- The Public Company Accounting Oversight Board (PCAOB) has once again flexed its regulatory muscles.

- On September 24, the PCAOB announced disciplinary orders against four audit firms for violating critical communication rules related to audit committees.

- Here’s everything you need to know about this latest round of sanctions.

Sweeping crackdown on audit firms

PCAOB, the US audit watchdog sanctioned four audit firms for failing to meet the required communications with audit committees, under AS 1301 and Rule 3524.

The sanctions were implemented as part of an enforcement sweep which is a deliberate effort to identify violations across multiple firms simultaneously.

In a separate case, another firm was sanctioned for violating mandatory reporting requirements to the PCAOB.

Which firms got sanctioned?

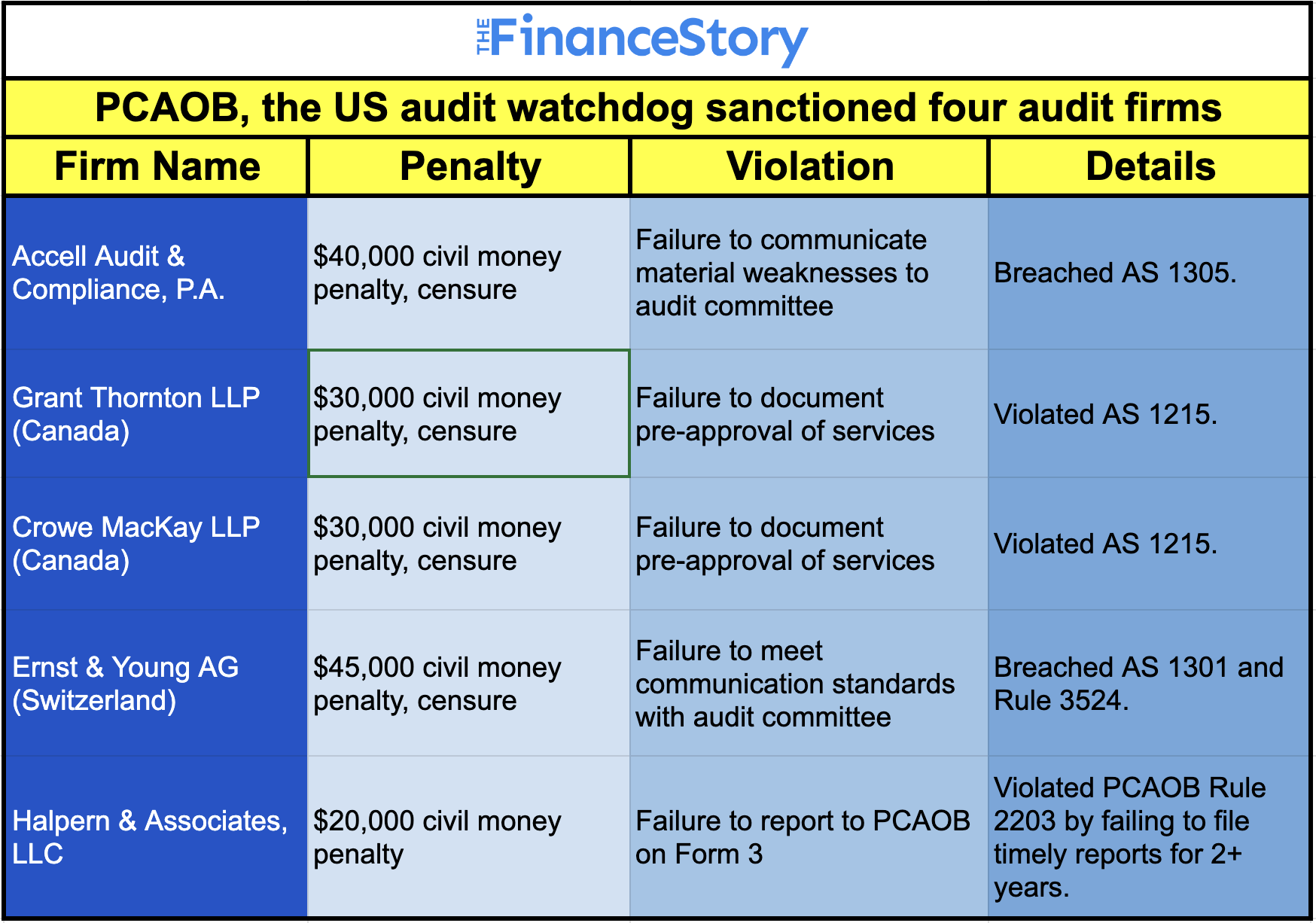

Accell Audit & Compliance, P.A.: $40,000 civil money penalty and censure. The firm failed to communicate material weaknesses to an issuer’s audit committee, breaching AS 1305.

Grant Thornton LLP (Canada): $30,000 civil money penalty and censure:

Crowe MacKay LLP (Canada): $30,000 civil money penalty and censure: Crowe MacKay LLP and Grant Thornton LLP also failed to document pre-approval of certain services, a violation of AS 1215.

Ernst & Young AG (Switzerland): $45,000 civil money penalty and censure

Halpern & Associates, LLC: In a separate order, this firm was fined $20,000 for failing to report to the PCAOB on Form 3 for over two years. Failure to file timely reports, as required under PCAOB Rule 2203, undermines the transparency that investors and regulators depend on.

Also read: What is the PCOAB – the U.S. audit watchdog and what are its roles?

What’s next for the sanctioned firms?

While none of the sanctioned firms admitted or denied the violations, they have agreed to pay civil penalties and undertake corrective measures.

This includes revising internal policies and ensuring compliance with PCAOB standards going forward.

PCAOB Chair Erica Y. Williams stated,

“The PCAOB will continue to hold firms accountable for providing audit committees, the PCAOB, and the public with important information to help keep investors protected,”

PCAOB is keeping a close eye on firms

This isn’t the first time the PCAOB has cracked down on audit firms.

Previous enforcement actions in 2023 and earlier in 2024 saw firms across the industry penalized for similar violations.

This latest round highlights that non-compliance with PCAOB standards remains a widespread issue, and firms are under increasing scrutiny.

Also read: PCAOB fines KPMG firms in India, the UK and Colombia with a penalty of $7.7 Million.

About PCAOB

For those unfamiliar, The Public Company Accounting Oversight Board is a nonprofit corporation. It was created by the Sarbanes–Oxley Act of 2002 to oversee the audits of US-listed public companies.

Its goal is to protect investors by ensuring audits are informative, accurate, and independent.

The PCAOB also monitors compliance reports filed by brokers and dealers registered with the SEC.

Wrapping up

Firms that fail to communicate properly or report significant events risk not only financial penalties but reputational damage.

Robert E. Rice, Director of the PCAOB’s Division of Enforcement and Investigations, warned that more actions could follow, reinforcing the importance of upholding professional standards.