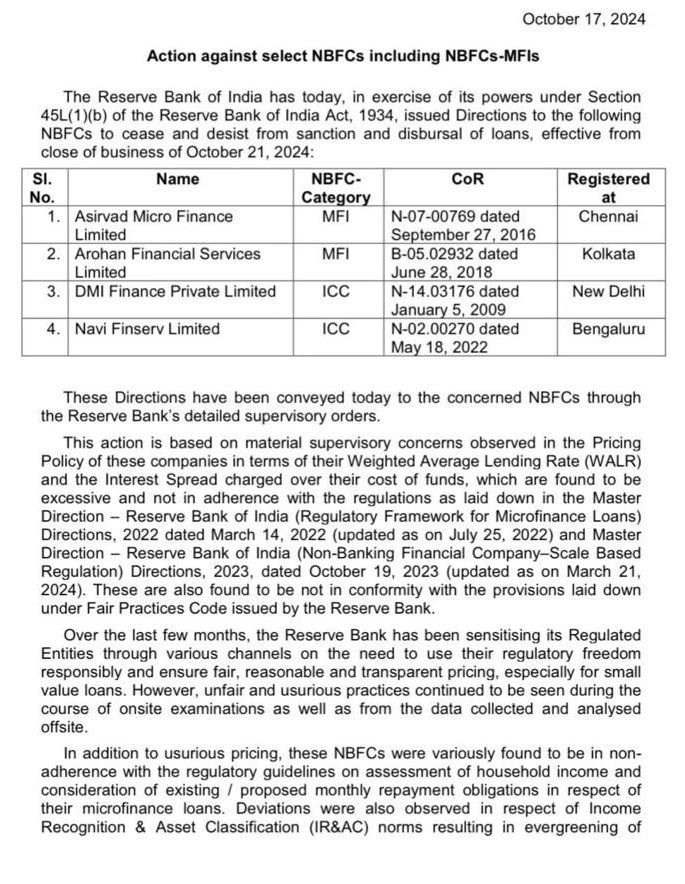

- The RBI has just banned four major NBFCs; Navi Finserv, DMI, Asirvad, and Arohan—banning them from issuing new loans.

- The reason? Excessive interest rates and failing to follow crucial regulatory guidelines. Here is the breakdown.

What’s the news?

The Reserve Bank of India (RBI) has pulled a major regulatory move.

Navi Finserv, a fintech digital lending platform and RBI-registered NBFC providing personal and home loans has been directed to stop sanctioning and disbursing loans, starting October 21, 2024.

