But going forward, the bank is betting heavily on AI to reduce redundancies and boost productivity.

CEO Jamie Dimon earlier signalled this direction, famously telling employees that “attrition is your friend” and to embrace job-disrupting AI.