- According to the EY Global IPO Trends 2024 report – the global IPO market recorded 1,215 deals, raking in US$121.2b in proceeds for 2024!

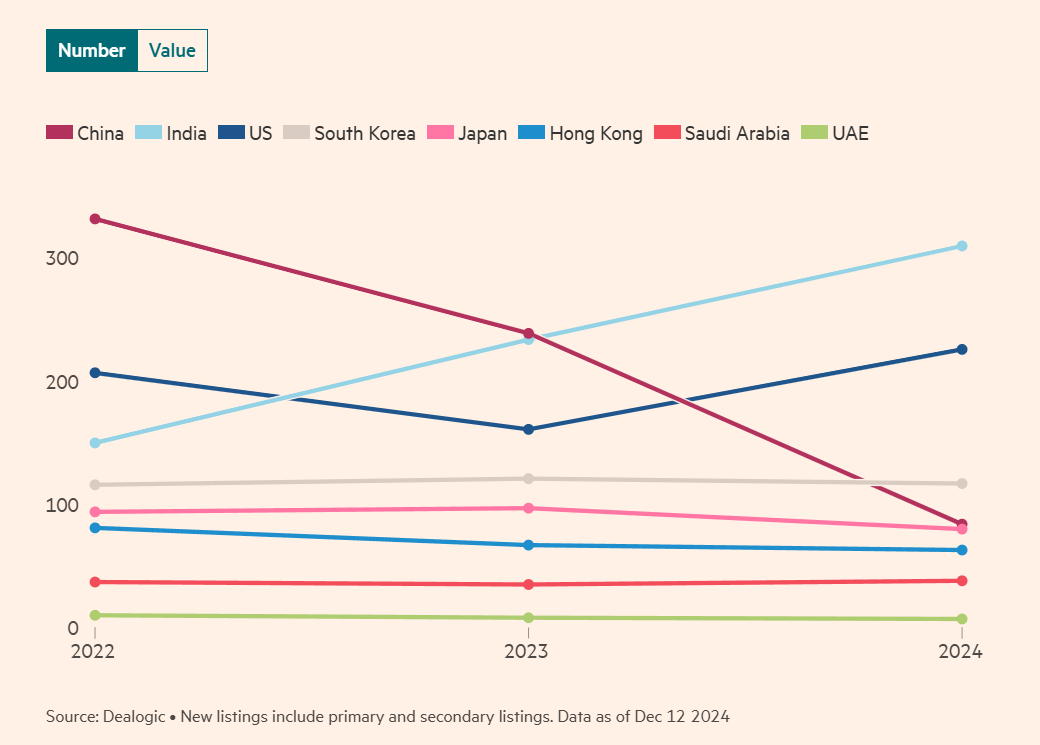

- India dethroned China as Asia’s top IPO market in 2024, raising a record $11.2 billion 💰, while China’s IPOs plunged 86% 📉, dropping from $48 billion to just $7.5 billion.

- India led in IPO volume, with a record number of listings.

India beats China in IPO rankings

In a recent Financial Times article there was a comparison between India and China’s IPO Market.

It highlighted how India has surged ahead of China to become Asia’s leading market for IPOs in 2024.

- India has raised a historic $11.2 billion – more than double the $5.5 billion raised in 2023.

- With 332 IPOs, India’s public market scene outpaces the US and China in 2024.

While India’s IPO market rose to prominence, its neighbour faced regulatory challenges and a slowdown.

- Data from the Financial Times suggest China’s IPO market struggled with only 64 IPOs a significant drop from the previous year.

- The value of listings fell by 86% in 2024, dropping from $48 billion in 2023 to just $7.5 billion!

- In 2024, more Chinese companies went public and raised more funds in the US!

As per Deloitte’s report, this represents reductions of 68% in deal volume and 81% in deal size!

Company listings in India and China

- The National Stock Exchange of India (NSE) became the world’s largest IPO venue in 2024 by funds raised.

