- CA firm proposed ₹1 as its Statutory Audit fee…And surprisingly won the bid for a recent National Highways Authority of India (NHAI) tender.

- The news immediately drew criticism across social media.

- Audit professionals are asking the obvious question: “If the lowest bid always wins, can quality even survive?”

What happened?

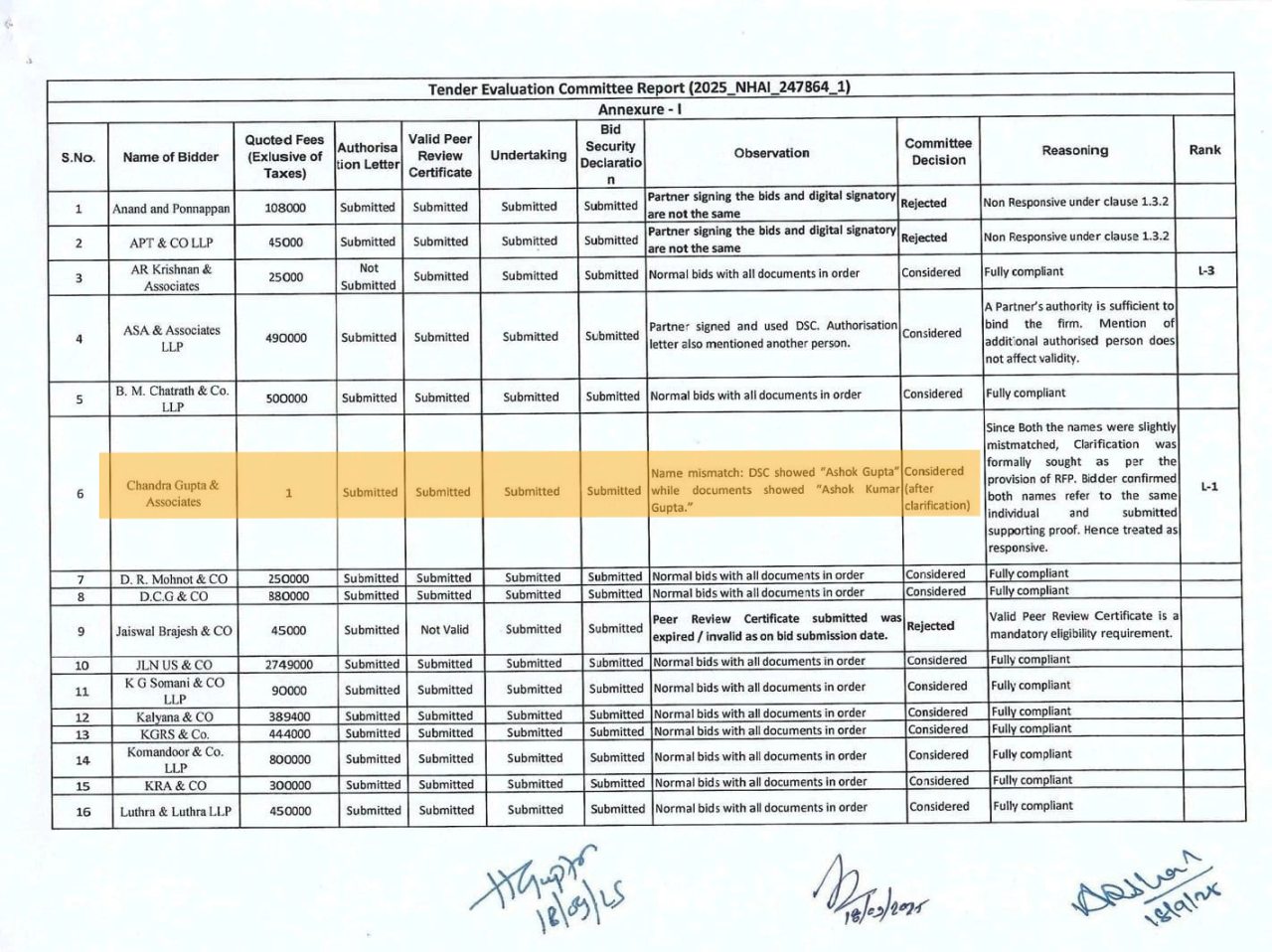

On September 15, 2025, the National Highways Authority of India (NHAI) closed bids for the statutory audit of its new subsidiary, Raajmarg Infra Investment Managers Private Limited.

