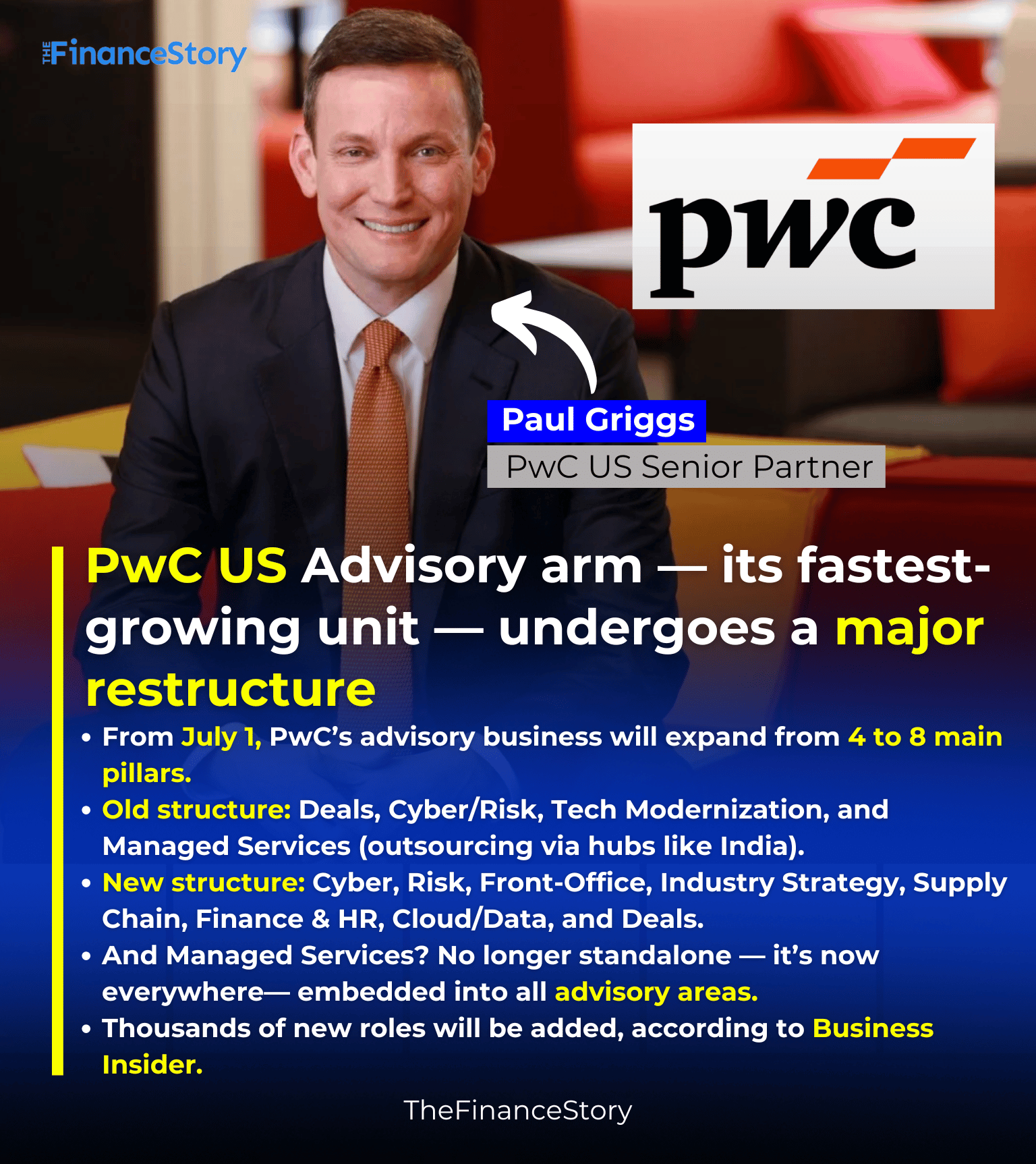

- Starting July 1, PwC US revamped its advisory division.

- Why? To meet demand for industry-specific advisory services.

- The biggest shift? Managed Services is no longer a standalone offering.

- PwC US Advisory has a total of 36,000 professionals (15,000 in India).

- Advisory remains PwC US largest and fastest-growing business, outpacing both audit and tax. But growth slowed to 3.1% in FY24.

What is happening…

PwC US advisory business operated under 4 main platforms

- Deals

- Cyber, Risk & Regulation

- Technology & Business Modernization

- Managed Services

Under the new structure…

PwC first told The Wall Street Journal that Advisory will be split into 8 platforms:

- Deals: Retain its original structure and continue to lead PwC’s work in M&A and capital transactions.