- Hosted the world’s 3rd largest IPO by the South Korean car manufacturer, Hyundai Motor.

- India achieved the top spot due to a large deal volume.

- Competitors: Nasdaq and the New York Stock Exchange ranked 2nd and 3rd.

As of October 2024, the NSE hosts over 2,379 listed companies, while the Bombay Stock Exchange (BSE) has 5,505 companies.

In comparison, by the end of September 2024, the Chinese domestic stock market had 5,363 listed companies, according to the China Association for Public Companies.

Also read: Ex-KPMG National Tax Head says not IPO or M&A but opportunity in family offices

Key Indian IPOs and sector performance

Among the standout IPOs of 2024 were,

- Hyundai Motor: This South Korean automaker’s $3.3 billion IPO was a major event, attracting significant investor interest.

- Swiggy: The popular food delivery platform raised $1.3 billion in its IPO, showcasing the strength of the Indian tech sector.

- NTPC Green Energy: This subsidiary of NTPC, India’s largest power producer, raised $1.2 billion in its green energy-focused IPO.

- Vishal Mega Mart: This retail chain raised $0.9 billion in its IPO, tapping into the growing Indian consumer market.

- Bajaj Housing Finance: This leading housing finance company raised $0.8 billion in its IPO, benefiting from the strong Indian real estate market.

The technology and communications sector led India’s IPO market with 118 deals, raising $3.8 billion.

The financial services sector followed with 60 transactions, totaling $2.6 billion.

Why Chinese mainland’s lowest IPO activity in a decade?

Economic weakness and regulatory hurdles

According to Reuters, the IPO market, once the world’s largest in 2022 and 2023, has stalled after new Securities Chief Wu Qing tightened scrutiny on listings and vowed to address irregularities.

In April 2024, China introduced new rules to tighten oversight of IPOs, public companies, and underwriters. It also restricted IPOs to limit equity supply and reduce selling pressure in the volatile secondary market.

Ongoing constraints

Although recent fiscal and monetary stimulus measures have provided some relief, China’s IPO market remains constrained.

Shift to Hong Kong for listings

As a result, many companies are exploring listing options abroad, especially in Hong Kong, serving as China’s offshore financial centre.

Over $10 billion was raised by December 2024, compared to just $6 billion the previous year.

The Hong Kong IPO market started to pick up in September 2024 with a mega listing!

It remained in 4th position globally in IPO fundraising in 2024 with the support of listings from leading Chinese companies after a slowdown in 2023.

Also read: CFO hiring boom in India: Surge in demand amid IPO rush

India on global IPO stage 2025

As a result, India’s IPO market is expected to continue its strong performance in 2025.

The Indian government’s emphasis on infrastructure development and private capital expenditure has been instrumental in strengthening market dynamics.

- 2025 IPO Outlook: Over a dozen listed firms are planning to take subsidiaries public: including HDFC Bank, Hero MotoCorp, Reliance Industries, Manappuram Finance, Muthoot Finance, Brigade Enterprises, Canara Bank, and Greaves Cotton,

- Reliance Jio IPO Plans: Reliance Industries has firmed up plans to launch the Reliance Jio IPO in 2025, aiming to make it India’s largest ever, surpassing Hyundai India’s $3.3 billion IPO in 2024.

China 2025 IPO?

“In the next few years, the chance of a domestic IPO is slim for Chinese startups,” said a Shanghai-based executive at a Chinese private equity firm who told Reuters.

As per a Deloitte report, it forecasts that in 2025 Hong Kong’s IPO market will be driven by: listings from A-share issuers, leading Chinese firms, US-listed China concept stocks, and overseas companies, with around 80 IPOs expected to raise significant capital.

Point to now: Foreign portfolio managers scale back…

As reported by the Financial Times, despite the IPO boom, India has also seen a record exodus of foreign portfolio investment (FPI).

In October 2024 alone, FPIs pulled over $11 billion from Indian equities, with an additional $2.5 billion leaving in November.

This has raised concerns about the sustainability of the IPO surge!