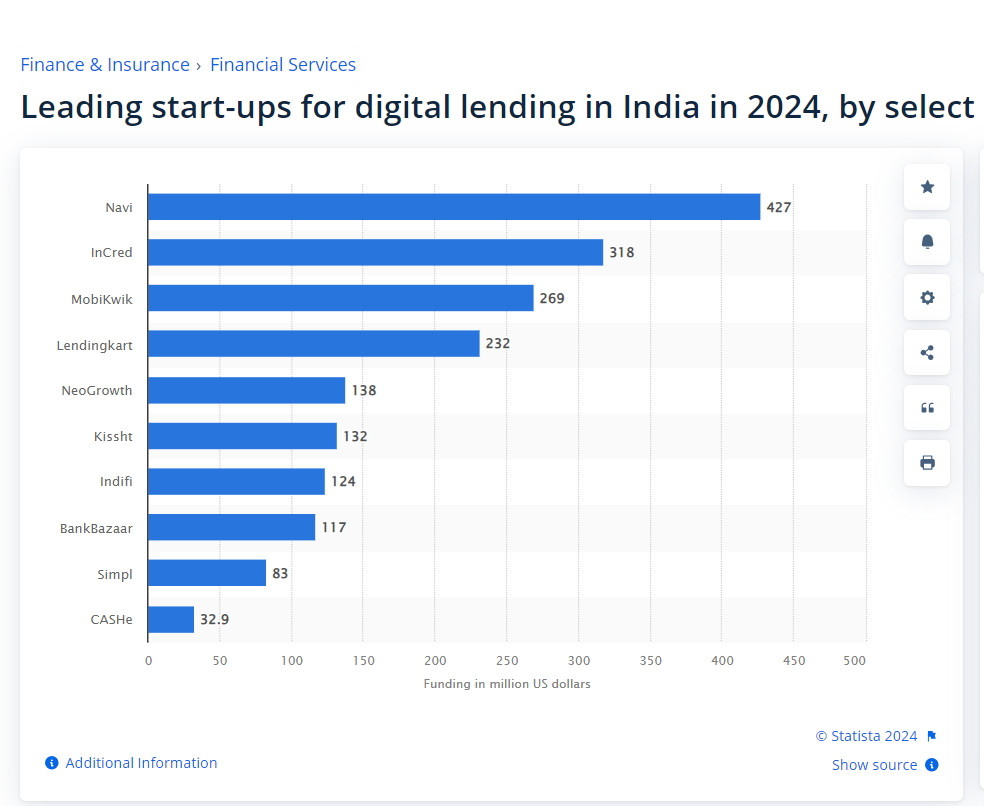

Navi was founded in 2018, by Sachin Bansal (ex-Flipkart founder) and Ankit Agarwal (ex-Bank of America). It has raised a total of $427 million over four rounds from 31 investors.

Apart from Navi Finserv, the RBI also took similar action against:

- DMI Finance

- Asirvad Micro Finance (IPO Bound)

- Arohan Financial Services

These companies will not be allowed to issue new loans until they fix the problems identified by the RBI.

However, they can still collect payments from existing customers.

Why did the RBI take this step?

Excessive Interest Rates: The RBI’s main concern lies with the excessive interest rates these companies were charging.

Navi Finserv, which offers unsecured personal loans up to ₹20 lakh, with rates ranging from 9.9% to 45%, was found to be charging above the regulated limits.

This raised alarms about predatory pricing, especially in the microfinance sector.

Non-Compliance with Fair Lending Practices: Navi Finserv, along with the other NBFCs, was found to violate several lending regulations.

These included failing to properly assess whether borrowers could repay the loans.

Additionally, they ignored rules that ensure fair loan pricing. Such practices posed a risk to financial stability and borrowers alike.

Unsustainable Growth: The RBI found that some NBFCs were pursuing unsustainable growth strategies.

This includes expanding rapidly without the necessary risk management frameworks in place, which could lead to financial instability.

Navi Finserv

Business Model: App-based personal finance solution offering personal and home loans.

Navi Finserv’s financial performance in FY24:

- Consolidated Operating Revenue: Fell 6.6% to ₹1,906.2 crore (down from ₹2,040.6 crore in FY23).

- Profit After Tax (PAT) from Continued Operations: Dropped by 41% to ₹155.6 crore (compared to FY23).

- Loan Write-Offs: Increased to ₹406 crore in FY24, up from ₹125 crore in FY23.

- Interest Income: Dropped by 12% to ₹1,611 crore.

- Profit from Discontinued Operations (Chaitanya Sale): Navi made substantial gains by selling its microfinance arm, Chaitanya India Fin Credit Private Limited (CIFCPL), to Svatantra Microfin for ₹1,167 crore. This sale, completed on November 23, 2023, resulted in a profit of ₹704.06 crore for Navi Finserv after accounting for related costs.

- Overall Net Profit: More than doubled to ₹545.1 crore in FY24 (up from ₹264.2 crore in FY23).

About DMI Finance

Co-founded by Yuvraja C. Singh and Shivashish Chatterjee, DMI Finance is a systemically important non-banking financial company and part of the DMI Group.

Investment Growth: Japanese MUFG Bank increased its investment to ₹4,712 crore.

Business Shift: Focus has shifted from corporate real estate lending to digital personal and affordable home loans.

Loan Book: Stood at ₹1,685 crore as of June 30, 2024, with an average ticket size of ₹10 lakh

Interest rates between 12% and 40%.

Recent Acquisition: Acquired BNPL startup ZestMoney.

Asirvad Microfinance (Headed for a INR 1500 Crore IPO)

Backed by: Manappuram Finance, with an AUM of ₹12,310 crore as of June 2024.

Profitability: Reported a net profit of ₹100 crore in June 2024, down from ₹458 crore in March 2024, indicating profitability challenges.

Arohan Financial Services

Operations in financially under-penetrated Low Income States of India.

Arohan provides income-generating loans and other financial inclusion-related products to customers who have limited or no access to financial services.

- Focus Areas: Operates primarily in West Bengal, Bihar, and Uttar Pradesh.