- Risk & Regulation: Assist businesses with compliance, governance, and evolving regulatory landscapes.

- Cyber Privacy & Tech Risk: Focus on helping clients navigate data protection and emerging tech vulnerabilities

- Cloud, Engineering & Data Analytics: Combining cloud transformation and data strategy, this group will empower clients to innovate through tech.

- Traditional Finance & HR: Focused on core enterprise functions such as financial planning, reporting, and human capital management.

- Front-Office Consulting: Modernizing marketing, sales, and customer service

- Industry-Specific Strategy: Dedicated sector specialists will address unique challenges within industries like healthcare, financial services, and manufacturing.

- Supply Chain: As global disruptions continue, this platform will help organizations build more resilient and agile supply chains.

Each platform is designed to bring:

- Deeper specialization

- Stronger tech capabilities,

- and a sharper focus on operational outcomes

This is part of Paul Griggs’ broader transformation strategy to deepen the integration of tech and delivery.

Wait — What happened to Managed Services?

Here’s where it gets interesting – Managed Services will no longer be a standalone profit-and-loss unit.

Instead, its teams will be “integrated” into the 8 new advisory platforms.

What are Managed Services? Long-term outsourcing of business-critical functions:

- Finance (payroll, accounting)

- IT & Cloud

- Cybersecurity

- HR

- Customer support

Delivered via global delivery hubs like India & Philippines.

Also read: PwC & EY UK has seen 150+ Partner reductions

Why is PwC embedding Managed Services everywhere?

Enterprises are struggling with:

- Cloud and AI adoption: Enterprises need partners to run cloud infrastructure, data pipelines, AI integrations.

- Cyber Threats: 24/7 outsourced cybersecurity monitoring is now a must-have for many large companies (demand is at an all-time high)

- Cost pressures

- Talent shortages: Most firms struggle to build in-house teams for IT, finance ops, and data engineering. They prefer specialist partners.

Clients want more than advice.

Thus Global Managed Services market is booming:

- $335.37 billion in 2024.

- It is projected to reach $731.08 billion by 2030.

- Growing at a CAGR of 14.1% from 2025 to 2030

Driven by cloud, AI, cybersecurity, and digital transformation.

Also read: PwC exit low-performing markets & cut ties with risky clients

Talent strategy

Despite layoffs in the recent past (1,800 in Sept 2024 and 1,500 in May 2025), PwC confirms NO advisory cuts.

Thousands of new hires planned in:

-

Cybersecurity

-

Cloud & data

-

Industry-specific consulting

-

Ops support

With the retirement of Nikki Parham, Tim Canonico will lead Managed Services.

What are competitors doing?

Deloitte: Ranked #1 globally by Gartner in Security Services (includes Managed Security Services). Heavy investment in AI services, sustainability, and cloud-managed offerings.

Now, PwC: Expanding cloud, cybersecurity, and industry-specific consulting. Big Push: End-to-end execution—not just advice but running operations.

KPMG: Investing in digital managed services via tech partnerships

EY: Invested heavily in technology platforms and managed services (particularly in tax and compliance).

Accenture: Operates one of the largest global managed services portfolios!

Big 4 Revenue

| Firm | Global Revenue (FY2024) | Workforce (Approx.) |

|---|---|---|

| Deloitte | $67.2B | 457,000+ |

| PwC | $55.4B | 364,000+ |

| EY | $51.2B | 395,000+ |

| KPMG | $38.4B | 273,000+ |

India’s critical role in managed services

India’s managed services market generated a revenue:

- $14.9 Bn in 2023

- Expected to reach $41.2 Bn by 2030.

And it is expected to grow at a CAGR of 15.7% from 2024 to 2030.

And India is more than just a growth market — it’s a global delivery engine.

According to Business Insider, PwC US has a total of 36,000 advisory professionals (15,000 of them based in India).

Bottom line? India isn’t just important — it’s indispensable to PwC’s and the Big 4s global managed services play.

Wrapping up…

PwC US is changing its advisory business to focus more on specialised services.

By embedding Managed Services, it’s betting big on recurring revenue, deep specialisation, and tech-enabled delivery.

This isn’t just PwC’s strategy — it reflects a broader Big 4 shift: Clients now want consulting firms to advise, implement, run, and optimize.

The future of advisory is not just consulting expertise — it’s execution.

(Compiled from public disclosures, media reports, and conversations with industry sources familiar with PwC’s advisory restructuring.)