- June 12, 2025 — KPMG India CEO Yezdi Nagporewalla just made it official: “Ownership change is complete — w.r.t Project Himalaya!”

- This announcement has sent ripples through India’s consulting ecosystem.

- Could this confirm the 2023 rumours? That KPMG US, KPMG UK, and KPMG India are merging their advisory arms, with India positioned as the global delivery hub?

- Details? Still hush-hush. But here’s what insiders are buzzing/speculating…

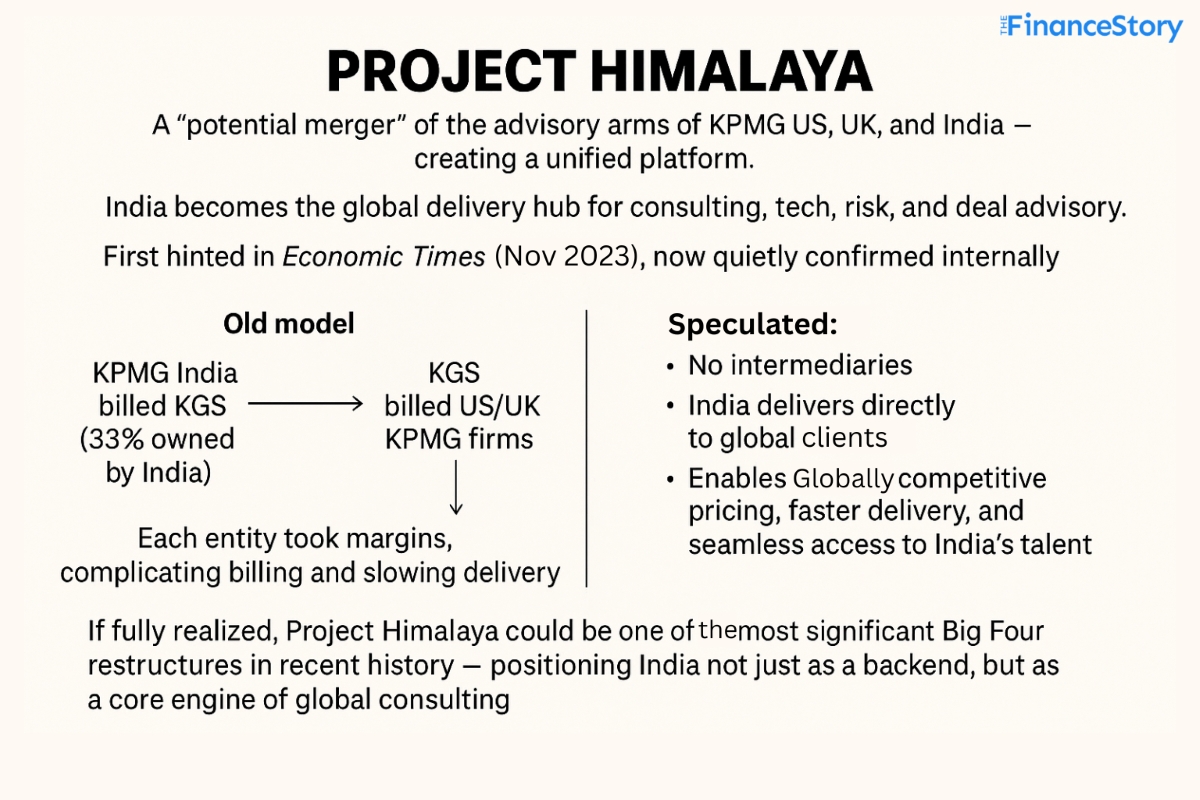

What is Project Himalaya?

The first public hint came in November 2023 when The Economic Times reported

“KPMG US, UK, India is set to merge its advisory arms — unifying consulting, risk, tech advisory, and deal advisory practices— with India as the delivery HQ.”

This implied a radical shift: a shared global advisory platform co-owned by the three countries, powered from India?

In April 2024, CEO Yezdi Nagporewalla said cautiously,

“We’re aligning three advisory practices to benefit India’s talent and insights, better serving cross-border clients.”

Most shrugged it off…Assuming this was just another ambitious Big Four experiment — like EY’s Project Everest — destined to remain on paper.

The industry blog Going Concern dismissed the Economic Times report as a “dubious rumour,” arguing that a full US–UK–India advisory merger seemed unlikely given KPMG’s complex global setup.

