- Milind Kothari’s BDO India plans a 15–20% stake sale to raise Private Equity, first reported by The Economic Times.

- The firm is open to diluting in fast-growing non-audit arms (tax, deals, tech).

- Why? To drive global growth and expand across Asia-Pacific.

BDO India eyes capital boost for non-audit services

As per The Economic Times report, BDO India is open to diluting 15–25% of its stake…But only in non-audit businesses, which include:

- Tax, Advisory, Deals & Outsourcing

- BDO India Technology Solutions (BITS): Proprietary tech arm, developing tools for the finance and audit space

Why is BDO a hotspot for PE investors?

Nearly 65% of BDO India’s revenue comes from non-audit services, exactly where the PE interest lies.

The firm is growing at a remarkable 26–30% annually over the past three years.

It has ambitious expansion plans, including:

- Investing in technology through BITS

- Global expansion beyond India

- According to ET sources, BDO India is close to acquiring a “majority stake in a few Asia-Pacific member firms”

Major restructuring

BDO India has transitioned from LLP to a private limited company, valuing the business at ₹750 crores ($90 Million)!

This could be in preparation for external investment, says an insider!

Oh, and heads up, the restructuring triggered a capital gains tax of ₹100 crore. BDO is certainly serious about further scaling.

Premium valuations

BDO India isn’t shy about its worth.

Industry insiders revealed to The Economic Times that BDO is targeting premium valuations, higher than what similar firms in the US and Europe are commanding.

And perhaps rightfully so…

- Mid-sized European firms with 3-6% annual growth seek 1.5-2x revenue multiples

- US firms growing at 12-14% aim for 2x multiples

- BDO India has been growing at a robust 26–30% annually over the past three years.

BDO India’s growth projection

- BDO India’s revenue for the fiscal year ending September 30, 2024, was estimated to be around ₹1,100 crore.

- BDO India is projected to clock ₹1,500 crore in revenue for FY25-26.

Milind Kothari’s story is inspiring…

Milind Kothari is a first-generation corporate leader, who started MZS & Associates in 2002.

It was later known as MZSK & Associates, formed after merging two Mumbai and Pune-based firms in 2011.

10 years later in 2012-2013, MZSK & Associates joined the BDO network (This was BDO International’s third entry into the Indian market.)

Following this association, MZSK & Associates was “rebranded” as BDO India…Milind Kothari was appointed as the Managing Partner.

When BDO entered India in 2013, MZSK & Associates had just 450 people and 32 partners.

Fast forward to 2025, it’s an 11,000+ strong force, with 350+ Partners!

Today BDO India is a key member of this global network, with operations in 19 offices across India.

Also read: Grant Thornton Bharat eyes Private-Equity stake sale?

Leadership at BDO India

BDO India’s key leadership roles include:

- Milind Kothari: Managing Partner

- Yogesh Sharma: Deputy Managing Partner

- Lav Goyal: Partner & Head, Business Advisory Services

- Munjal Almoula: Partner & Head, Tax

- Samir Sheth: Partner & Head, Deal Advisory Services

- Arjun Mehta: Partner & Leader, Risk Advisory Services

- Dipankar Ghosh: Partner & Leader, Sustainability & ESG

Also read: US firm CohnReznick in talks with Private Equity, has 1000+ India-GCC team

What’s happening at BDO US?

BDO’s USA, the sixth-largest accounting and consulting firm in the US secured $1.3 billion in debt financing from Apollo Global Management, in August 2023.

BDO USA mentioned that the funding will be used to,

- Buy out a minority stake from existing partners

- Establish an Employee Stock Ownership Plan (ESOP)

- Refinance parts of the firm’s current debt

In July 2024, BDO transitioned from a Partnership to a Corporate Structure, converting its 860 partners into employee shareholders.

BDO’s global revenue exceeded US$15 billion (€13.9 billion), for the financial year ending 30 September 2024; a 7% increase in USD terms.

PE betting big on Indian professional services firms

And yes – Private equity funds and family offices are actively scouting Indian professional services firms with:

- Strong fundamentals

- Growing compliance/advisory revenue

- Offshoring potential

- With the rise of remote work, India’s importance as a delivery hub has grown

PE investors are placing big bets on firms with cross-border potential.

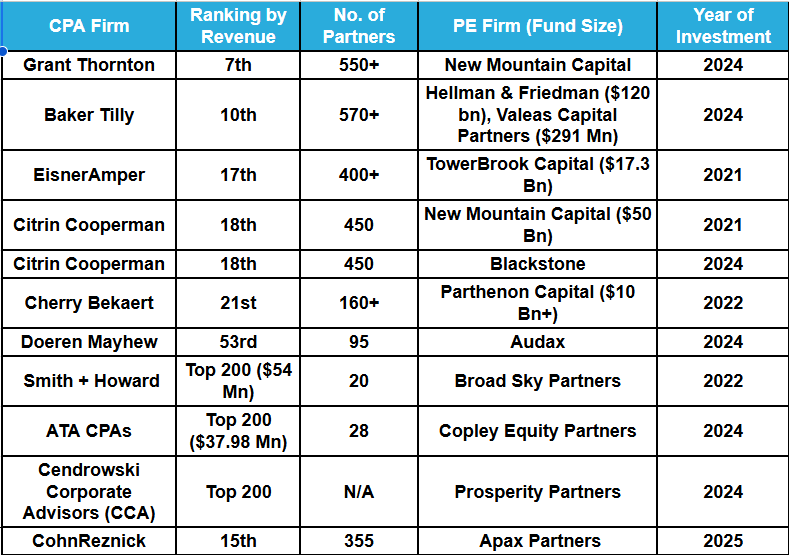

In February 2025, Grant Thornton Bharat CEO Vishesh Chandiok exclusively told Financial News London that they are open to PE, but no deal is on the table just yet!

The bigger picture: Why now?

The competition in the advisory space is heating up.

While the Big 4s continue to dominate, mid-market firms like BDO are catching up by expanding capabilities, investing in tech, and building deeper client relationships.

But to play big, you need big backing, and that’s where private equity steps in.

If the BDO India PE deal goes through, even for a minority stake, it would send a strong message to the market.

FAQs:

1. What is BDO India?

BDO India is the Indian member firm of BDO Global, one of the world’s leading networks of professional services firms.

Globally, BDO operates in over 160 countries, providing:

- Audit & Assurance

- Tax Advisory

- Risk & Advisory Services

- Business Services & Outsourcing

- Digital and Technology Consulting

In India, BDO has grown rapidly and now competes with mid-to-top-tier firms like Grant Thornton, Nexdigm, and even the Big Four (EY, Deloitte, PwC, KPMG) in certain areas.

2. What is BDO Edge?

In April 2024, BDO India launched BDO EDGE (Exceptional Delivery for Global Enterprises) – a Centre of Excellence.

It is formed through a joint venture with BDO member firms in the United States, the United Kingdom, and Germany.

3. BDO in India is among the largest accounting firms in India?

Yes, BDO India is a key member of the global BDO organisation.

BDO is Headquartered in Mumbai.

The firm offers – domestic and international clients in Assurance, Tax, Advisory, Managed Services & Outsourcing, Technology Products & Solutions, and Digital Transformation.