- Hey, big news from the accounting world!

- Bench Accounting, a Canada-based leader in tech-enabled accounting and bookkeeping, raised over $113M and was a favourite for small businesses.

- But on December 27th, they shocked everyone by announcing their closure.

- Here is what happened!

The end of Bench Accounting

After 12 years of operation, Vancouver-based bookkeeping firm Bench Accounting announced its shocking and abrupt closure.

This move has left hundreds of employees jobless and forced thousands of small business customers to scramble for alternatives, just days before year-end.

In a sombre statement on its website, Bench confirmed that the platform was “no longer accessible.”

Currently, the company’s entire website is offline, displaying only the closure notice.

Where it all started

Bench was originally founded in 2010 as 10sheet Inc. in the US by:

- Ian Crosby

- Jordan Menashy

What started as a scrappy idea in Crosby’s Toronto apartment when he was just 23 years old quickly evolved into a game-changer in the bookkeeping world.

The company rebranded to “Bench” in 2013 after relocating to Vancouver, British Columbia, where it publicly launched its product.

Bench became a trusted partner for over 20,000 US-based customers. At its peak, the Vancouver-headquartered company employed around 650 people.

Bench’s evolution

Bench Accounting (branded as “Bench”) was a fintech pioneer that combined:

- Proprietary software, offering subscription-based access to its cloud-based platform

- In-house bookkeepers to deliver streamlined financial solutions for small business owners.

Bench specialised in historical and monthly bookkeeping, cash flow tracking, expense management, and financial reporting.

In June 2019, Bench introduced “Pulse,” a cash flow management tool, followed by “BenchTax” in August 2019, a tax preparation service developed in collaboration with Taxfyle.

By 2021, Bench made a bold move into integrated financial services with “Bench Banking,” cementing its status as a true innovator in tech-enabled accounting.

Also read: GenAI in Accounting, Tax and Finance….Impact on Billable Hours!

Hundreds of Millions raised

Over the years, Bench secured multiple rounds of venture funding – $113 million in investor funding to be precise!

- Seed (2013): Raised $2M.

- 2014: Secured an additional $1M from VCs and angel investors.

- Series A (2015): Raised $7M led by Altos Ventures and Contour Venture Partners.

- Series B (2016): Raised $16M led by Bain Capital Ventures, joined by Altos Ventures and Contour.

- Series B-1 (2018): Raised $18M led by iNovia Capital with support from existing investors.

- Series C (2021): Raised $60M led by Contour Venture Partners to expand into integrated banking services.

The investors include

- Altos Ventures

- Primary Venture Partners

- Inovia Capital

- Contour Venture Partners

- Bain Capital Ventures

But where did it go wrong, after raising over $100 Mn in funding?

Bench Founders ousted from his position

However, it wasn’t all sunshine and rainbows.

Bench’s founding team faced significant turmoil over the years.

Co-founder Adam Saint, who served as VP of Design, quit in 2016.

What was even more shocking, however, was when Ian Crosby, the company’s CEO and founder, was ousted from his position in 2021.

Leadership then transitioned to Jean-Philippe Durrios, who was appointed as Bench’s president and CFO.

The final nail in the coffin was when VP of Marketing and fellow co-founder Jordan Menashy resigned in October 2024.

The fall of Bench

No additional information regarding Bench’s closure is available at this time.

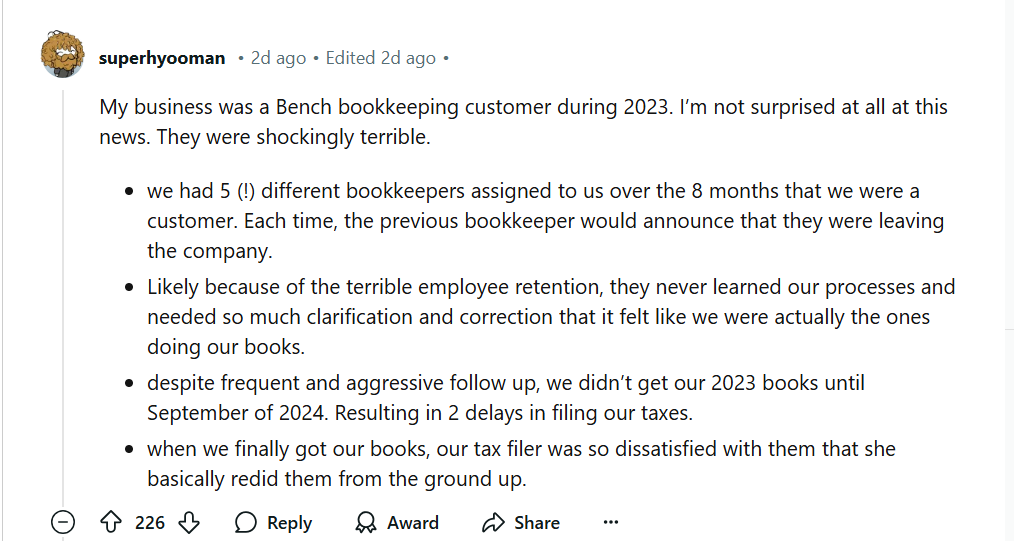

But that didn’t stop people from taking to social media platforms like LinkedIn to share their views.

Vaishnav Raj, Co-Founder of Pennyflo.io, remarked,

- Bench struggled to balance its dual identity as both a technology company and a service provider.

- Despite raising millions in funding and charging premium rates, the company failed to achieve operational profitability, with its last reported FY revenue at $89.3 million (according to Zoominfo).

- In recent weeks, Bench had been pushing customers to switch to annual contracts, hinting at cash flow concerns.

- Customers increasingly reported declining service quality, citing significant delays in bookkeeping updates.

- Bench’s limitations in service offerings were glaring: it only supported cash-basis accounting, lacked crucial accrual-basis capabilities for scaling businesses, and provided no tracking for accounts payable or receivable.

- The inability to manage prepaid expenses, unearned revenue, and inventory further hampered its appeal to growing businesses seeking comprehensive financial solutions.

Former CEO and Co-Founder’s message

Ian Crosby, the former CEO and co-founder of Bench, couldn’t hold back his thoughts on the demise of the company that he founded.

He recalled the day he was ousted from the firm.

“The board member thanked me for bringing the company to this point but said that they would be hiring a new professional CEO to take the company to the next level.

They wanted me to take the company in a new direction that I thought was a very bad idea.

I hope the story of Bench goes on to become a warning for VCs who think they can upgrade a company by replacing the founder. It never works.”

What will happen to their customers?

While the shutdown caught many off-guard, the company has outlined steps for clients to retrieve their data.

- Customers will be notified by December 30 and can download their current and prior year-end financials, as well as uploaded documents like receipts and bank statements, until March 7.

- Customers were also urged to file for tax extensions to buy extra time to find a new bookkeeper to handle their taxes.

Also read: Thomson Reuters acquires Materia, an AI assistant for tax, audit, & accounting

Competitors step in

Bench’s clients, including small business owners, are now scrambling to find a new bookkeeping service just before year-end filing deadlines.

Competitors have flooded LinkedIn and other social media platforms with offers to help.

Rival bookkeeping firms include: Acuity, Better Bookkeeping, Kick, Backyard Bookkeeper, and even AdviceKey Professional Services.

Ironically, Bench has posted a notice on its website, recommending its customers transition to Kick, a new accounting startup. Kick is also offering a 20% discount on the Kick Plus Plan* and a free Bench migration!