Then…

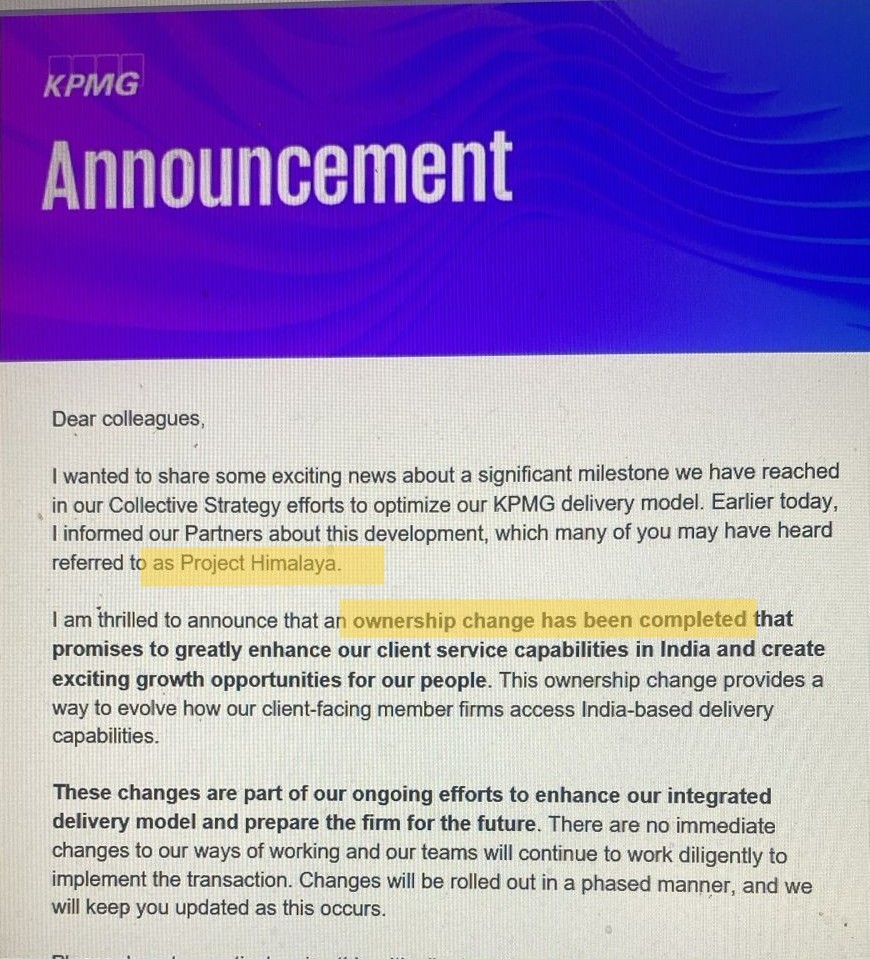

On Thursday afternoon, an unexpected internal memo arrived from KPMG India CEO Yezdi Nagporewalla.

“It is a significant milestone we have reached in our Collective Strategy efforts to optimize our KPMG delivery model.

Earlier today (Thursday, 12th June 2025), I informed our Partners about this development, which many of you may have heard referred to as Project Himalaya.

I am thrilled to announce that an ownership change has been completed….”

The memo quietly confirmed: A completed “ownership change” that will:

- Enhance how we serve clients using India-based capabilities

- Create more growth opportunities for our people in India

- Strengthen global collaboration across member firms

- No immediate changes to your day-to-day work

- The transition will happen gradually and in phases

Quite unclear, but at least after months of whispers, we know – Project Himalaya is real, and it’s here.

Industry speculation…

Industry speculation…

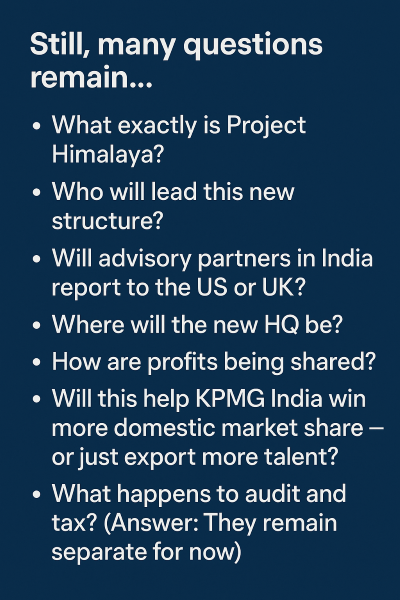

It’s still early days, and much of it is unfolding behind closed doors.

