- Bluestone files IPO papers with SEBI to raise Rs 1,000 crore.

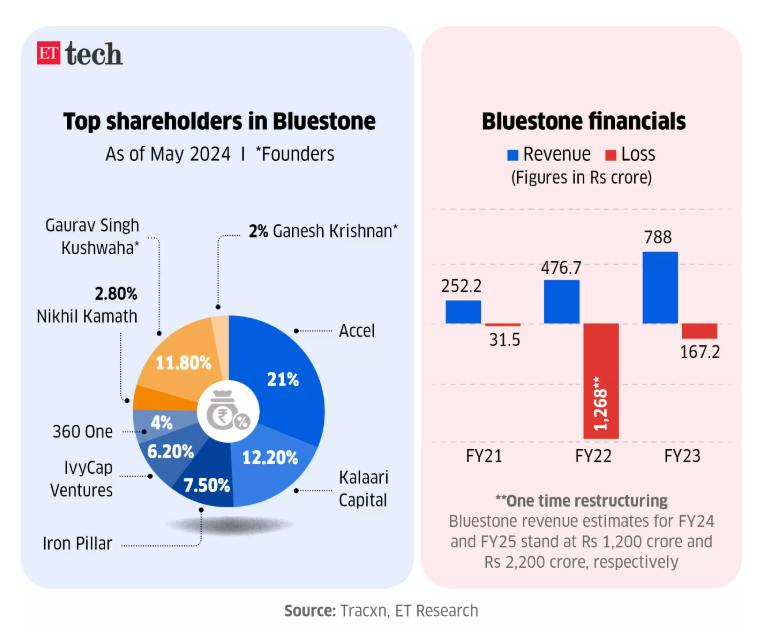

- Founders Gaurav Kushwaha and Ganesh Krishnan hold an 18% stake.

- Major stakeholders, including Accel India, Kalaari Capital, and Sunil Kant Munjal, will sell shares in the OFS.

Stats as reported by ET

- Bluestone projects revenues to reach Rs 2,200 crore in FY25, after a strong jump from Rs 476 crore in FY22 to Rs 788 crore in FY23, driven by rapid offline expansion.

- The company anticipates Rs 1,200 crore in FY24 revenue, with an EBITDA of Rs 3 crore.

- Notably, Rs 150 crore of this will come from online sales, with the majority generated by its physical stores.

IPO Details and Fund Utilization

Bluestone intends to raise Rs 1,000 crore from the IPO, with the fresh issuance contributing Rs 750 crore and the remainder being raised through an OFS.

The funds will be primarily used to meet the company’s working capital requirements and general corporate purposes, as outlined in the filings.

- Rs 750 crore: Working capital requirements

- Rs 250 crore: General corporate purposes, which include store expansion, loan repayment, strategic initiatives, and acquisitions of fixed assets like furniture and fixtures. Funds will also be allocated for marketing, insurance, and maintenance expenses.

Offer for Sale (OFS) Breakdown

In the OFS, several major stakeholders will offload their shares, including:

- Kalaari Capital: Up to 7.98 million shares

- Saama Capital: Up to 4.1 million shares

- IvyCap Ventures: Up to 3.12 million shares

- Accel India: Up to 3.1 million shares

- Iron Pillar: Up to 1.75 million shares

- Sunil Kant Munjal: Chairman of Hero Enterprise, who will sell 4 million shares.

These transactions will allow existing investors to partially liquidate their holdings while allowing the company to strengthen its financial position for the next phase of growth.

Founders and Angel Investors

- Bluestone’s founders, Gaurav Kushwaha and Ganesh Krishnan, currently hold an 18% stake in the company

- Accel India owns 17.3%

- Notably, prominent angel investors Manipal group chief Ranjan Pai, Zomato founder Deepinder Goyal, and Zerodha’s Nikhil Kamath, among others, invested at a valuation of $450 million

Pre-IPO Fundraising

Earlier in August 2024, Bluestone successfully raised Rs 900 crore in a pre-IPO round.

The round was a mix of fresh capital infusion and secondary share sale at a valuation of $970 million. This fundraising underscored the confidence investors have in Bluestone’s business model and growth prospects.

Future Plans and Expansion

Bluestone’s IPO is part of its aggressive strategy to expand its presence in India’s highly competitive jewellery market.

The funds raised will support its ongoing efforts to increase its store footprint, scale operations, and explore potential partnerships and joint ventures.

As the IPO draws closer, investors are keenly watching the offering, which is expected to set the stage for Bluestone’s next phase of expansion in the thriving Indian retail sector.

(Source Financial Express and Economic Times)