- AUM: ₹6,339 crore.

- Profit Growth: Reported a net profit of ₹211 crore for the nine months ending FY2024, a jump from ₹71 crore in FY2023.

Industry impact: Mixed reactions

Support for RBI’s Move

Some industry leaders believe the RBI’s crackdown was necessary to ensure sustainable and ethical lending practices.

They argue that prioritizing customer protection over aggressive growth is essential for the long-term health of the financial sector.

Concerns Over Innovation

Few players in the fintech space express concerns that such stringent regulations might stifle innovation, particularly in underserved areas like Tier 2 and Tier 3 cities, where Navi Finserv was making inroads by offering loans to those with varied credit profiles.

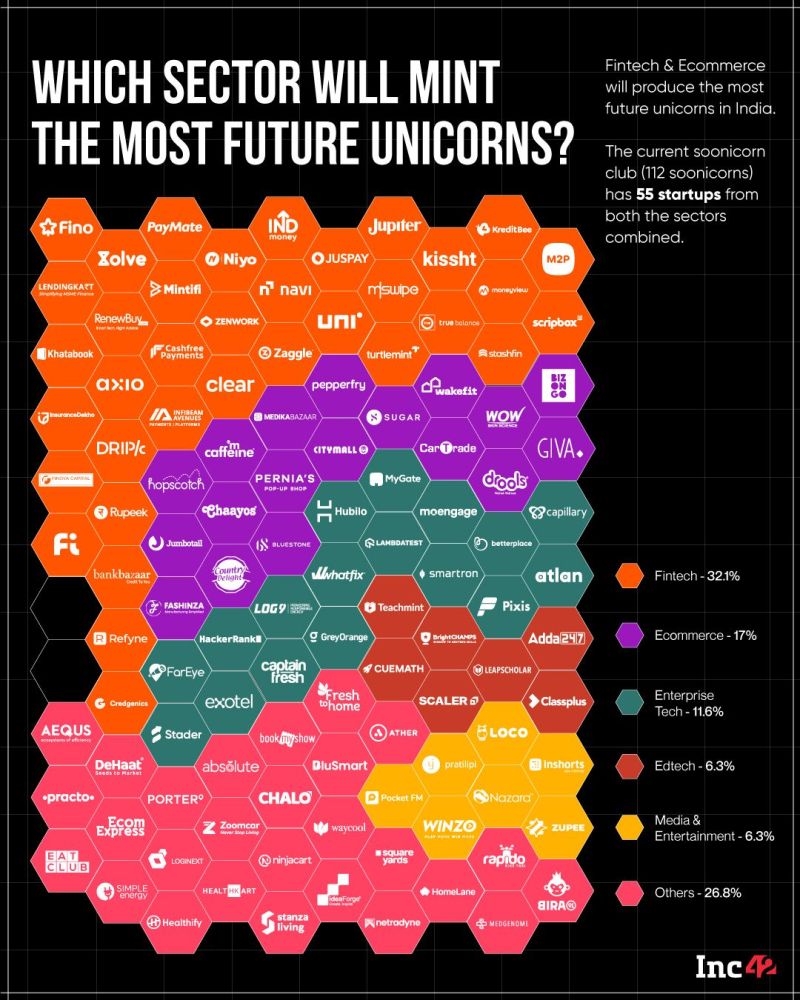

Overview of the Fintech industry in India

A fintech company refers to any company that offers financial services or applications that rely heavily on technology.

Definition: Fintech refers to the integration of technology in the delivery of financial services.

Growth: The fintech industry in India has experienced rapid growth and is one of the fastest-growing markets globally.

Internet User Base: India has the second-largest base of internet users, facilitating quick adaptation to fintech solutions.

There are more, but Key Segments of the Fintech Sector:

Digital Lending: Online platforms providing loans and credit services. (Navi Finserv, Lendingkart, Bankbazaar etc)

Digital Payments: Solutions enabling electronic transactions and payments. (Razopray, Cred, Payglocal )

Insurtech: Technology-driven insurance solutions for enhanced customer experience and efficiency.(Policybazaar, Digit, Acko, Coverfox)

Wealth Tech: Platforms and tools for investment and wealth management (Upstox, Groww, Zerodha, and Robo-advisors)

Blockchain: Technology used for secure and transparent transactions.