Even Partners and Directors don’t know much about it, except the top few!

Here’s what industry insiders are saying (or speculating):

For years, KPMG India teams (advisory/consulting teams) have powered global work — quietly, in the background through intermediaries like KPMG Global Services (KGS).

In the old model:

- KPMG India billed KGS (which it partially owned)

- KGS billed KPMG US or UK

- Each entity took a margin, complicating billing and slowing delivery

Under Project Himalaya (as industry insiders speculate):

- The need for intermediary entities is removed

- KPMG can offer clients “globally competitive pricing”

- Access to India’s advisory talent becomes frictionless

It’s a win for global clients — and a bigger win for consultants in India:

- More international assignments

- Simpler engagement structures

- And possibly, equity in the global advisory business for Indian partners

Also read: Big 4 India gets bigger: Revenue surged to ₹38,800Cr & to surpass ₹45,000 crore

What Project Himalaya could (potentially) unlock

- Unifying advisory services across US, UK, and India into one seamless, co-owned global platform—breaking down long-standing silos

- Put India on par with the biggest global consulting players

- Unify 50,000+ professionals across advisory functions (as per Economic Times)

- Generate $1Bn+ in advisory revenue from only India-based delivery teams

- Position India as the global delivery hub

- New growth and equity opportunities for Indian partners, giving them a direct stake in the global advisory business for the first time

One interesting piece…

KPMG India owned a 33% stake in this global delivery powerhouse, KGS, alongside KPMG US and UK.

But in April 2025, KPMG India exited KGS, selling its entire stake to the US and UK firms.

Insiders say KGS — now fully owned by the US and UK firms — may eventually get absorbed into the “new unified advisory structure”.

Here’s a quiet but telling sign from the ground: Previously, KPMG India and KGS employees were unable to access both workspaces with a single access card. This changed when the office environments were integrated.

Why India?

US and UK bring revenue and client relationships, but India has what no other KPMG firm does:

- Deep talent bench (Among the three regions, India leads in headcount by far)

- Specialised capabilities (AI, Cyber, Tech, Risk)

- Scalable delivery infrastructure

India already powers much of the advisory work for US/UK clients, with innovation hubs and AI labs in place.

With margin pressures mounting, consolidating delivery in India isn’t just smart — it’s strategic.

KPMG has been actively consolidating its member firms…

- May 2024: KPMG UK and KPMG Switzerland merged to form a $4.4 billion entity, creating a single legal and financial unit.

- August 2024: KPMG Saudi Levant (Saudi Arabia, Jordan, Lebanon, Iraq) merged with KPMG Lower Gulf (UAE, Oman).

- March 2025: A confidential strategy presentation revealed that KPMG plans to reduce over 100 separate “economic units” to just 32 by 2026.

Wrapping up…

Yes—KPMG is actively doing something major.

Project Himalaya is real, ambitious, and reshaping KPMG’s advisory network. It’s different from Grant Thornton’s PE-backed global platform, but still a potent strategic shift.

Another fact, KPMG is the smallest of the Big Four (by global revenue and headcount), but it’s outperforming PwC, Deloitte, and EY in revenue growth rate.

Based on data, FY 2023:

| Firm | Global Revenue (approx.) | Employees (approx.) |

|---|---|---|

| Deloitte | $64.9 billion | 457,000+ |

| PwC | $53.1 billion | 364,000+ |

| EY | $49.4 billion | 395,000+ |

| KPMG | $36.4 billion | 273,000+ |

FY 2024

| Firm | Global Revenue (FY2024) | Workforce (Approx.) |

|---|---|---|

| Deloitte | $67.2B | 457,000+ |

| PwC | $55.4B | 364,000+ |

| EY | $51.2B | 395,000+ |

| KPMG | $38.4B (highest revenue growth 5.4%) | 273,000+ |

But that’s exactly why Project Himalaya is interesting — If KPMG merges its UK, US, and India advisory arms and uses India as the powerhouse, it could punch above its weight.

Till then? The industry will be watching.