Among 43 firms competing nationwide, most quoted normal fees.

Then… came Chandra Gupta & Associates with a jaw-dropping quote: ₹1.

Yes, despite the shockingly low fee, the bid was accepted, making them the statutory auditor for Raajmarg Infra Investment Managers Private Limited.

The firm behind the ₹1 Bid

Chandra Gupta & Associates isn’t a fly-by-night operation. They have:

- Offices in New Delhi, Mumbai, Jaipur, Chandigarh, Mohali, Solan, Hazaribagh, Guwahati, Ahmedabad plus an advisory office in Canada.

- Around 7 partners and 50+ professionals.

- Experience in audits (including Ind AS), tax, compliance, and financial advisory.

Is it even legal to quote ₹1?

The ICAI issues recommended minimum fees, but they aren’t binding law.

Firms can undercut these recommendations, especially in tenders.

So legally, the ₹1 bid is allowed.

Also read: ICAI says Partners can sign only 60 Tax Audits annually

Outrage in the Audit World

Retired professors, Big 4 veterans, and small-firm partners all had one question: “Is audit work now cheaper than a cup of chai?”

Some say it’s genius. Others call it reckless.

Narayanaswamy R, retired IIM Bangalore professor, wondered aloud: “What if they had quoted zero? Would anyone even care about accountability?”

Tharun Raj, CEO of Tharun’s Brainery, couldn’t help but point out the irony: “PM Modi wants a Desi Big 4, and here we are, firms bidding ₹1 just to grab a marquee audit.”

Big problem

Audit fees in India have “barely” increased in real terms over the past five years.

Now let’s compare the audit fee landscape:

- UK (FTSE 100 Companies): Audit fees increased by 75% between 2018 and 2023 (CAGR: 11.82%).

- India (Nifty 500 Companies): Fees rose by just 28% over the same period. Indian auditors, despite facing similar (or even greater) complexities, struggle with under-compensation.

Lower fees lead to…

- Long-term risk management: Poor-quality audits can expose companies to compliance risks and reputational damage.

- Inadequate reporting: A low-cost approach may compromise the depth and accuracy of audits.

- Increased risks: Poor audits expose companies to regulatory penalties and reputational damage.

Wrapping up…

Well, some argue it’s a marketing masterstroke: a bold move to gain credibility and future clients.

Others worry about the race-to-the-bottom effect: when winning depends on the lowest bid, does quality even matter anymore?

The real question now: will this spark a race-to-the-bottom in audit fees, or will it push regulators and firms to rethink how audits are valued in India?

Also read: Expectation from Auditors are rising… But India is one of the lowest audit fee markets

FAQs

1. Does ICAI set a minimum fee guideline for CA services?

The Institute of Chartered Accountants of India (ICAI) has issued the Revised Minimum Recommended Scale of Fees for professional assignments undertaken by its members.

But the recommended fees are not mandatory; they serve as guidelines to ensure fair compensation and maintain professional standards.

Tax Audit:

- ₹40,000 (Metro cities), ₹30,000 (Tier-2 cities)

Audit Assignments:

- Principal: ₹18,000 per day (Metro cities), ₹12,000 per day (Tier-2 cities)

- Qualified Assistants: ₹10,000 per day (Tier-1 cities), ₹8,000 per day (Tier-2 cities)

2. Are there penalties for underquoting audit fees?

There are no direct penalties for underquoting.

However:

If the low fees lead to compromised audit quality, and the auditor violates professional standards, ICAI can initiate disciplinary proceedings under the Chartered Accountants Act, 1949. Potential consequences include censure, suspension, or removal from the ICAI register in extreme cases.

As a CA specialising in audits, this ₹1 bidding trend honestly worries me because it pushes the profession toward undervaluing serious responsibility. Quality audit work needs fair compensation, and moves like this may hurt the profession more than they help in the long run.